Please use a PC Browser to access Register-Tadawul

Plug Power (PLUG): Evaluating Valuation as Global Expansion and New Long-Term Deals Drive Investor Interest

Plug Power Inc. PLUG | 2.27 | +2.03% |

If you’re weighing what to do with Plug Power (PLUG) shares after the latest round of headlines, you’re not alone. The company just revealed a strategic partnership with Brazil’s GH2 Global to bring hydrogen-powered logistics to new international markets, while also locking in a long-term extension with its major client Uline through 2030. These new deals combine international ambition with solidifying existing revenue streams, a mix that is hard to ignore for anyone tracking the hydrogen market’s evolution.

Plug Power’s recent news comes against a backdrop of meaningful financial momentum. The year-over-year revenue growth sits at 21%, and gross margins have moved up from -92% to -31%, suggesting some real operational progress even as profitability remains elusive. Despite this, the stock is still deep in the red for the year, and while there has been a bounce of 18% over the past three months, long-term holders have seen substantial losses. It is clear any bullish energy behind these deals is running in parallel with lingering doubts about the path to sustained profits.

So with international partnerships building and some signs of improvement, could Plug Power be trading at a discount to its future potential, or is the market already factoring in all that growth?

Most Popular Narrative: 22.8% Undervalued

The prevailing narrative sees Plug Power trading at a significant discount to fair value, signaling upside potential if projections hold true. This view is underpinned by strong growth expectations and improving margins, despite the company's current lack of profitability.

Strong policy momentum and new government funding in both the U.S. and Europe are catalyzing the pace of final investment decisions (FIDs) for large-scale hydrogen projects. This is positioning Plug Power to capture significant new orders and recurring revenues as regulatory support further expands the addressable market.

Curious about what’s fueling this bull case? There is a bold blend of future growth estimates and profit assumptions at play that might surprise even long-time market watchers. Want to know what’s behind that above-average valuation and where analysts expect the numbers to go next? The real formula driving Plug Power’s fair value is just a click away.

Result: Fair Value of $1.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent negative margins and ongoing dependence on government incentives remain key risks that could quickly undermine Plug Power’s growth promises.

Find out about the key risks to this Plug Power narrative.Another View: The Market’s Ratio Comparison

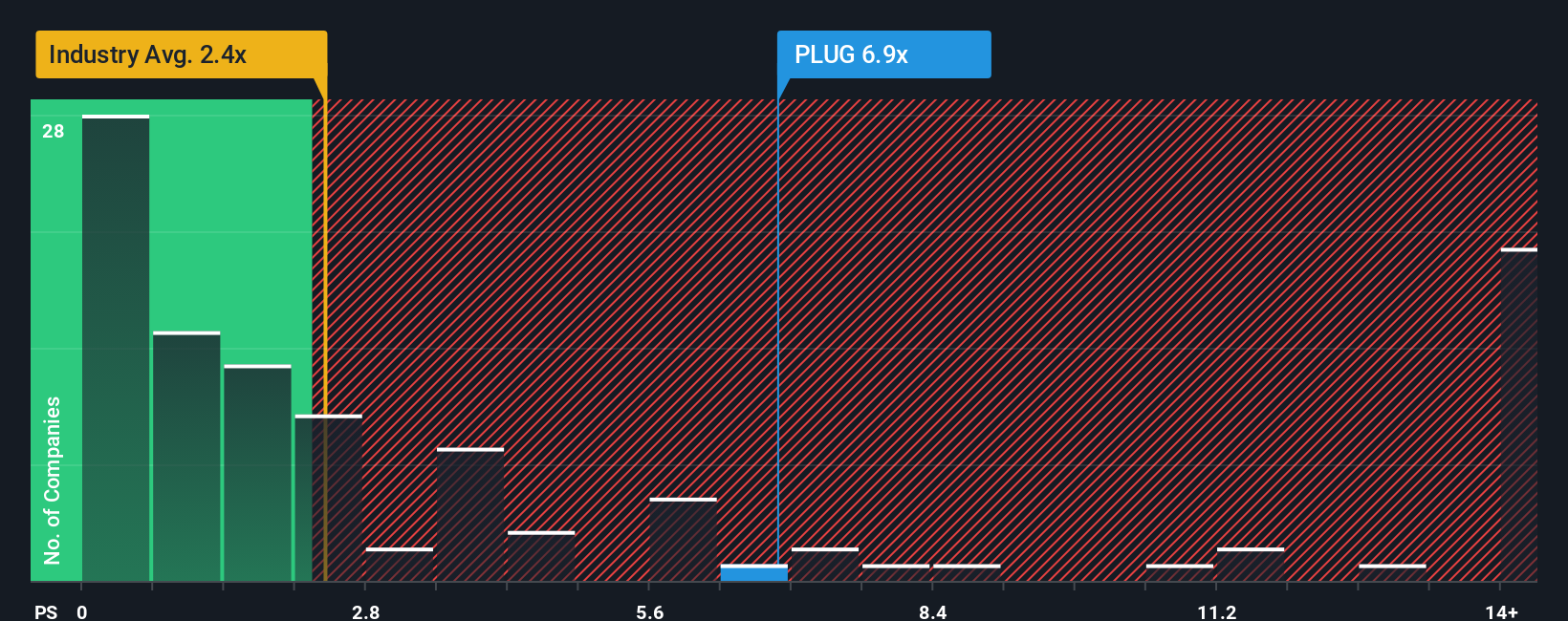

There’s another angle investors are weighing, using the price-to-sales ratio to gauge Plug Power’s value versus the wider industry. This method challenges the bullish narrative by suggesting Plug may be pricier than it first appears. Which method do you trust when the signals diverge?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plug Power Narrative

If you see things differently or want to back your own convictions, the data is yours to explore and your view can be built in minutes. Do it your way.

A great starting point for your Plug Power research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market and don’t let promising opportunities slip by. Uncover game-changing stocks tailored to themes shaping tomorrow's portfolios with these hand-picked ideas:

- Boost your income stream and tap into companies offering reliable yields by visiting our selection of dividend stocks with yields > 3%.

- Get a step up on tomorrow’s tech leaders focused on artificial intelligence breakthroughs by checking out our curated list of AI penny stocks.

- Find bargain opportunities others might miss by targeting undervalued stocks with robust cash flow potential in our tailored undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.