Read This Before Considering First Internet Bancorp (NASDAQ:INBK) For Its Upcoming US$0.06 Dividend

First Internet Bancorp INBK | 0.00 |

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that First Internet Bancorp (NASDAQ:INBK) is about to go ex-dividend in just 4 days. The ex-dividend date occurs one day before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Accordingly, First Internet Bancorp investors that purchase the stock on or after the 30th of June will not receive the dividend, which will be paid on the 15th of July.

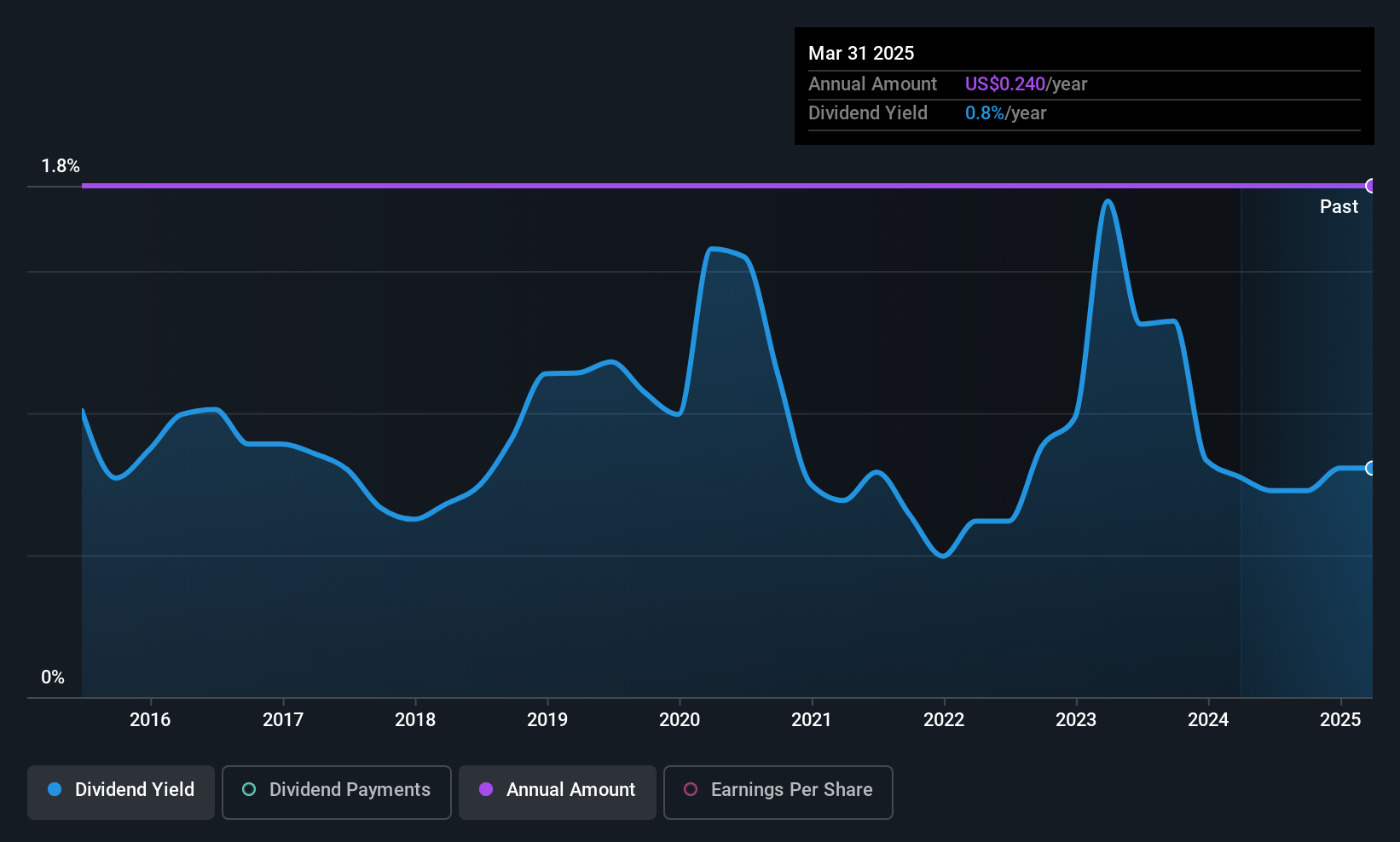

The company's next dividend payment will be US$0.06 per share, on the back of last year when the company paid a total of US$0.24 to shareholders. Looking at the last 12 months of distributions, First Internet Bancorp has a trailing yield of approximately 0.9% on its current stock price of US$26.71. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether First Internet Bancorp can afford its dividend, and if the dividend could grow.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. First Internet Bancorp paid out just 9.9% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're not enthused to see that First Internet Bancorp's earnings per share have remained effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. First Internet Bancorp's dividend payments are effectively flat on where they were 10 years ago.

To Sum It Up

Should investors buy First Internet Bancorp for the upcoming dividend? First Internet Bancorp's earnings per share have not grown at all in recent years, although we like that it is paying out a low percentage of its earnings. It doesn't appear an outstanding opportunity, but could be worth a closer look.

Curious what other investors think of First Internet Bancorp? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 02/12 14:00

Executive Vice President Jeffrey Michael Martin Acquires Community West Bancshares Common Shares

Reuters 02/12 17:00President and Director Martin E. Plourd Acquires Community West Bancshares Common Shares

Reuters 02/12 16:59Director Robert C. Field Acquires Common Shares of First US Bancshares Inc

Reuters 02/12 21:35Assessing Regions Financial’s valuation after recent outperformance versus bank peers

Simply Wall St 03/12 15:29Is Columbia Banking System a Value Opportunity After Recent Share Price Rebound?

Simply Wall St 03/12 16:21Avidia Bancorp Chairman Michael Dennis Murphy Acquires Common Shares

Reuters 03/12 16:27Piper Sandler Assumes City Holding at Neutral, Announces Price Target of $125

Benzinga News 03/12 17:23