Please use a PC Browser to access Register-Tadawul

Quantum Computing (QUBT) Is Up 30.6% After Oversubscribed $750 Million Private Placement - Has The Bull Case Changed?

Quantum Computing Inc. QUBT | 12.05 | -6.08% |

- Quantum Computing Inc. announced an oversubscribed private placement with institutional investors, raising approximately US$750 million through the issuance of 37,183,937 shares of common stock at US$20.169 per share, with closing expected around October 8, 2025, subject to standard conditions.

- A key insight is that this significant capital infusion, coming alongside the launch of the company’s next-generation Quantum Secure Solution, has elevated Quantum Computing Inc.'s profile in the advanced computing industry as it seeks broader commercial and government engagement.

- We’ll examine how the substantial new capital from institutional investors may reshape Quantum Computing Inc.’s investment narrative and growth ambitions.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Quantum Computing's Investment Narrative?

To be a shareholder in Quantum Computing Inc., you really need to believe in the long-term promise of quantum technologies reshaping tech, security, and communications, as the company remains in very early stages of revenue generation and product rollouts. The recent US$750 million capital raise from institutional investors marks a significant milestone, potentially giving QCi the firepower to accelerate commercial launches and scale its new photonic chip foundry. While this addresses prior concerns about funding runway and signals confidence from major shareholders, it does bring further dilution risk into focus given the already high share count and multiple prior raises this year. The new capital could become a key short-term catalyst by enabling more partnerships and customer wins, but it also magnifies the pressure to translate funding into contract revenue and meaningful commercial adoption, especially as QCi is not expected to turn profitable in the next three years. The stakes have never been higher, QCi’s investment narrative now hinges on executing after a series of headline-grabbing fundraisings.

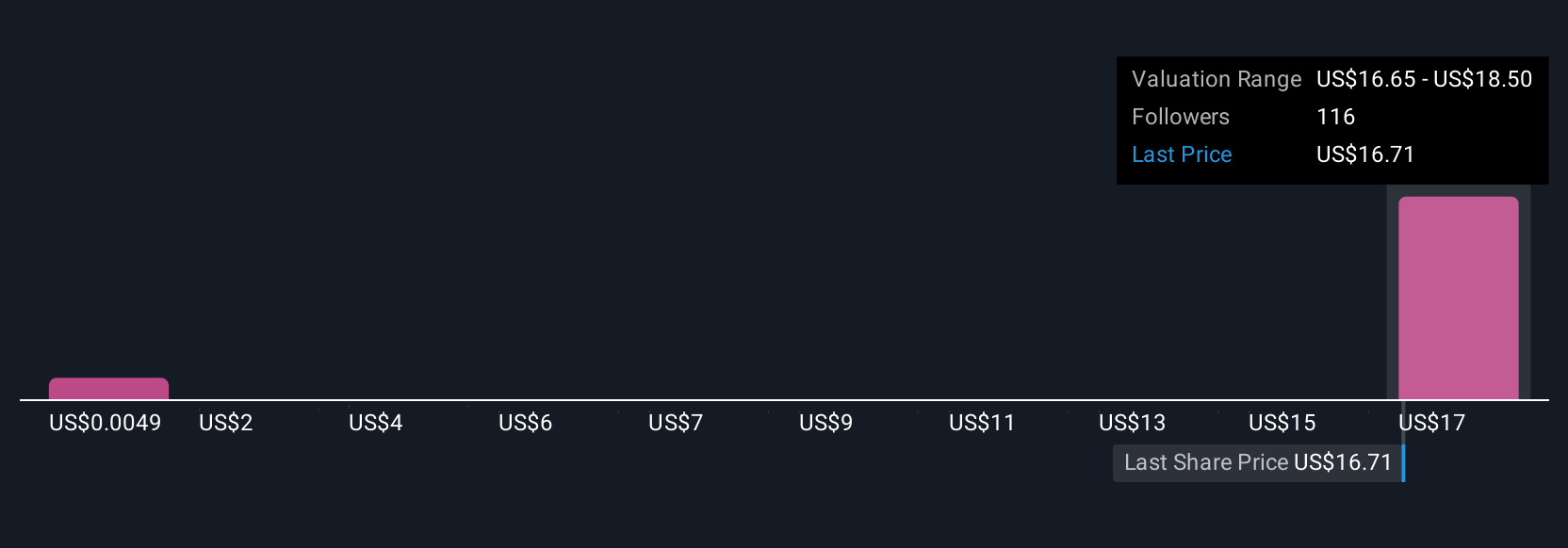

Yet the risk of ongoing dilution is something investors should watch closely. According our valuation report, there's an indication that Quantum Computing's share price might be on the expensive side.Exploring Other Perspectives

Explore 31 other fair value estimates on Quantum Computing - why the stock might be worth less than half the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.