Please use a PC Browser to access Register-Tadawul

Promising Lung Cancer Trial Results Could Be a Game Changer for Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb Company BMY | 54.57 | +4.12% |

- BioNTech SE and Bristol-Myers Squibb announced promising interim data from a global Phase 2 trial evaluating pumitamig combined with chemotherapy in extensive-stage small cell lung cancer, presented at the IASLC 2025 World Conference on Lung Cancer in Barcelona.

- These results, including a high disease control rate and an encouraging safety profile, contributed to pumitamig receiving Orphan Drug designation in the US and ongoing advancement into Phase 3 trials across multiple countries.

- We’ll explore how this positive clinical update strengthens Bristol-Myers Squibb’s late-stage oncology pipeline and the broader investment case.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bristol-Myers Squibb Investment Narrative Recap

For anyone considering Bristol-Myers Squibb, the investment focus is on whether its late-stage pipeline and major partnerships can offset looming patent expiries on key drugs and maintain growth momentum. The recent upbeat Phase 2 data for pumitamig in small cell lung cancer bolsters BMS’s oncology portfolio, but this development does not meaningfully change the near-term focus on execution of new launches and management of revenue concentration risks.

Among recent updates, the expanded alliance with BioNTech for co-developing bispecific antibodies like pumitamig stands out, as it aims to stack the drug pipeline against both current and future revenue headwinds, complementing BMS’s efforts to broaden its innovative offerings and reduce dependency on legacy medicines.

However, in contrast to the pipeline advances, investors should be aware of the considerable risk posed by upcoming patent cliffs on some of BMS’s largest revenue drivers...

Bristol-Myers Squibb is forecast to bring in $41.3 billion in revenue and $9.2 billion in earnings by 2028. This outlook reflects an annual revenue decline of 4.7% and a $4.2 billion increase in earnings from the current $5.0 billion.

Uncover how Bristol-Myers Squibb's forecasts yield a $53.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

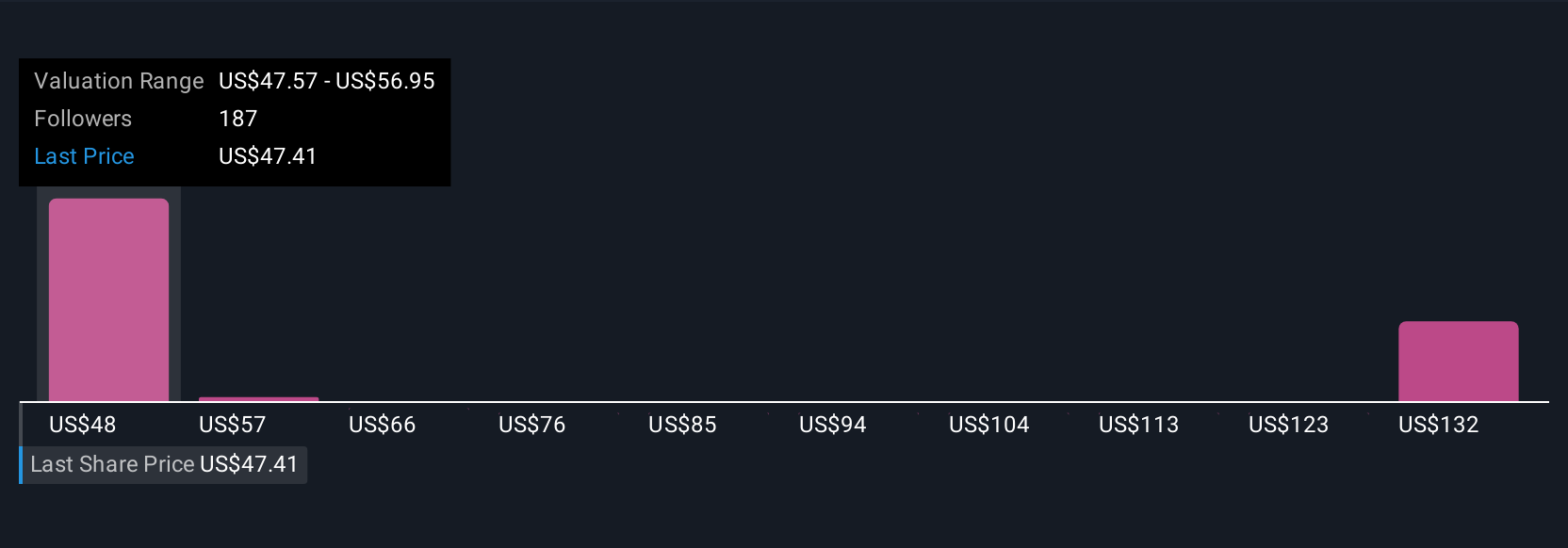

Thirteen members of the Simply Wall St Community value BMS shares between US$47.57 and US$140.23, reflecting wide variance in outlook. With new drugs yet to offset key patent expiries, consider how differing forecasts might affect future market confidence.

Explore 13 other fair value estimates on Bristol-Myers Squibb - why the stock might be worth just $47.57!

Build Your Own Bristol-Myers Squibb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bristol-Myers Squibb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristol-Myers Squibb's overall financial health at a glance.

No Opportunity In Bristol-Myers Squibb?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.