Please use a PC Browser to access Register-Tadawul

PulteGroup (PHM) Valuation Check After Raymond James Backs Shift Toward Core Homebuilding

PulteGroup, Inc. PHM | 140.02 | +0.29% |

PulteGroup (PHM) has just filed an omnibus shelf registration covering multiple securities, including common and preferred shares, senior subordinated debt, warrants and stock purchase units, giving the homebuilder flexible access to future financing options.

The filing lands after a busy spell for PulteGroup, with the board affirming a quarterly dividend of $0.26 per share, recent buybacks totaling $300 million in Q4 2025, and plans to exit off site manufacturing while expanding Del Webb communities. Against that backdrop, the shares have a 7 day share price return of 6.31% and a 90 day share price return of 11.44%. The 1 year total shareholder return of 27.77% and 5 year total shareholder return of 192.59% point to stronger long term momentum than the recent 30 day share price return of 2.19%.

If this news has you thinking beyond a single homebuilder, it could be a moment to broaden your watchlist with 22 top founder-led companies as potential long term candidates.

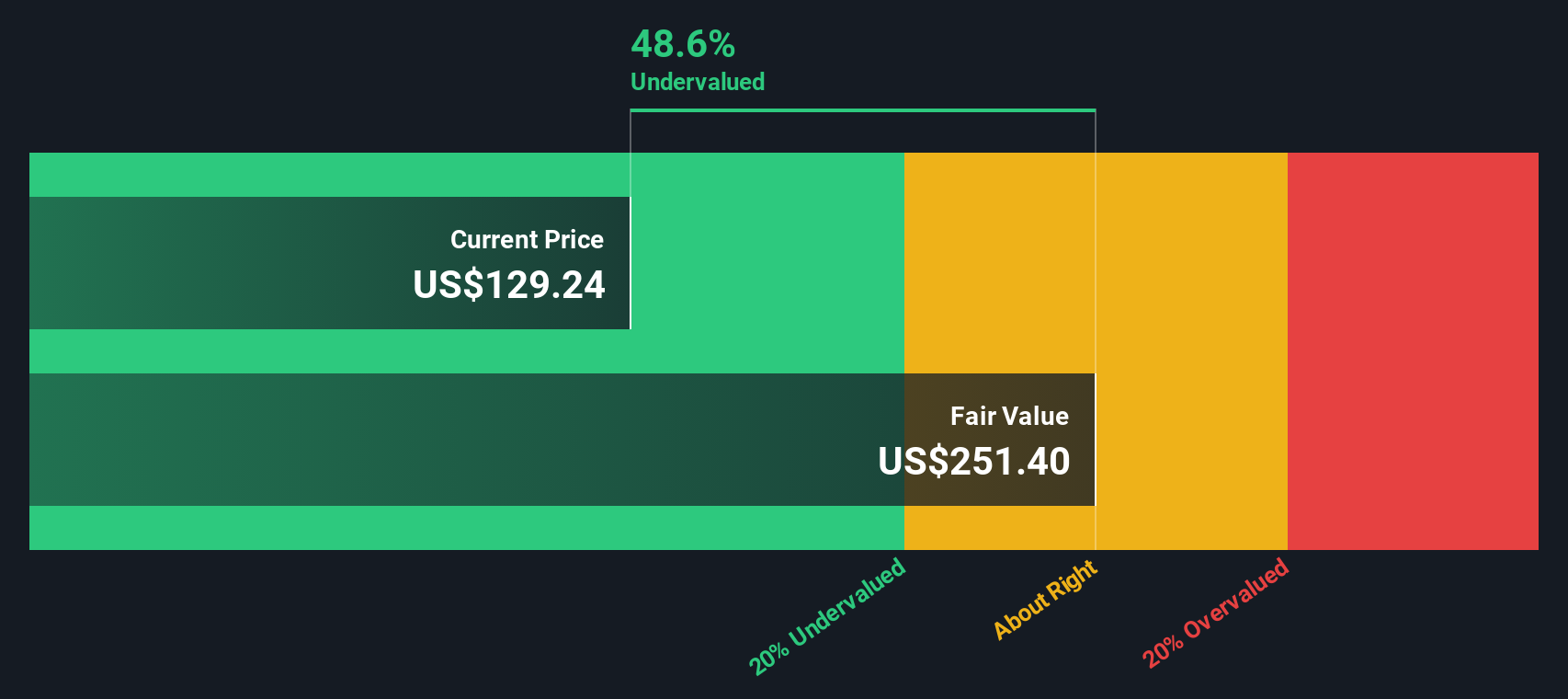

With revenue at $17.3b, net income at $2.2b and the stock recently closing at $135.09, the question now is whether PulteGroup is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 4.1% Undervalued

With PulteGroup last closing at $135.09 and the most followed narrative setting fair value around $140.92, the gap is small but meaningful for valuation focused investors.

PulteGroup's strategic expansion and strong performance in active adult communities (Del Webb and Del Webb Explorer), which command higher prices and margins, positions the company to benefit from sustained demand among aging but financially strong demographics. This is likely to support both revenue growth and margin expansion, particularly as these communities come online more fully in 2026.

Curious how a modest revenue outlook, margin reset and a lower future earnings multiple can still point to upside against today’s price? The full narrative lays out the earnings path, valuation bridge and discount rate assumptions that have analysts holding a slightly higher fair value line than the market.

Result: Fair Value of $140.92 (UNDERVALUED)

However, the story can change quickly if affordability pressures deepen or if regional softness in markets like the West and Texas weighs more heavily on orders and margins.

Another Angle On Value

Our DCF model presents a different perspective compared with the 4.1% undervalued narrative. Based on those cash flow assumptions, PulteGroup at $135.09 appears above an estimated fair value of $102.99, which screens as overvalued. For you, that raises a simple question: which set of assumptions feels more realistic?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PulteGroup for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PulteGroup Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your PulteGroup research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at one company, tap into broader ideas that could round out your exposure.

- Target quality by checking our solid balance sheet and fundamentals stocks screener (45 results) that highlight companies with financial foundations built to handle tougher conditions.

- Hunt for value by scanning the 52 high quality undervalued stocks that may flag shares priced below what their fundamentals suggest.

- Boost your income focus with the 14 dividend fortresses that surface companies offering higher yields with an eye on resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.