Please use a PC Browser to access Register-Tadawul

Rayonier Dividend Reclassification Puts Tax Focus On Total Return Profile

Rayonier Inc. RYN | 22.66 | +0.49% |

- Rayonier (NYSE:RYN) has announced that its 2025 dividend distributions will be classified as 100% capital gain distributions for tax purposes.

- This tax treatment applies to dividends paid during the 2025 tax year and is relevant for shareholders planning their future tax filings.

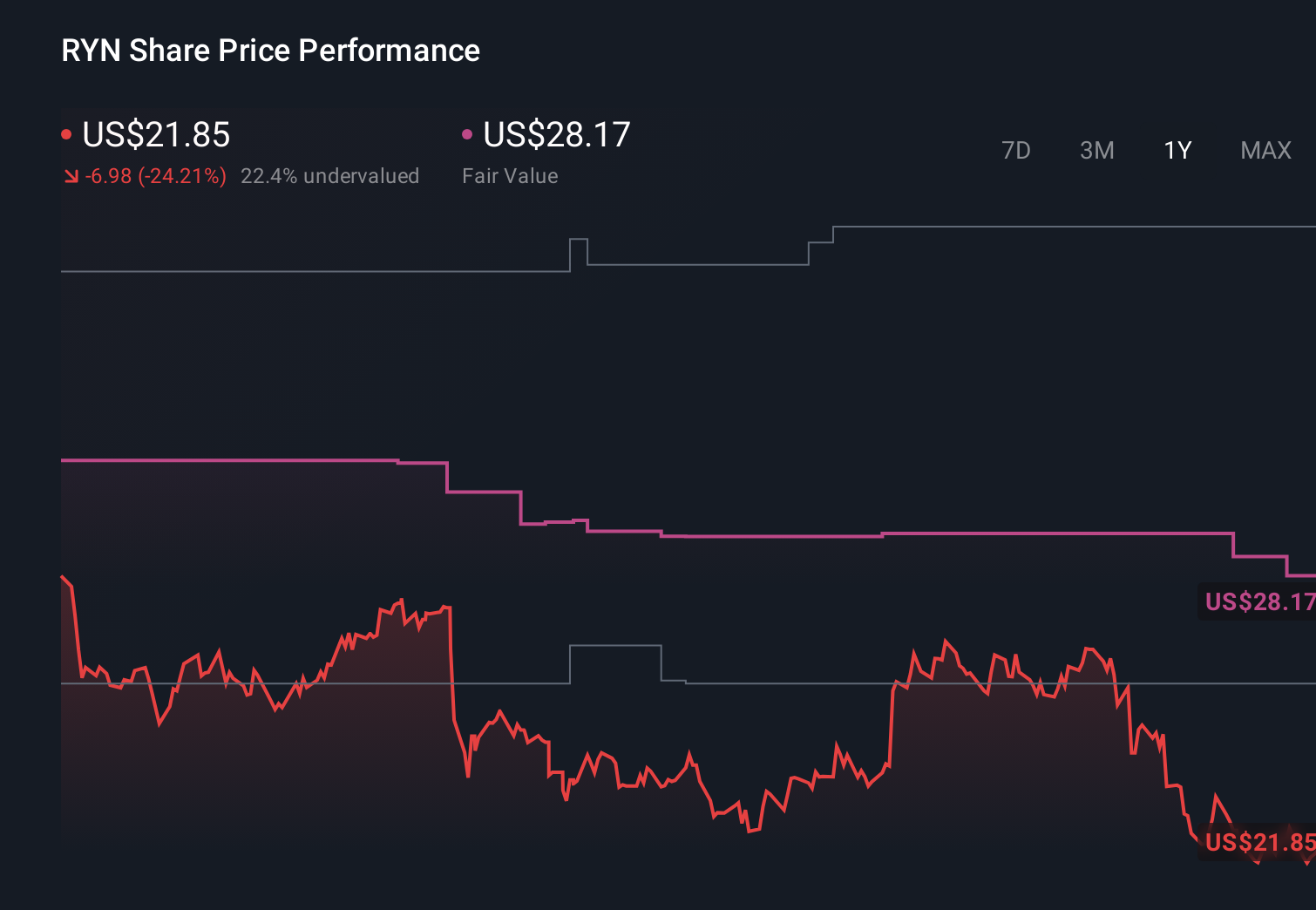

For investors watching Rayonier at a share price of $24.29, this tax update adds another factor to consider alongside recent price moves. The stock is up 5.3% over the past week and 11.5% over the past month, with a 12.4% return year to date. Over longer periods, performance has been mixed, including a 10.5% decline over three years and a 4.4% return over five years.

This shift in dividend tax classification may influence how you think about holding Rayonier in taxable versus tax-advantaged accounts. It can also prompt a closer look at whether the return profile of NYSE:RYN aligns with your income needs, time horizon and sensitivity to capital gain distributions.

Stay updated on the most important news stories for Rayonier by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Rayonier.

Classifying the entire 2025 dividend of US$2.49 per share as a capital gain distribution is mainly a tax outcome, but it can influence how different types of investors view Rayonier. For income focused holders who care about qualified dividends, this may be less appealing, while investors who manage capital gains actively or have loss offsets available might see it as more flexible for tax planning.

Rayonier narrative, now with a tax twist

Even without a formal narrative published, this kind of tax disclosure can feed into existing views on Rayonier as either a long term income vehicle or a total return holding. For some shareholders, the shift toward capital gain treatment could reinforce the idea that the story is less about consistent dividend income and more about the overall return profile, including how gains are realized and taxed over time.

Rayonier risks and rewards in focus

- ⚠️ Analysts have flagged one major risk, with forecasts indicating earnings could decline by an average of 53.9% per year over the next 3 years.

- ⚠️ There are two minor risks, including concerns that the 11.9% dividend is not well covered by free cash flows and signs of substantial insider selling over the past quarter.

- 🎁 On the upside, Rayonier is assessed as trading at good value compared to peers and the wider industry.

- 🎁 Earnings grew by 185.5% over the past year, which supports the view that the business can still produce strong results even as future forecasts remain cautious.

What to watch next

From here, it is worth watching how income oriented investors respond to the 100% capital gain classification and whether that affects ownership trends, trading volumes or how the dividend yield is perceived relative to the risks already identified by analysts. Check out how other investors are framing the Rayonier story and compare their narratives with your own view.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.