Please use a PC Browser to access Register-Tadawul

Reassessing Coinbase (COIN) Valuation After Recent Share Price Pullback

Coinbase COIN | 246.13 | +0.08% |

Recent performance and why investors are watching

Coinbase Global (COIN) has been sliding over the past month, with the stock down about 6% and roughly 22% in the past 3 months, even as revenue continues to grow modestly.

Stepping back, the recent 30 day share price pullback fits into a choppier year for Coinbase Global, with share price returns softening even as its three year total shareholder return remains exceptionally strong. This suggests that momentum is cooling while the long term crypto story remains intact.

If Coinbase has you thinking about where growth and volatility might show up next in markets, it could be worth scanning high growth tech and AI stocks as another hunting ground for big thematic winners.

With the stock down sharply from recent highs but still trading well below analyst price targets, the real question now is whether Coinbase is quietly slipping into undervalued territory or if the market is already baking in its next leg of growth.

Most Popular Narrative: 37.5% Undervalued

With Coinbase Global closing at $239.73 against a narrative fair value near $383, the valuation case leans heavily on how its onchain ecosystem scales.

The company's leadership in building trusted, compliant infrastructure has resulted in partnerships with major financial institutions (e.g., BlackRock, PNC, JPMorgan, Stripe, Shopify). This positions Coinbase as the preferred onramp for institutions entering the digital asset space, which is likely to drive institutional trading volumes and custody revenues higher over time.

Want to see how steady revenues, shifting margins and a richer product mix can still justify a punchy future earnings multiple? The narrative spells it out.

Result: Fair Value of $383.46 (UNDERVALUED)

However, stubbornly weak trading volumes and intensifying fee pressure from ETFs and decentralized exchanges could quickly undermine the bullish earnings and valuation narrative.

Another way to look at value

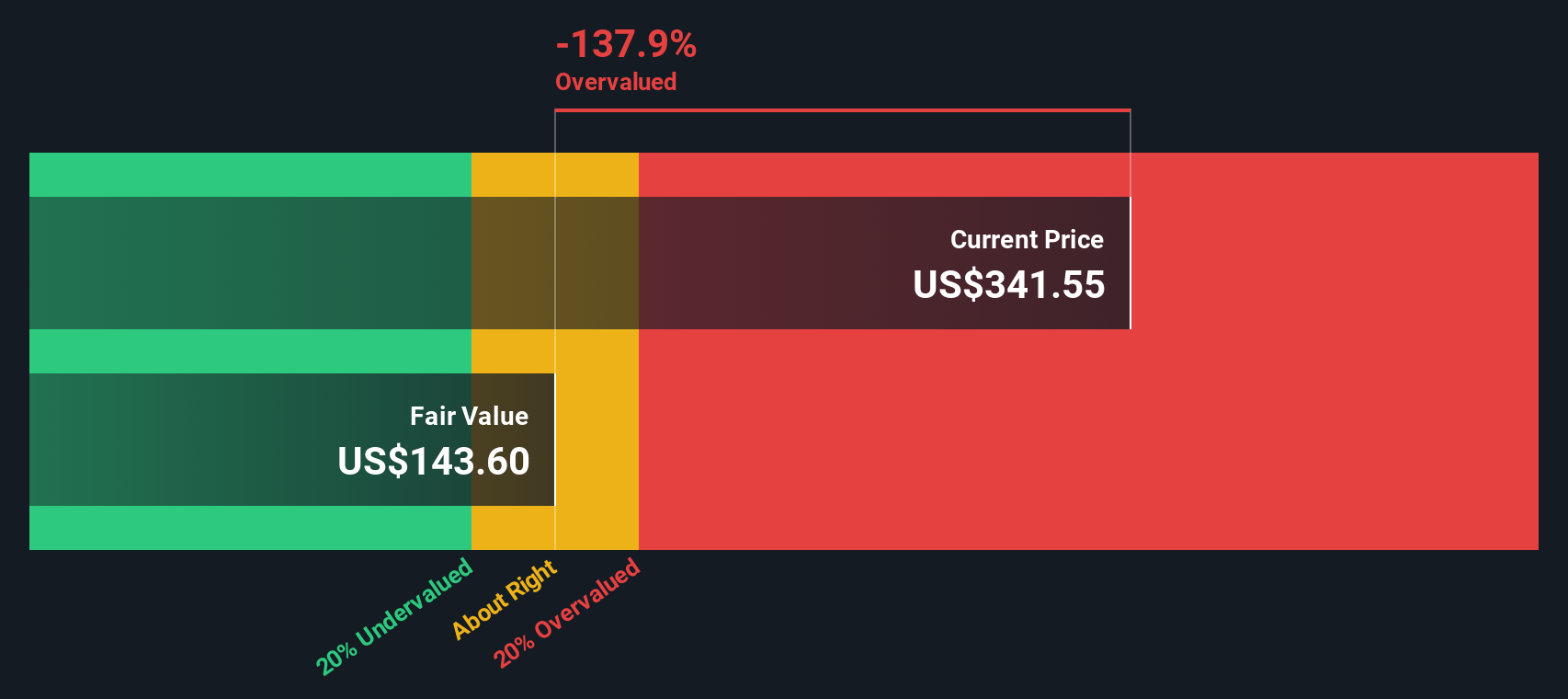

Our SWS DCF model paints a cooler picture, suggesting Coinbase is trading above an estimated fair value of $125.6. This implies the shares may actually be overvalued on cash flow assumptions, even as narratives call it undervalued. Which lens do you trust when the story and the math disagree?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coinbase Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coinbase Global Narrative

If you would rather challenge these assumptions and work from your own numbers, you can build a personalized Coinbase Global story in minutes, Do it your way.

A great starting point for your Coinbase Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before you log off, line up your next opportunities with a few targeted screens so you are not late when the market moves again.

- Capture mispriced potential by scanning these 905 undervalued stocks based on cash flows that pair resilient fundamentals with attractive valuations.

- Ride powerful technology trends by reviewing these 24 AI penny stocks positioned at the forefront of real world AI adoption.

- Target asymmetric upside by hunting through these 3629 penny stocks with strong financials that already show promising financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.