Please use a PC Browser to access Register-Tadawul

PureCycle Technologies (PCT) Valuation Check After High Profile College Football Recycling Partnership

PureCycle Technologies Inc PCT | 8.99 | -2.81% |

Event context and why it matters for PureCycle

PureCycle Technologies (PCT) is in focus after partnering with Churchill Container and 4ocean to supply reusable Run It Back souvenir cups made with its recycled resin at the College Football Playoff National Championship.

The program ties every 20 cups sold to the removal of one pound of ocean trash, giving PureCycle a high profile platform for its recycling technology and putting a clear environmental metric in front of fans and investors.

PureCycle’s recent College Football Playoff exposure and the updated timeline for its Augusta facility have arrived alongside a 57.85% 1 month share price return and a 31.40% year to date share price return. However, the 5 year total shareholder return of a 38.07% loss shows that momentum is a relatively recent shift.

If this kind of recycling story has your attention, it could be worth scanning other high growth tech and AI names using our high growth tech and AI stocks.

With PureCycle shares up 57.85% over the past month and 31.40% year to date, yet still showing a 38.07% 5 year total shareholder loss, you have to ask: Is there still upside here, or is recent enthusiasm already pricing in future growth?

Price-to-Book of 31.1x: Is it justified?

PureCycle’s shares last closed at US$11.76 and its P/B of 31.1x sits far above both peers and the broader US Chemicals industry, which sets a high bar for expectations baked into the current price.

P/B compares the market value of the company to its net assets on the balance sheet, so a higher multiple usually reflects strong confidence in future earnings power or asset-light business models. For a company that is currently loss making, such a premium suggests that investors are placing considerable weight on future revenue growth and the scalability of its recycling technology rather than current financials.

Relative to an average P/B of 2.9x for peers and 1.4x for the US Chemicals industry, PureCycle’s 31.1x multiple is extremely rich in comparison. That kind of gap indicates that the market is pricing in a very optimistic path from today’s small revenue base and substantial losses to a much larger, more profitable operation.

Result: Price-to-Book of 31.1x (OVERVALUED)

However, the story can quickly change if PureCycle struggles to move beyond US$5.66 million in revenue, or if losses such as the US$234.38 million net loss persist.

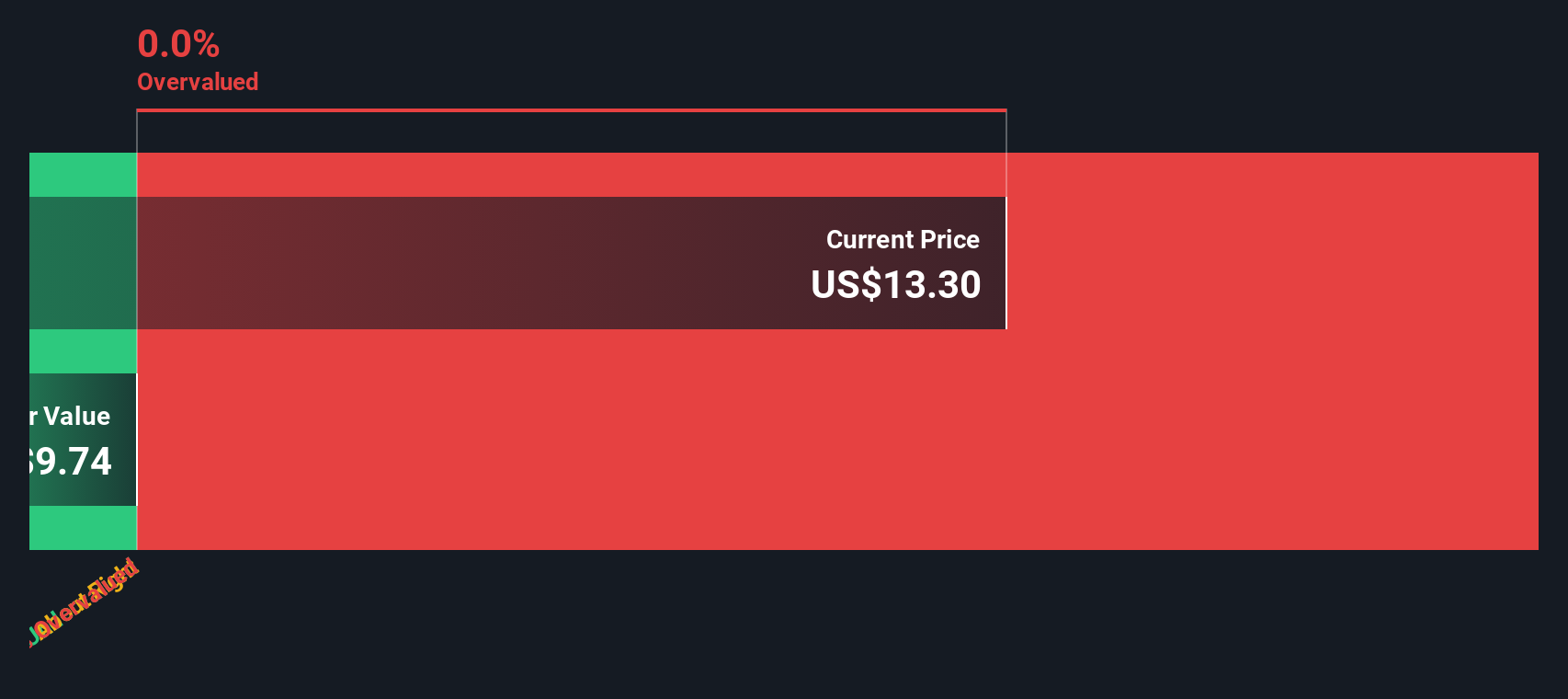

Another view: what the DCF model says

While the 31.1x P/B ratio flags PureCycle as expensive on asset value, our DCF model points to a similar message. With shares at US$11.76 versus an estimated fair value of US$4.65, the model suggests the price embeds a lot of optimism already. That raises the question: how much execution risk are you comfortable owning at this level?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PureCycle Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PureCycle Technologies Narrative

If you see the numbers differently or want to stress test your own view, you can build a personalised PureCycle story in just a few minutes, starting with Do it your way.

A great starting point for your PureCycle Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more stock ideas beyond PureCycle?

If PureCycle has you thinking about where capital could work harder, do not stop here. Broaden your watchlist with a few targeted idea generators today.

- Spot potential high risk high reward names by scanning these 3530 penny stocks with strong financials that pair tiny share prices with balance sheets and earnings quality filters.

- Ride the AI trend more deliberately by focusing on these 24 AI penny stocks that link artificial intelligence themes with underlying business fundamentals.

- Hunt for possible mispriced opportunities by reviewing these 865 undervalued stocks based on cash flows that flag companies trading below what their cash flows might suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.