Please use a PC Browser to access Register-Tadawul

ProPetro Holding Corp.'s (NYSE:PUMP) 34% Cheaper Price Remains In Tune With Revenues

ProPetro Holding Corp. PUMP | 10.24 | -8.08% |

Unfortunately for some shareholders, the ProPetro Holding Corp. (NYSE:PUMP) share price has dived 34% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

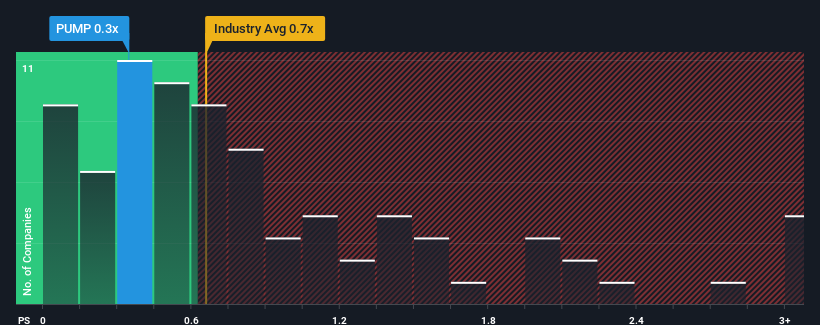

Although its price has dipped substantially, there still wouldn't be many who think ProPetro Holding's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Energy Services industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does ProPetro Holding's P/S Mean For Shareholders?

ProPetro Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ProPetro Holding will help you uncover what's on the horizon.How Is ProPetro Holding's Revenue Growth Trending?

ProPetro Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Even so, admirably revenue has lifted 65% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.3% per annum during the coming three years according to the six analysts following the company. With the industry predicted to deliver 4.3% growth per year, the company is positioned for a comparable revenue result.

With this information, we can see why ProPetro Holding is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From ProPetro Holding's P/S?

ProPetro Holding's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that ProPetro Holding maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.