Please use a PC Browser to access Register-Tadawul

Quanterix (NASDAQ:QTRX) delivers shareholders stellar 129% return over 1 year, surging 7.2% in the last week alone

Quanterix QTRX | 7.41 7.41 | -1.98% 0.00% Post |

Quanterix Corporation (NASDAQ:QTRX) shareholders have seen the share price descend 18% over the month. But that doesn't change the fact that the returns over the last year have been very strong. Indeed, the share price is up an impressive 129% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

The past week has proven to be lucrative for Quanterix investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for Quanterix

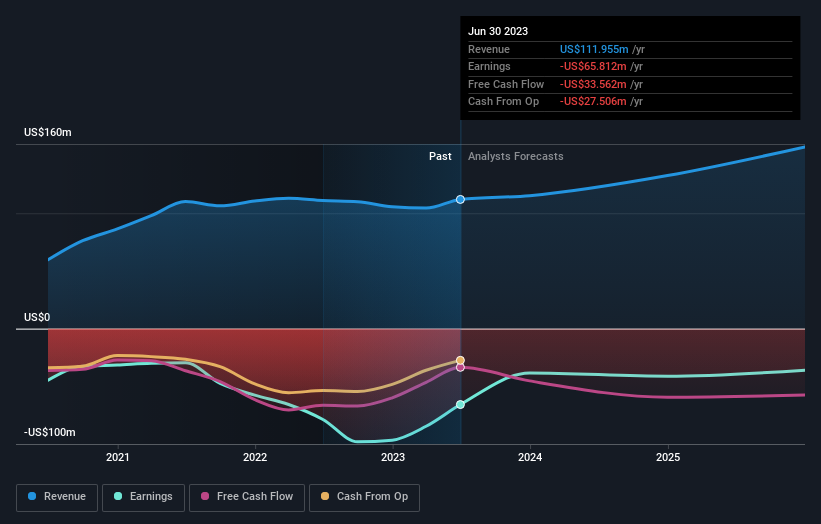

Quanterix wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Quanterix's revenue grew by 0.8%. That's not a very high growth rate considering it doesn't make profits. So we wouldn't have expected the share price to rise by 129%. We're happy that investors have made money, though we wonder if the increase will be sustained. It's quite likely that the market is considering other factors, not just revenue growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Quanterix shareholders have received a total shareholder return of 129% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Quanterix better, we need to consider many other factors. For instance, we've identified 2 warning signs for Quanterix that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.