Please use a PC Browser to access Register-Tadawul

PTC Therapeutics (NASDAQ:PTCT) shareholders are still up 36% over 1 year despite pulling back 7.4% in the past week

PTC Therapeutics, Inc. PTCT | 75.42 | -1.09% |

PTC Therapeutics, Inc. (NASDAQ:PTCT) shareholders have seen the share price descend 11% over the month. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 36%.

While the stock has fallen 7.4% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

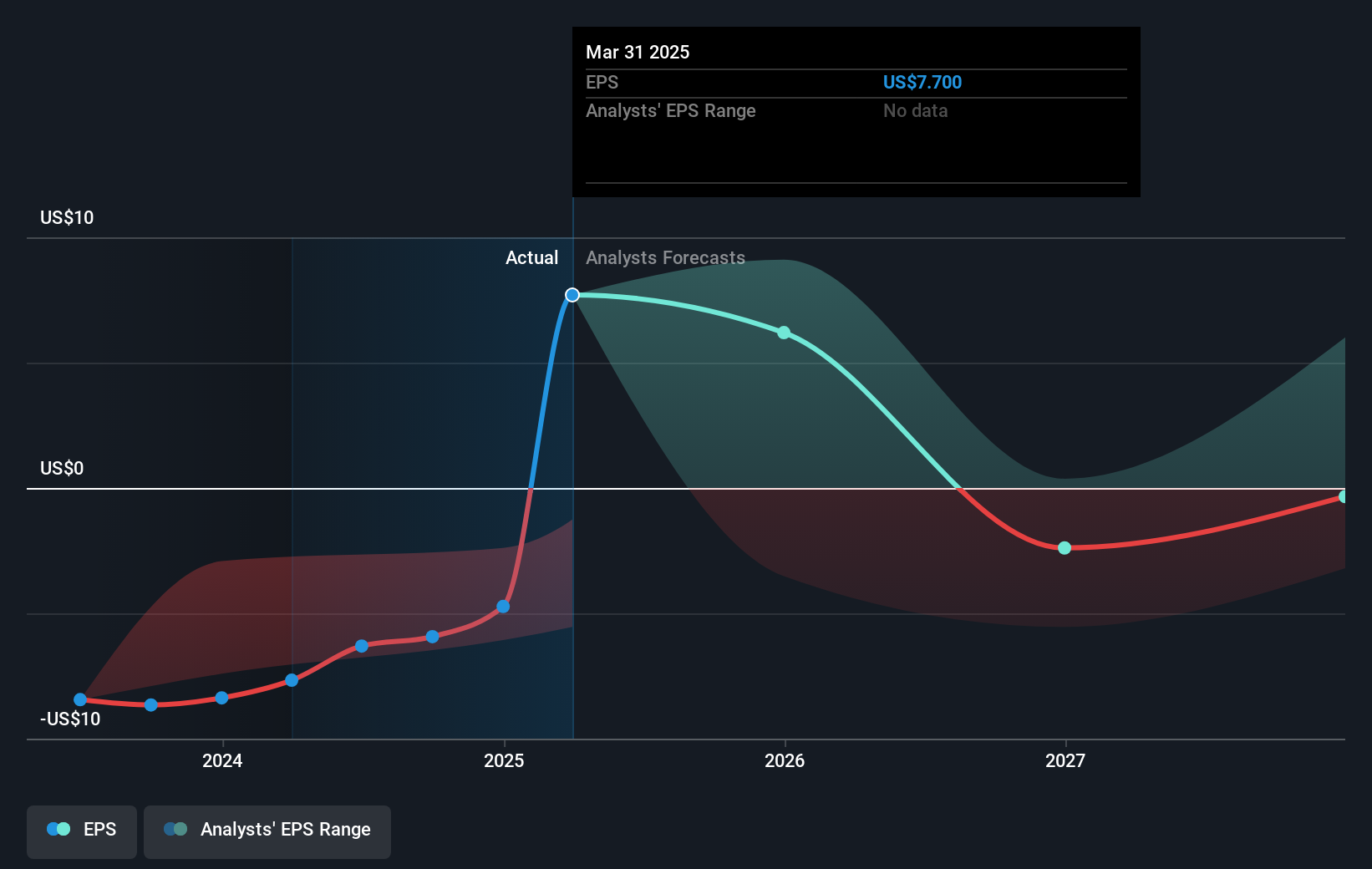

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year PTC Therapeutics grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how PTC Therapeutics has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at PTC Therapeutics' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that PTC Therapeutics shareholders have received a total shareholder return of 36% over one year. Notably the five-year annualised TSR loss of 1.4% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.