Please use a PC Browser to access Register-Tadawul

Progressive (PGR): Is the Current Valuation Overlooked by Investors?

Progressive Corporation PGR | 235.97 | +0.48% |

Should Investors Rethink Progressive After Recent Moves?

Progressive (PGR) has recently caught the attention of investors, but not due to a specific news event or major announcement. Sometimes, the absence of a headline is enough to make people wonder why the stock is moving and whether the current price signals new opportunities or hidden risks. When stocks like Progressive shift gears quietly, it often means the market is recalibrating its expectations about the company’s value.

Over the past year, Progressive’s share price has slipped about 5%, even as its longer-term record tells a different story, with returns exceeding 100% over the past three years and nearly 180% over five years. Short-term momentum has faded in recent months. This may reflect a market adjusting to slower revenue growth or recent drops in net income. There haven’t been big surprises or headlines, just a steady recalibration that investors can’t ignore.

Given these shifts, is Progressive’s current price a window for value-oriented buyers, or is the market already anticipating future growth? Let’s dig into the valuation to find out.

Most Popular Narrative: 40% Undervalued

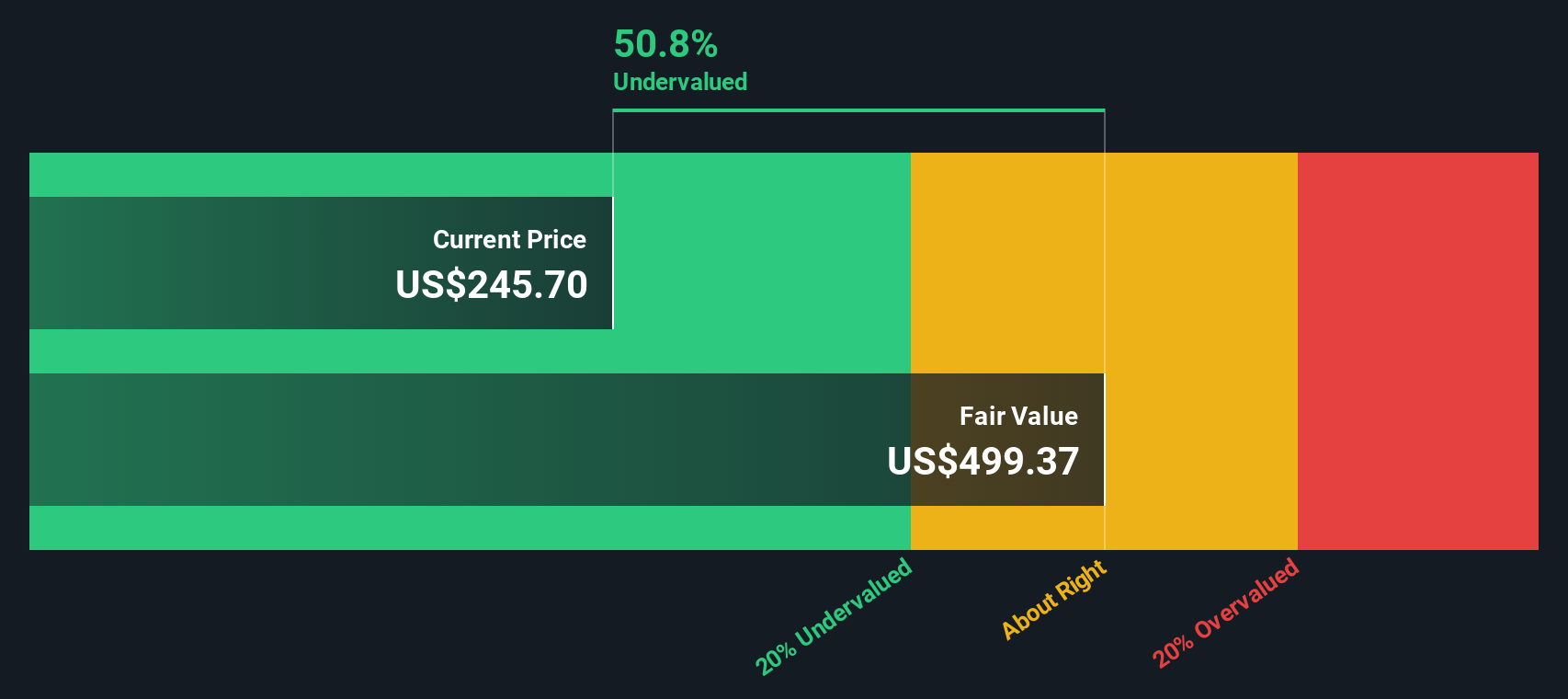

According to the most widely followed narrative, Progressive is trading well below its estimated fair value. The narrative sees the company as significantly undervalued and expects strong future growth driven by its innovation and leadership in the insurance space.

Innovative Tools and Services: Progressive offers unique services like Name Your Price®, Snapshot®, and HomeQuote Explorer®. These tools help attract and retain customers by providing personalized and competitive pricing. Industry Tailwinds: Progressive is benefiting from several industry tailwinds.

Curious why this narrative calls the stock 40% undervalued despite recent share price weakness? The real story is under the hood. There is a dramatic split between past performance and assumptions about how fast this insurer can outgrow its rivals, along with a key bet on how new technologies will impact the sector. Find out which eye-catching financial estimates and bold strategies are fueling this high conviction, and why the fair value target leaves room for upside that many investors are missing.

Result: Fair Value of $399.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, economic downturns or aggressive competitor pricing could quickly undermine Progressive’s outlook and challenge even well-founded expectations for growth.

Find out about the key risks to this Progressive narrative.Another View: What Does Our DCF Model Suggest?

While popular narratives point toward undervaluation, our SWS DCF model reaches a similar conclusion. This reinforces the view that Progressive’s shares could be trading below their intrinsic value. Could both methods be missing something important in today’s market?

Build Your Own Progressive Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Progressive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your horizons and seize your next advantage. The Simply Wall Street Screener gives you access to unique investing ideas you won’t want to overlook.

- Uncover resilient dividend payers and add stability to your portfolio by starting with our curated list of dividend stocks with yields > 3%.

- Spot tomorrow’s market disruptors among emerging businesses at the cutting edge of artificial intelligence when you check out our collection of AI penny stocks.

- Explore hidden value opportunities that could be trading far below their real worth with our handpicked selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.