Please use a PC Browser to access Register-Tadawul

Quantum Computing (NasdaqCM:QUBT) Soars 245% Last Quarter With US$17 Million Net Income Turnaround

Quantum Computing Inc. QUBT | 12.05 | -6.08% |

Quantum Computing (NasdaqCM:QUBT) recently posted a 245% increase in its share price over the last quarter, highlighting significant investor enthusiasm. This surge follows the company's announcement of a notable earnings turnaround, reporting a net income of $17 million compared to a loss last year, and the opening of its quantum photonic chip foundry in Tempe, Arizona. These developments potentially boosted investor confidence as the market anticipated broader adoption of quantum technologies. During this period, the broader market saw a modest rise, with the S&P 500 nearing record highs, suggesting that Quantum's impressive rally wasn't entirely market-driven.

Quantum Computing Inc.'s shares have shown remarkable growth, with a very large total return of approximately 2843.37% over the past year. In comparison, the company outperformed the US Tech industry over the same one-year period, which experienced a 7.3% decline, as well as the broader US market which increased by 11.2%. This suggests a strong investor interest despite the company's ongoing challenges. The changes indicated in the introduction, including the earnings turnaround and advancements in quantum technology, likely fueled this heightened investor confidence.

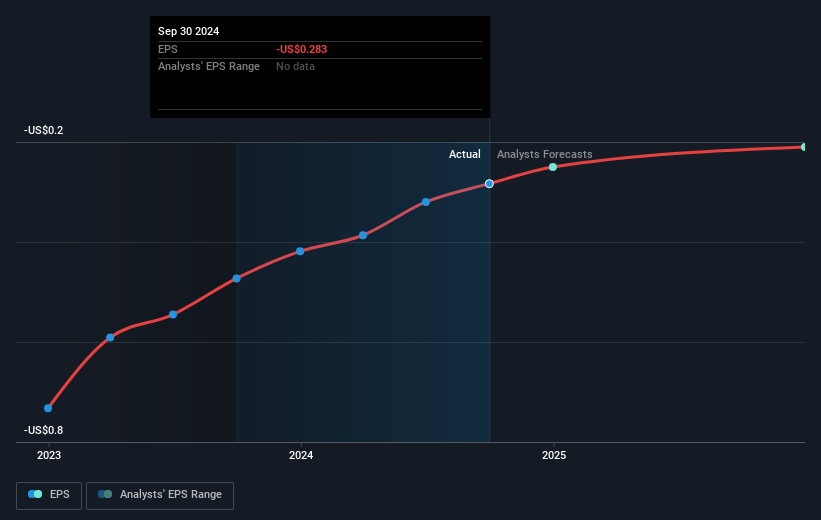

Although the company's revenue forecast shows an expected growth rate of 82.5% per year, Quantum remains unprofitable and is not expected to achieve profitability in the next three years. This rapid share price ascendancy occurs with a valuation that seems high given Quantum's current financial position, being well above consensus analyst price targets which are 15.97% higher than the current share price. Investors are advised to consider these aspects when evaluating Quantum's long-term potential and current market valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.