Please use a PC Browser to access Register-Tadawul

PNC Financial Services Group (PNC): Reviewing the Bank’s Valuation After Recent Share Price Momentum

PNC Financial Services Group, Inc. PNC | 197.86 | -0.21% |

Most Popular Narrative: 6.8% Undervalued

According to the most widely followed narrative, PNC Financial Services Group is trading at a notable discount to fair value, suggesting potential upside if the narrative's optimistic assumptions play out.

- PNC expects positive operating leverage by maintaining well-controlled expenses while aiming for record net interest income (NII) growth of 6% to 7% for 2025. This could potentially boost future earnings.

- The company is focusing on organic growth opportunities with an emphasis on customer acquisition and deepening relationships across its national franchise, which could drive revenue increases.

Ready to discover the strategy behind this bullish outlook? Analysts are betting on profit expansion and the company flexing its cost control muscle, all while projecting performance that could outshine industry averages. There is a key financial metric at the heart of their story. Want to see what truly sets PNC's future apart? The fair value math might surprise you.

Result: Fair Value of $214.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, capital market volatility or a mild recession could challenge PNC’s revenue growth and could potentially put pressure on margins and expense management strategies.

Find out about the key risks to this PNC Financial Services Group narrative.Another View

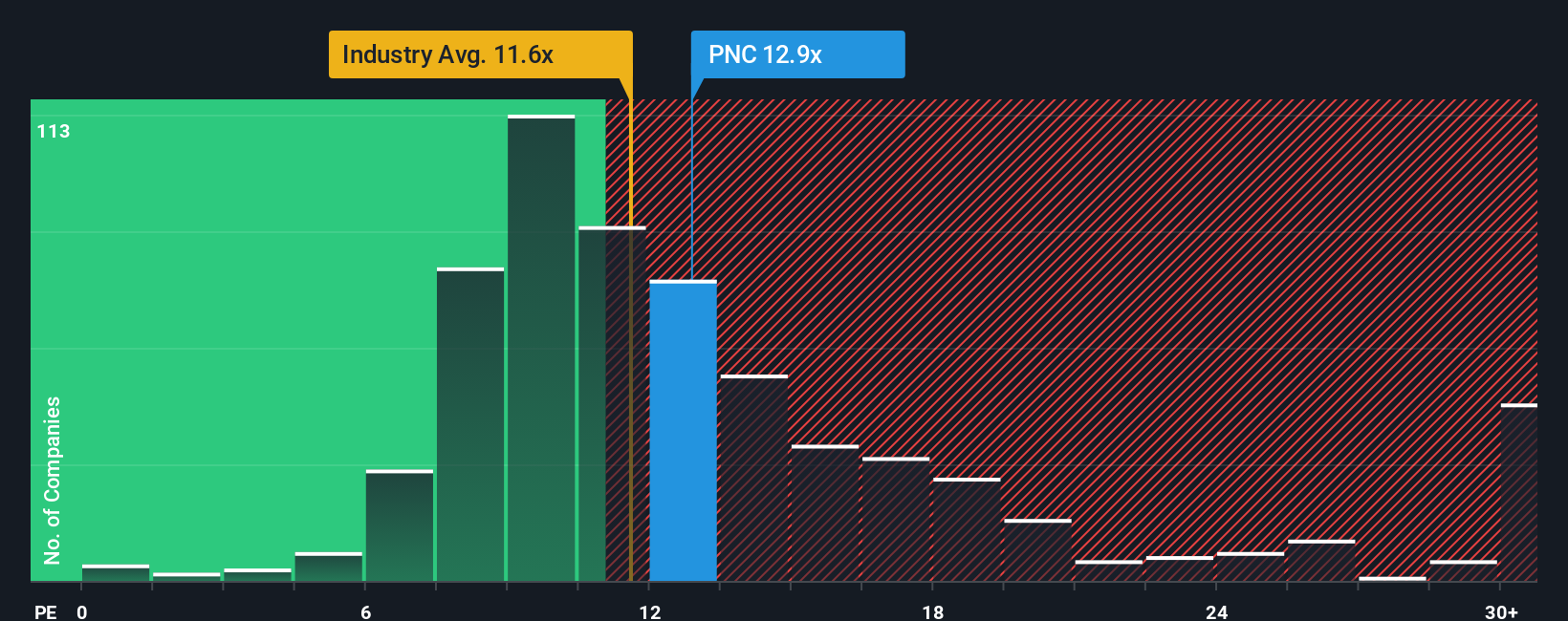

While the consensus suggests PNC is undervalued, another angle compares its valuation to the broader banking sector. This approach indicates the stock may actually be priced above industry norms. Could the fundamentals justify this premium?

Build Your Own PNC Financial Services Group Narrative

If you want to dig deeper or take the story in your own direction, you can craft your own analysis in just a few minutes. Do it your way.

A great starting point for your PNC Financial Services Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Instantly level up your investment watchlist with handpicked ideas that could match your goals, spark new strategies, or reveal hidden gems before the crowd.

- Tap into tomorrow’s tech transformation by searching for AI penny stocks, which are redefining industries with smart automation and breakthrough innovation.

- Strengthen your portfolio with dividend stocks with yields > 3% that offer reliable yields and consistent performance in any market environment.

- Ride the cutting edge of high-growth with quantum computing stocks leading the charge in next-generation computing and game-changing breakthrough applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.