Please use a PC Browser to access Register-Tadawul

Quest Diagnostics MRD Blood Test May Support Growth In Higher Value Oncology

Quest Diagnostics Incorporated DGX | 202.41 | -0.01% |

- Quest Diagnostics (NYSE:DGX) has introduced a blood based minimal residual disease test for multiple myeloma that uses advanced flow cytometry.

- The company reports that the assay offers sensitivity comparable to next generation sequencing with a lower expected cost and less invasive sampling.

- FDA draft guidance recognizes minimal residual disease as an endpoint in multiple myeloma clinical trials, supporting broader use of MRD testing in research.

For you as an investor, this development sits squarely in Quest’s core business of diagnostic testing, but in a higher complexity corner of oncology where reimbursement, clinical adoption, and data quality matter a lot. Multiple myeloma monitoring is a meaningful clinical need, and a blood based test can be easier to use in routine practice than repeated bone marrow biopsies. The new assay adds to Quest’s menu of specialty tests in cancer care at a time when precision monitoring is becoming more important to clinicians and drug developers.

Looking ahead, attention will likely focus on how quickly oncologists and trial sponsors adopt MRD by blood as part of care pathways and study designs. For NYSE:DGX, the commercial impact will depend on factors such as payer coverage, ordering patterns from cancer centers, and the role of MRD data in future multiple myeloma therapies and trials.

Stay updated on the most important news stories for Quest Diagnostics by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Quest Diagnostics.

Quick Assessment

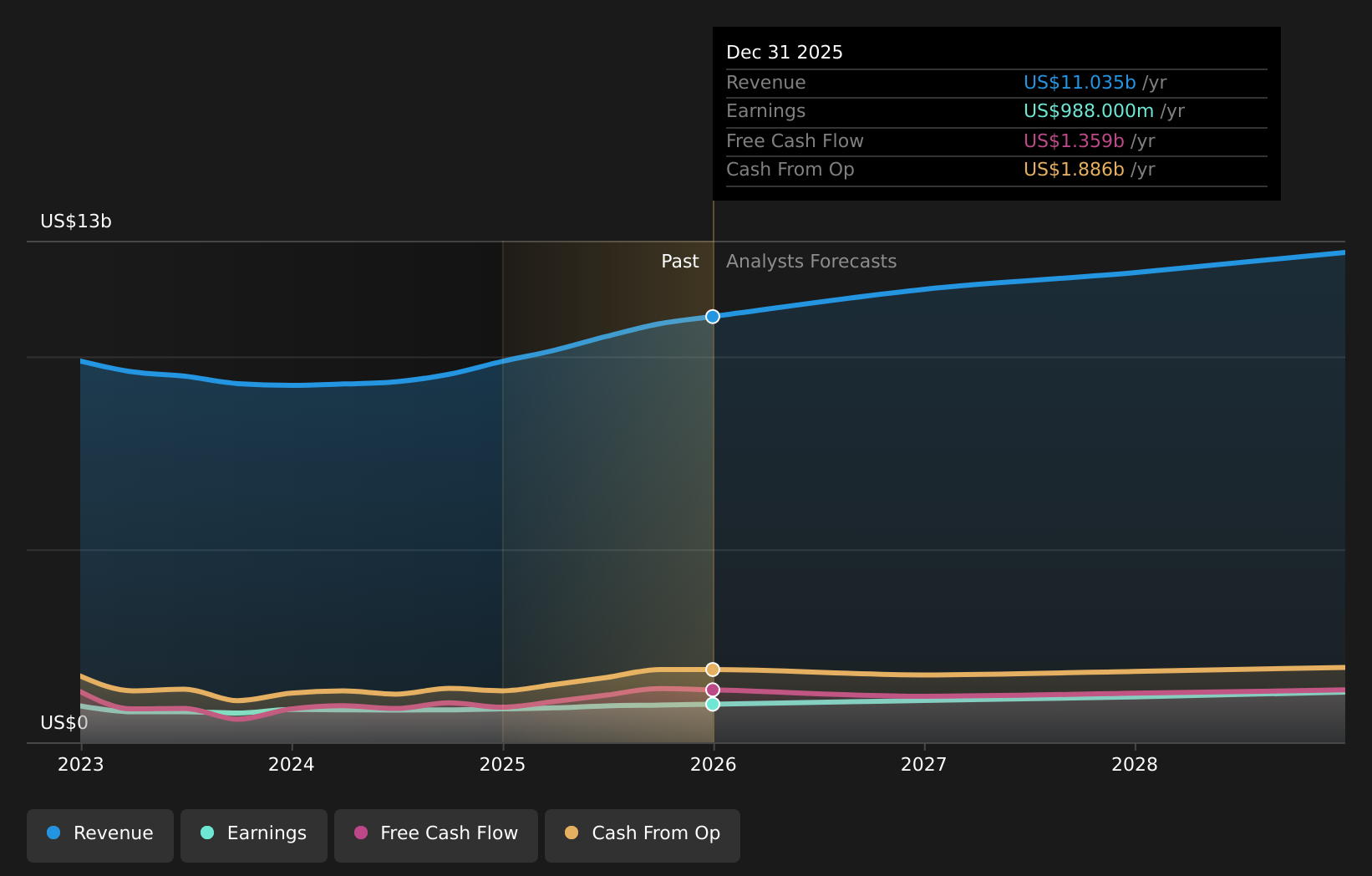

- ⚖️ Price vs Analyst Target: At US$209.32, Quest trades about 1.3% below the US$212.07 analyst target, so it is roughly in line with consensus.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading about 33.6% below fair value, indicating potential upside relative to its model.

- ✅ Recent Momentum: The 30 day return of about 19% shows investors have reacted positively over the past month.

There is only one way to know the right time to buy, sell or hold Quest Diagnostics. Head to the Simply Wall St company report for the latest analysis of Quest Diagnostics's Fair Value.

Key Considerations

- 📊 The new multiple myeloma MRD blood test sits in a higher value segment of diagnostics, so you may want to see how it contributes to oncology related revenue over time.

- 📊 Keep an eye on MRD test volumes, payer coverage decisions and how often the assay is used in clinical trials that rely on the FDA backed MRD endpoint.

- ⚠️ Simply Wall St flags a high level of debt as a risk, so investors may want to see that new test investments are matched by disciplined balance sheet management.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Quest Diagnostics analysis. Alternatively, you can visit the community page for Quest Diagnostics to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.