Please use a PC Browser to access Register-Tadawul

Rayonier Advanced Materials Inc. (NYSE:RYAM) Held Back By Insufficient Growth Even After Shares Climb 26%

Rayonier Advanced Materials Inc RYAM | 7.76 | -0.64% |

Rayonier Advanced Materials Inc. (NYSE:RYAM) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.7% in the last twelve months.

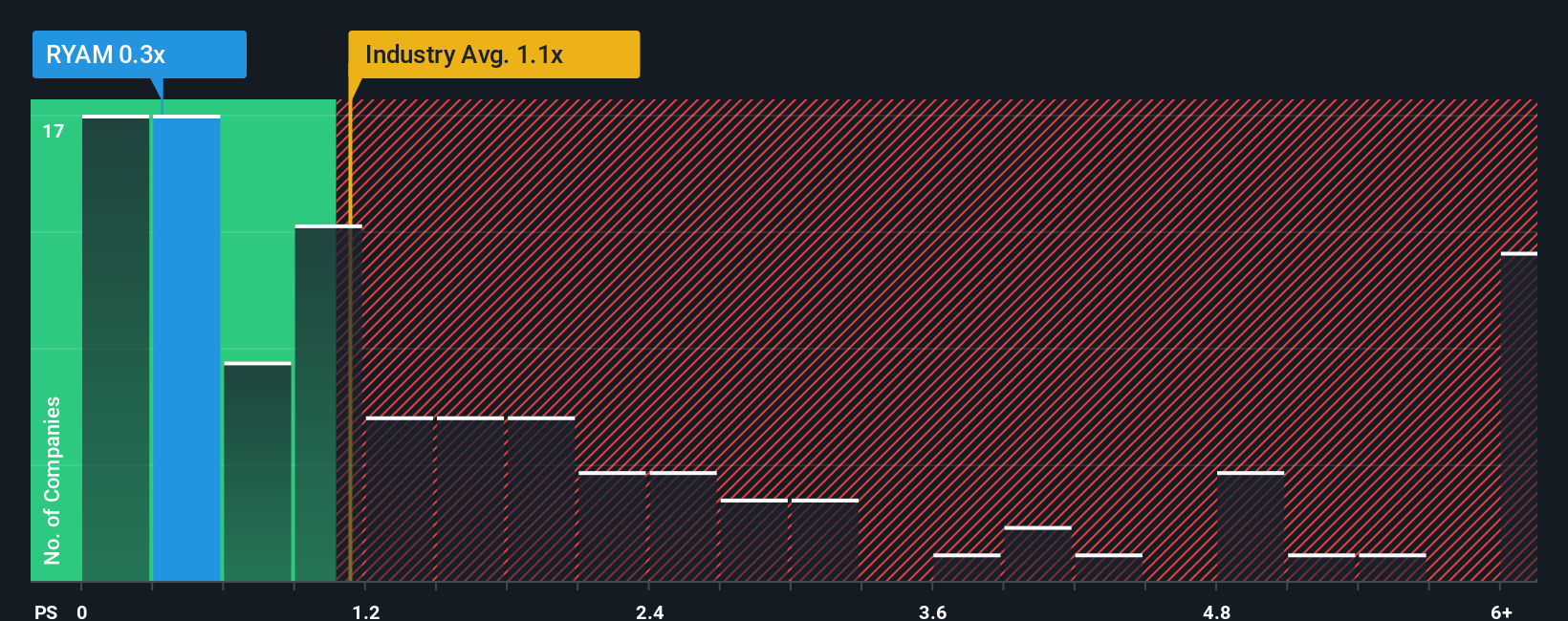

Although its price has surged higher, given about half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Rayonier Advanced Materials as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Rayonier Advanced Materials Performed Recently?

Rayonier Advanced Materials hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rayonier Advanced Materials.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Rayonier Advanced Materials' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.7%. As a result, revenue from three years ago have also fallen 7.5% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.6% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.4%, which is noticeably more attractive.

In light of this, it's understandable that Rayonier Advanced Materials' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Rayonier Advanced Materials' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Rayonier Advanced Materials' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.