Please use a PC Browser to access Register-Tadawul

Procore Technologies (PCOR): Assessing Valuation as Trade Policy Headlines Drive Market Swings

Procore Technologies Inc PCOR | 51.29 | -0.81% |

Procore Technologies (PCOR) was caught up in the recent market volatility triggered by renewed U.S.-China tariff threats, which have kept technology and software investors on their toes as global trade headlines shift.

Procore Technologies has ridden a wave of volatility this year, as shifting headlines on U.S.-China trade policy and broader software sector sentiment have fueled sharp market moves. While its share price dipped on tariff threats and rebounded when trade worries cooled, the stock ultimately shows solid momentum, delivering a 14% total return over the past year and 43% in total returns over three years. These results are well ahead of most pure price-related measures. These swings underscore how quickly risk perceptions can shift, but also hint at investors' underlying optimism about Procore’s long-term opportunity as digital construction evolves.

If market turbulence has you wondering where else opportunity might lie, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding from trade-related dips and analysts maintaining bullish price targets, the question remains: is Procore undervalued at current levels, or has the market already factored in its growth prospects?

Most Popular Narrative: 12.6% Undervalued

With Procore Technologies closing at $71.77, the most widely followed narrative pegs its fair value more than 12% higher than yesterday’s price. This perspective signals optimism about the company’s future earnings trajectory and places significant weight on international expansion and product innovation as key drivers behind the target valuation.

The ongoing expansion of Procore's product suite and successful cross-selling initiatives, evidenced by the increasing attach rate of financial modules and broader adoption across diverse industry verticals, indicate greater average revenue per customer, higher net retention, and improved durability of revenue growth.

Want to know why this evaluation isn’t just about growth rates? The secret ingredient here combines financial cross-sell momentum and a future profit jump that is rarely seen outside top-tier software companies. Wondering which powerful assumptions turn that into a surprisingly bullish valuation? Uncover the numbers and logic that underpin this forecasted upside.

Result: Fair Value of $82.12 (UNDERVALUED)

However, persistent macroeconomic uncertainty and Procore’s heavy reliance on North America could still limit growth and challenge the optimistic narrative.

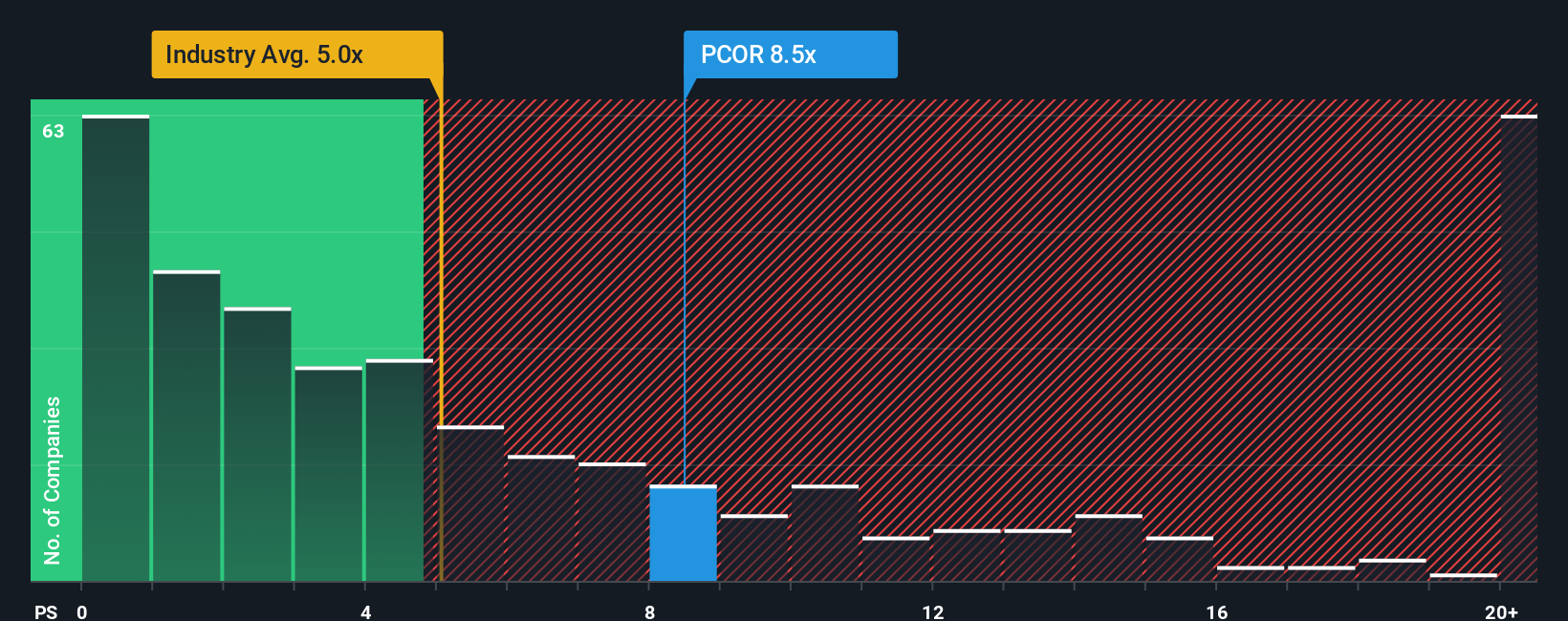

Another View: Caution on Revenue-Based Valuation

While analyst forecasts suggest upside, looking at the price-to-sales ratio offers a more skeptical view. Procore’s revenue multiple stands at 8.7x, which is not only higher than its peer average of 8.2x, but also significantly above the US Software industry’s 5x mark and the market’s fair ratio of 7.9x. This premium implies investors are already banking on strong future performance, increasing the risk if growth expectations slip. Is the optimism around future earnings justified, or is the current price running ahead of fundamentals?

Build Your Own Procore Technologies Narrative

If you’d like to dig deeper or take a different perspective, you can build your own view of Procore Technologies in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Procore Technologies.

Looking for more investment ideas?

Take advantage of today’s market opportunities and don’t settle for just one stock. The Simply Wall Street Screener can help you pinpoint tomorrow’s standouts with ease.

- Uncover fast-growing trends in artificial intelligence by tapping into these 25 AI penny stocks, and learn which companies are set to shape this era of disruption.

- Spot hidden gems trading below their intrinsic value with these 891 undervalued stocks based on cash flows, so you never miss a compelling opportunity to strengthen your portfolio.

- Boost your long-term returns and cash flow with steady income ideas using these 18 dividend stocks with yields > 3%, featuring businesses with yields above 3% and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.