PTC (NasdaqGS:PTC) Surges 19% Following Autodesk Acquisition Speculation

PTC Inc. PTC | 0.00 |

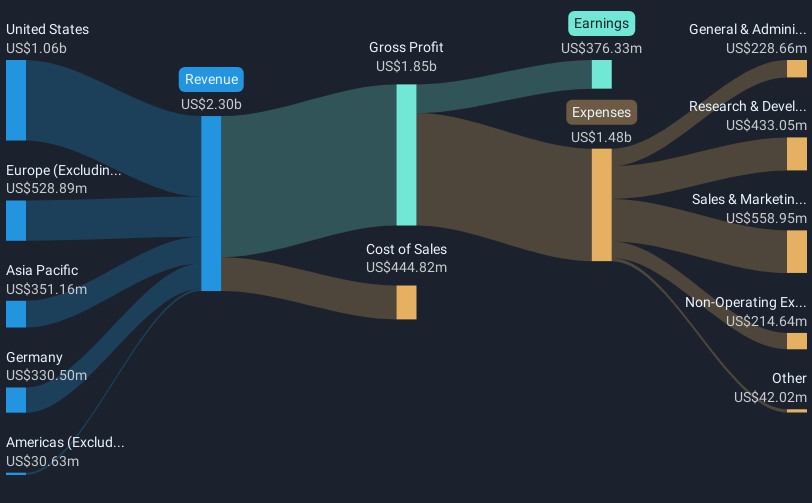

PTC (NasdaqGS:PTC) has been at the center of attention following Autodesk's contemplation of acquiring the company, which led to a notable 19% surge in its stock price. Over the last quarter, PTC's stock saw a significant 32% increase. This uptick is reflective of market optimism fueled by the M&A rumors, as well as PTC's client wins and new product launches, like the Supply Chain Intelligence offering. Despite broader market uncertainties around trade policies, PTC's addition to several Russell indices and its robust Q2 earnings have bolstered investor confidence amid a largely stable market.

The news around Autodesk contemplating acquiring PTC has sparked considerable market interest and has already influenced the company's stock significantly. With PTC witnessing a substantial share price increase recently, this development is integral to the narrative that highlights PTC's generative AI initiatives and strategic acquisitions. Such potential M&A activity could accelerate market transformation and bolster PTC's existing product offerings, which may lead to enhanced future revenue and profitability.

Over the longer term, PTC's total shareholder return, including dividends, reflected a very large increase of 133.05% over the past five years. This historical performance underscores the company's resilience and growth potential in a competitive landscape. However, over the past year, PTC underperformed the US Software industry with an 18.9% return, which could pose concerns when juxtaposed against its recent share price gains.

Given the context, one might expect the boost in share price and potential acquisition by Autodesk to impact positively on revenue and earnings forecasts. Enhancements in earnings per share, supported by continued share buybacks and robust cash flow, are anticipated to reinforce PTC's financial strength. Yet, cautious sentiment due to macroeconomic conditions or extended sales cycles might affect the company's ability to meet these expectations fully.

In relation to the price target, PTC's recent share price of US$158.72 is close to analysts' consensus price target of US$185.62, indicating a potential for a price increase. This brings PTC's valuation closer to the bullish expectations and could play a crucial role in shaping investor sentiment moving forward. As the market continues to digest this news, stakeholders will be observing how these actions translate into tangible financial results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Simply Wall St 24/11 08:14

Cango Inc.'s (NYSE:CANG) market cap dropped US$116m last week; Individual investors bore the brunt

Simply Wall St 24/11 10:28Procore Technologies Chief Legal Officer Benjamin C. Singer Reports Disposal of Common Shares

Reuters 22/11 02:16BTQ Technologies Included In MSCI Canada Small Cap Index, Effective Nov. 25

Benzinga News 24/11 12:36Morgan Stanley Initiates Coverage On Navan with Overweight Rating, Announces Price Target of $19

Benzinga News 24/11 13:21Deals of the day-Mergers and acquisitions

Reuters 24/11 15:03Why Are Shares Of Alibaba Higher Today?

Benzinga News 24/11 15:38PTC Inc. Files Initial Statement of Beneficial Ownership for Chief Product Officer Jon Stevenson

Reuters 24/11 22:59