Please use a PC Browser to access Register-Tadawul

Procore Technologies (PCOR): Assessing Valuation After Major AI Upgrades to Procore Helix Platform

Procore Technologies PCOR | 74.45 | -3.10% |

Procore Technologies (PCOR) has rolled out major updates to its Procore Helix platform, introducing new AI-driven tools aimed at streamlining workflow automation and enriching project delivery for construction professionals. These enhancements reflect a clear push toward deeper AI integration and customization.

Procore Technologies has spent much of the year making headlines, from fresh AI features in Procore Helix to new industry partnerships like the recent Adaptive integration. Shares have rebounded this week, culminating in a one-year total shareholder return of 16%, signaling building momentum even as operating margins remain under watch from investors. Recent AI-driven product launches and broader sector optimism appear to be fueling renewed interest in the stock's long-term potential.

If you want to see which other tech disruptors are making waves, explore the sector with our curated selection of innovative growth stories. See the full list for free.

With shares bouncing back and Procore rolling out cutting-edge AI features, the real question is whether there is still upside left for investors or if the market has already factored in the company’s growth potential.

Most Popular Narrative: 10.5% Undervalued

With Procore Technologies' most popular narrative setting fair value at $82.12 versus a last close of $73.49, expectations of future growth are front and center. This sets an ambitious stage for the company in the eyes of those following the consensus.

The ongoing expansion of Procore's product suite and successful cross-selling initiatives, evidenced by the increasing attach rate of financial modules and broader adoption across diverse industry verticals, indicate greater average revenue per customer, higher net retention, and improved durability of revenue growth.

What is fueling this gap between market price and consensus value? It all comes down to bold projections about future revenues, margins, and the company's transformation into a global construction tech leader. Discover which factors push this narrative to a premium. Could the next leg up already be embedded in their numbers?

Result: Fair Value of $82.12 (UNDERVALUED)

However, persistent macroeconomic headwinds and heavy reliance on North America could limit Procore's revenue growth and earnings stability in the future.

Another View: Market Ratios Tell a Different Story

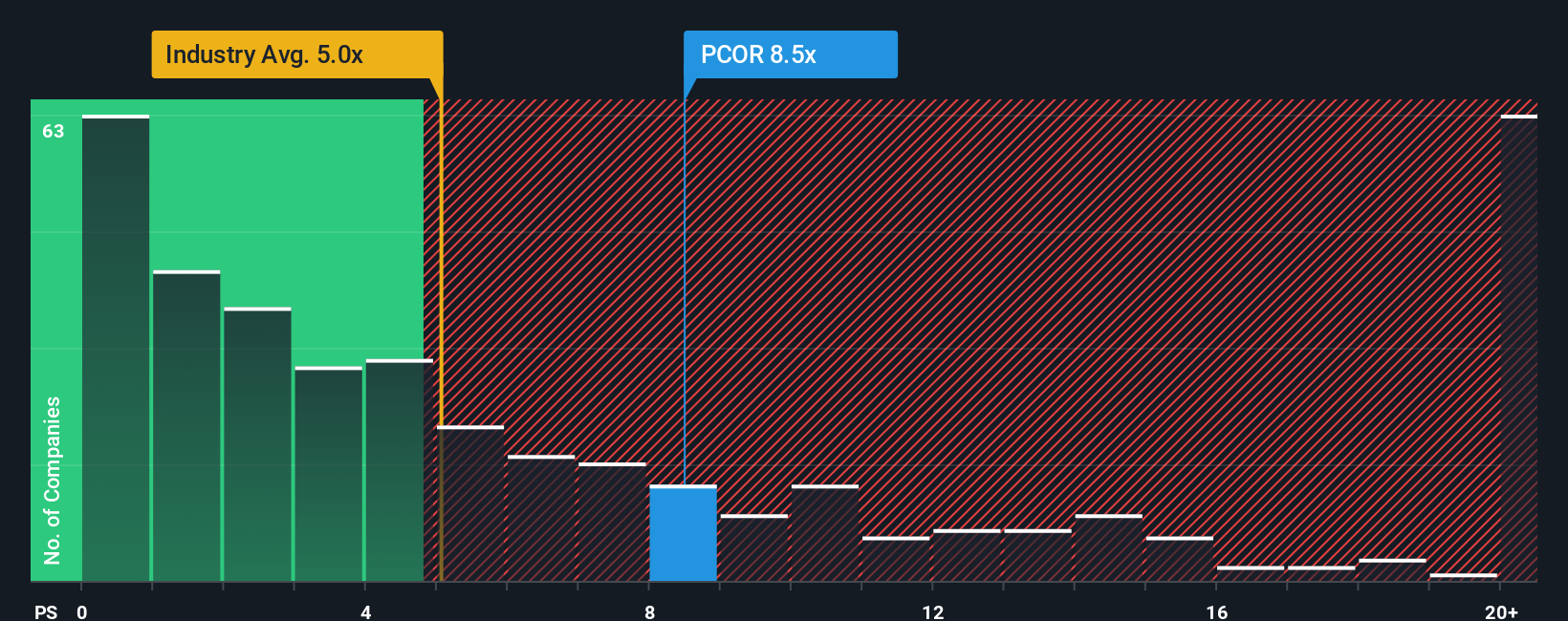

While consensus points to upside, current market ratios send a cautionary signal. Procore's price-to-sales ratio sits around 9x, noticeably higher than the US Software industry average of 5.2x and the peer average of 8.4x. Even compared to a fair ratio of 8x, this premium suggests investors are already paying up for future growth, which raises the stakes if results fall short. Are current expectations running ahead of the company's near-term prospects?

Build Your Own Procore Technologies Narrative

Whether you want to dig deeper into the numbers or prefer to craft your own perspective, building a personalized view takes just a few minutes with our tools. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Procore Technologies.

Looking for more investment ideas?

Unlock opportunities that could boost your portfolio by running powerful searches trusted by informed investors. Do not let these standout stocks pass you by.

- Uncover hidden value when you check out these 868 undervalued stocks based on cash flows and see which companies signal strong upside based on future cash flows and solid fundamentals.

- Tap into high-yield potential by browsing these 17 dividend stocks with yields > 3%, where stocks offer attractive returns and robust dividend yields above 3%.

- Ride the next tech wave with these 27 AI penny stocks, highlighting innovators at the forefront of artificial intelligence and future industry trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.