Please use a PC Browser to access Register-Tadawul

Procter & Gamble (NYSE:PG) Launches Luxurious Unstopables Laundry Scent Collection With Jasmine Tookes

Procter & Gamble Company PG | 145.21 146.19 | +0.06% +0.67% Pre |

Procter & Gamble (NYSE:PG) launched the Unstopables Unlimited Collection, a line of in-wash scent boosters, in collaboration with Jasmine Tookes. Despite this product release, the company's stock price experienced a moderate increase of 1.33% over the last quarter, aligning with a general market trend that remained largely flat with a yearly gain of 13%. The market was tempered by ongoing trade uncertainties as tariffs were postponed and broader economic concerns lingered. The company's other recent activities, like board appointments and earnings results, added weight to these generally stable market conditions.

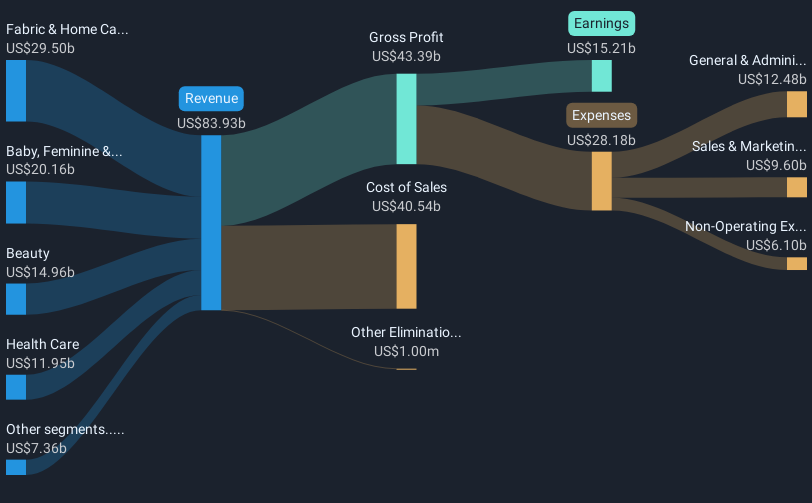

The introduction of Procter & Gamble's Unstopables Unlimited Collection aligns with its ongoing strategy of product innovation to boost market share. This launch may positively influence revenue if consumer confidence rises, capturing a larger consumer base amid economic uncertainties. As Procter & Gamble continues to enhance its product offerings, this initiative might mitigate the effects of geopolitical tensions and volatility, offering potential upside to future earnings forecasts, which are expected to reach US$18.0 billion by May 2028. However, the moderate 1.33% stock price increase over the last quarter reflects broader market conditions, which could delay expected growth in revenue and earnings if consumer spending remains tepid.

Long-term shareholders have seen a total return of 46.34% over five years, demonstrating solid returns despite recent underperformance in the last year where the company matched the US Household Products industry’s return of 4.2%, but lagged behind the US market's 12.5%. While the stock currently trades at US$159.25, it is priced 7.1% below the analyst consensus price target of US$171.51, signaling room for potential appreciation if the market aligns with analysts' forecasts. Although the company's price-to-earnings ratio is higher than the industry average, it remains lower than analysts' fair value estimates, suggesting a complex evaluation of its future potential amidst external risk factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.