Please use a PC Browser to access Register-Tadawul

Playtika Holding (NASDAQ:PLTK) Will Pay A Dividend Of $0.10

Playtika Holding Corp. PLTK | 3.98 | +0.76% |

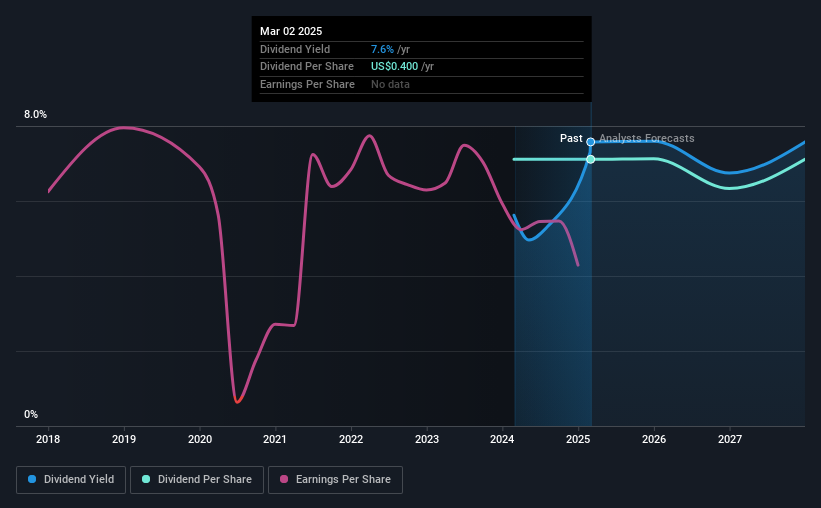

Playtika Holding Corp. (NASDAQ:PLTK) will pay a dividend of $0.10 on the 4th of April. Based on this payment, the dividend yield on the company's stock will be 7.6%, which is an attractive boost to shareholder returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Playtika Holding's stock price has reduced by 38% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Playtika Holding's Future Dividend Projections Appear Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last payment made up 92% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

The next year is set to see EPS grow by 61.6%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 57% which brings it into quite a comfortable range.

Playtika Holding Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Playtika Holding's EPS has fallen by approximately 11% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Our Thoughts On Playtika Holding's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Is Playtika Holding not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.