Please use a PC Browser to access Register-Tadawul

Protara Therapeutics (TARA): Evaluating Valuation Following S&P Global BMI Index Inclusion

ARTARA THERAPEUTICS INC TARA | 5.70 | -5.16% |

Protara Therapeutics (TARA) just got a boost of attention by being added to the S&P Global BMI Index. For investors, this type of milestone often signals a shift in profile, drawing more eyes from institutions and fund managers who track major indices. Index addition does not guarantee major price moves, but it can influence sentiment, making some take another look at stocks that were previously flying under the radar.

This index news arrives after a year of change for Protara Therapeutics. The stock climbed 69% in the past year, reversing longer-term losses and pushing momentum to the upside, especially in recent months. Over the past month alone, the share price rose 3%, suggesting some renewed optimism as broader visibility grows, even as earlier years have seen heavy drawdowns.

Now that Protara Therapeutics has fresh attention and short-term momentum, the key question is whether the stock is undervalued by the market or if the recent gains already reflect most of its future growth potential.

Price-to-Book of 0.9x: Is it justified?

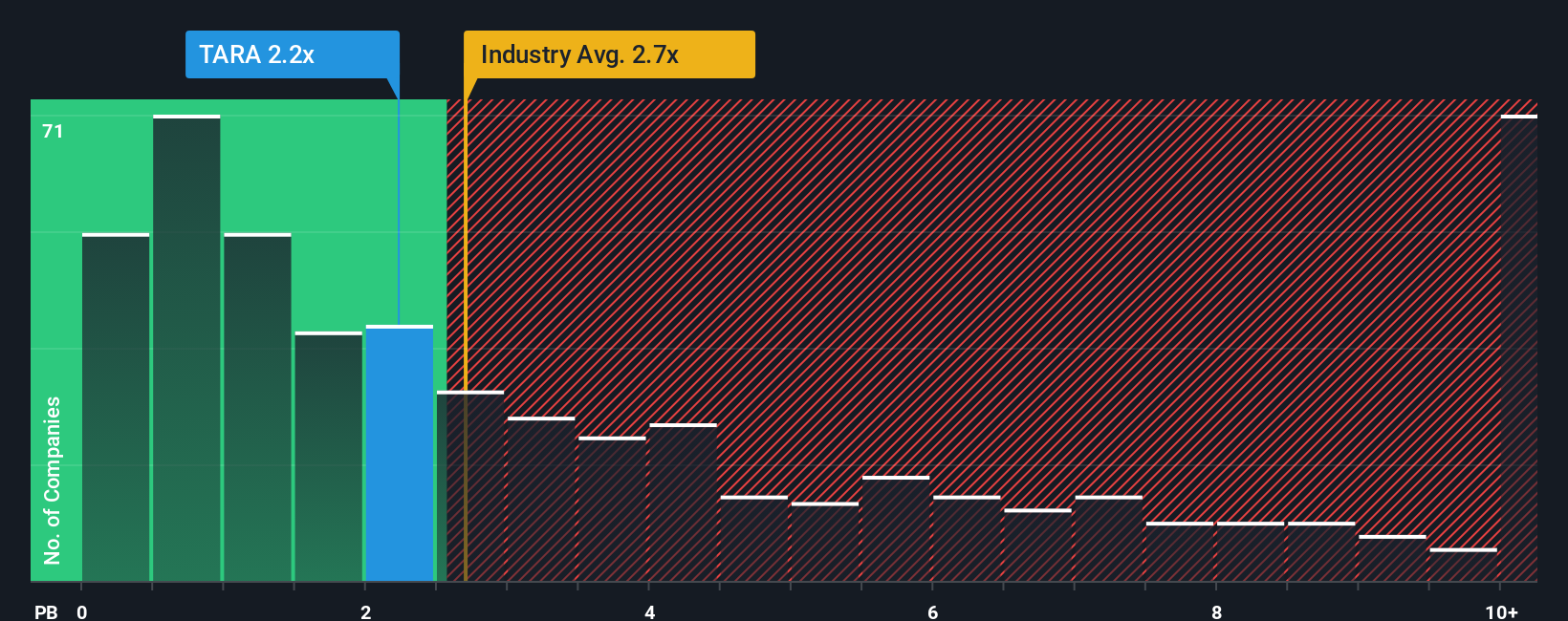

Protara Therapeutics is viewed as undervalued when looking at its Price-to-Book (P/B) multiple, which currently sits at 0.9x. This means the company’s stock price is trading below the value of its net assets when compared to its peers and the wider US biotech sector.

The Price-to-Book ratio measures the market’s valuation of a company relative to its book value, or net asset value. For early-stage biotech firms like Protara, which often post negative earnings, P/B is a preferred gauge of value instead of earnings-based ratios.

With peers averaging a P/B ratio of 3.5x and the broader US biotech industry averaging 2.2x, Protara’s discount suggests the market may be overlooking the company’s potential, or it could be a reflection of ongoing losses and uncertainty about future revenue. In either scenario, the low multiple means investors are paying less for each dollar of Protara’s net assets than is typical in the industry.

Result: Fair Value of $24.2 (UNDERVALUED)

See our latest analysis for Protara Therapeutics.However, despite the discounted valuation, ongoing losses and zero recorded revenue highlight lingering risks. These factors could quickly sour current investor optimism.

Find out about the key risks to this Protara Therapeutics narrative.Another View: Multiples Alone May Not Tell the Full Story

While the stock trades below its net asset value, suggesting it is undervalued, this view relies on asset-based comparisons. Other methods, like our SWS DCF model, currently have insufficient data to confirm or challenge this result. Should investors just focus on the low multiple or wait for more complete data?

Build Your Own Protara Therapeutics Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own view on Protara Therapeutics in just a few minutes. Do it your way

A great starting point for your Protara Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more ways to spot opportunity?

Serious investors do not limit themselves to a single pick. Instead, they unlock fresh strategies by spotting themes, trends, and emerging growth stories. Your next win could start with these handpicked shortcuts to smart stocks:

- Uncover high-potential plays with AI penny stocks that are harnessing artificial intelligence to disrupt industries and drive breakthrough innovation.

- Target tomorrow’s market gems among undervalued stocks based on cash flows that are trading below their cash flow potential and might offer big upside before the crowd catches on.

- Strengthen your income game by choosing dividend stocks with yields > 3% delivering reliable yields above 3% for compounding returns and peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.