Please use a PC Browser to access Register-Tadawul

Qualcomm Expands APAC AI And Open RAN As Smartphone Reliance Eases

QUALCOMM Incorporated QCOM | 138.93 | +1.16% |

- Qualcomm (NasdaqGS:QCOM) has launched the Qualcomm AI Program for Innovators in APAC, targeting startups in Japan, Singapore, and South Korea to accelerate edge AI solutions.

- The company also announced a major Open RAN collaboration with Rakuten Mobile and Fujitsu's 1Finity for a large scale network deployment.

- These moves align with Qualcomm's ongoing efforts to broaden its business across automotive and IoT markets, alongside its core smartphone segment.

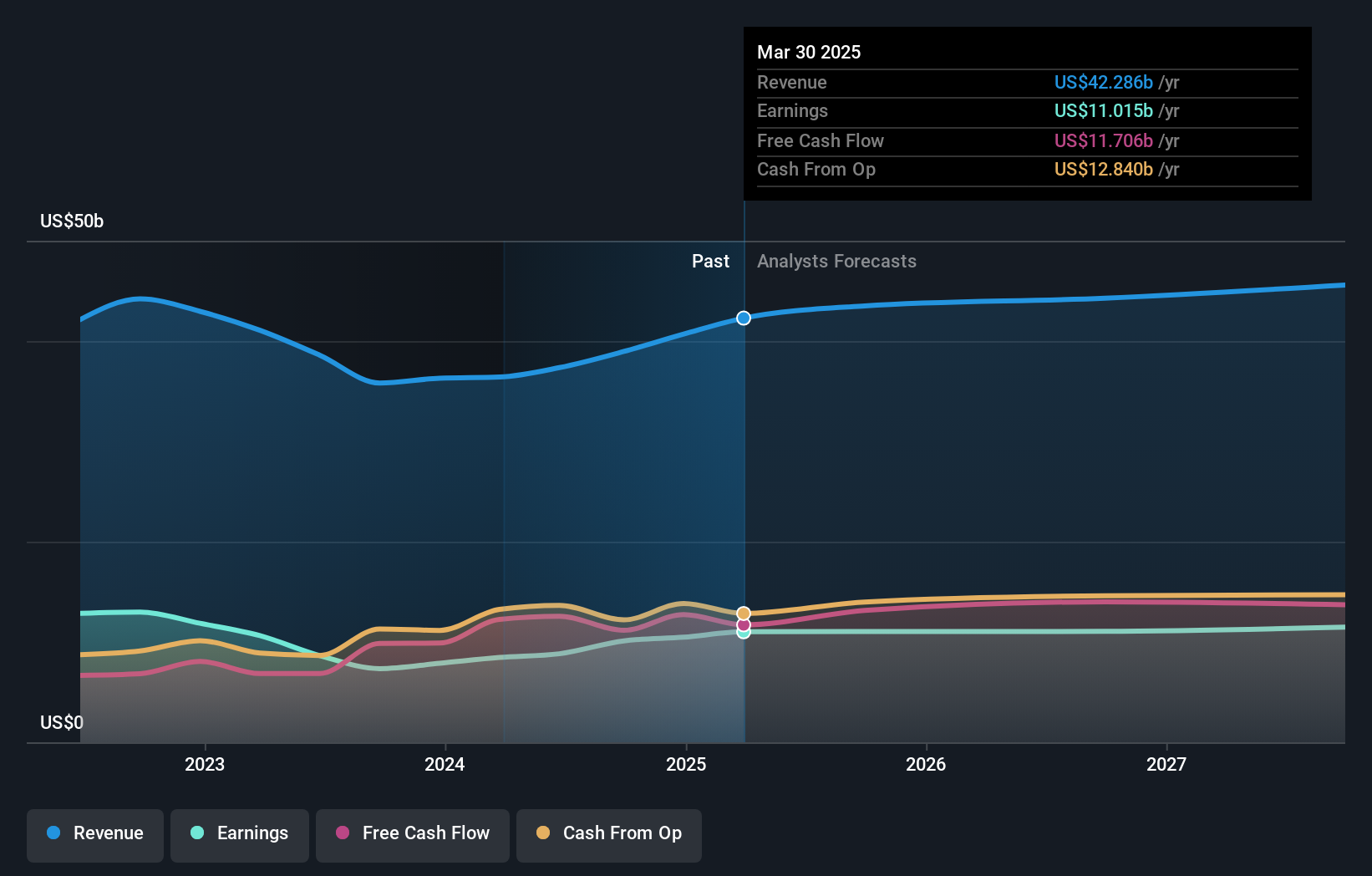

Qualcomm sits at the center of mobile connectivity and computing and is increasingly tied to edge AI, automotive electronics, and IoT devices. The new APAC AI program and Open RAN deployment plan indicate how the company is working to plug its technology into a wider range of connected products and networks. For investors watching NasdaqGS:QCOM, these developments provide additional detail on how the business mix could evolve beyond handsets.

Looking ahead, the depth and quality of adoption in AI, Open RAN, automotive, and IoT partnerships will be important to track. You may want to watch for design wins, rollout milestones, and ecosystem uptake around these initiatives, as they can influence Qualcomm's revenue sources and bargaining power with customers over time.

Stay updated on the most important news stories for QUALCOMM by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on QUALCOMM.

The APAC AI Program and the large scale Open RAN deployment with Rakuten Mobile and Fujitsu both point to Qualcomm trying to deepen its role in edge computing and carrier networks at the same time that handset demand faces pressure and major customers like Apple work on in-house modems. By putting its platforms into startup ecosystems and into a cloud-native mobile network, Qualcomm is looking to widen its customer base and use cases. This can be relevant for investors tracking whether automotive, IoT, and AI at the edge can become more meaningful against a softer smartphone backdrop and rising competition from MediaTek and others.

How this fits the QUALCOMM growth story investors have been watching

The new AI and Open RAN pushes fit with the existing investor narratives that see Qualcomm using its smartphone cash engine to support expansion in automotive, PCs, and connected devices. Prior results that showed growth in automotive and IoT, plus recent design work with Volkswagen, Hyundai Mobis, and ECARX, line up with this news. All of these moves point toward Qualcomm supplying the connectivity and compute layer that brings AI to devices and vehicles rather than only chasing data center chips like NVIDIA or AMD.

Risks and rewards to keep in mind

- The AI startup program in Japan, Singapore, and South Korea can widen Qualcomm's partner base and help seed future design wins across edge AI hardware and services.

- The Open RAN rollout in Rakuten Mobile's network could strengthen Qualcomm's position in 5G infrastructure and add another revenue stream beyond handsets and licensing.

- Analyst comments highlight pressure from weaker global handset demand, content cuts by Apple and Huawei, and tougher competition from MediaTek, which can offset gains from newer areas.

- Investors also face company specific governance and geopolitical questions, including shareholder proposals on special meetings and China related risk disclosure.

What to watch next

From here, it is worth watching how many AI startups actually commercialize products on Qualcomm platforms, how quickly the Rakuten Mobile deployment scales, and whether management commentary in upcoming earnings ties these efforts to more diversified revenue away from Apple and premium Android phones. If you want a broader view of how these moves fit into the long term thesis, check community narratives on Qualcomm's dedicated page and see how other investors are interpreting the same signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.