Please use a PC Browser to access Register-Tadawul

Reassessing Driven Brands (DRVN) Valuation After Timothy Johnson’s Appointment to the Board and Audit Committee

Driven Brands Holdings, Inc. DRVN | 14.50 14.50 | -2.16% 0.00% Post |

Driven Brands Holdings (DRVN) just added veteran retail finance executive Timothy Johnson to its Board and Audit Committee, a governance move that lands as the company wrestles with weak returns and frustrated shareholders.

Those governance tweaks are arriving after a choppy stretch for investors, with a roughly 5.6% one month share price return at $14.91 failing to offset a weak one year total shareholder return and a deeply negative three year record. This suggests momentum is still fragile rather than firmly recovering.

If this kind of turnaround story has you looking wider, it could be worth exploring auto manufacturers as a way to find other auto related names that might offer cleaner growth or more resilient returns.

With shares trading at a steep discount to analyst targets despite sluggish sales and negative returns on capital, investors face a key question: is DRVN quietly undervalued, or is the market already pricing in any credible recovery?

Most Popular Narrative: 29.5% Undervalued

Compared to Driven Brands Holdings last close at $14.91, the most followed narrative pegs fair value materially higher, implying meaningful upside if its assumptions hold.

The company is capitalizing on its scale and operational leverage by integrating digital platforms and data analytics to enhance customer retention, increase predictive maintenance offers, and optimize store level economics, likely driving improvements in both net margins and earnings predictability over time. Strategic deleveraging following asset sales and strong free cash flow generation from franchise and international operations is enhancing financial flexibility, supporting future growth investments and potentially reducing interest expense, thereby positively impacting net income and EPS.

Curious how modest top line growth can still justify a punchy upside case, with fatter margins and a lower future earnings multiple built in? The full narrative unpacks the numbers that make that math work.

Result: Fair Value of $21.15 (UNDERVALUED)

However, the upside case could crack if EV adoption accelerates faster than expected, or if Take 5 expansion hits saturation and drags on returns.

Another Angle on Valuation

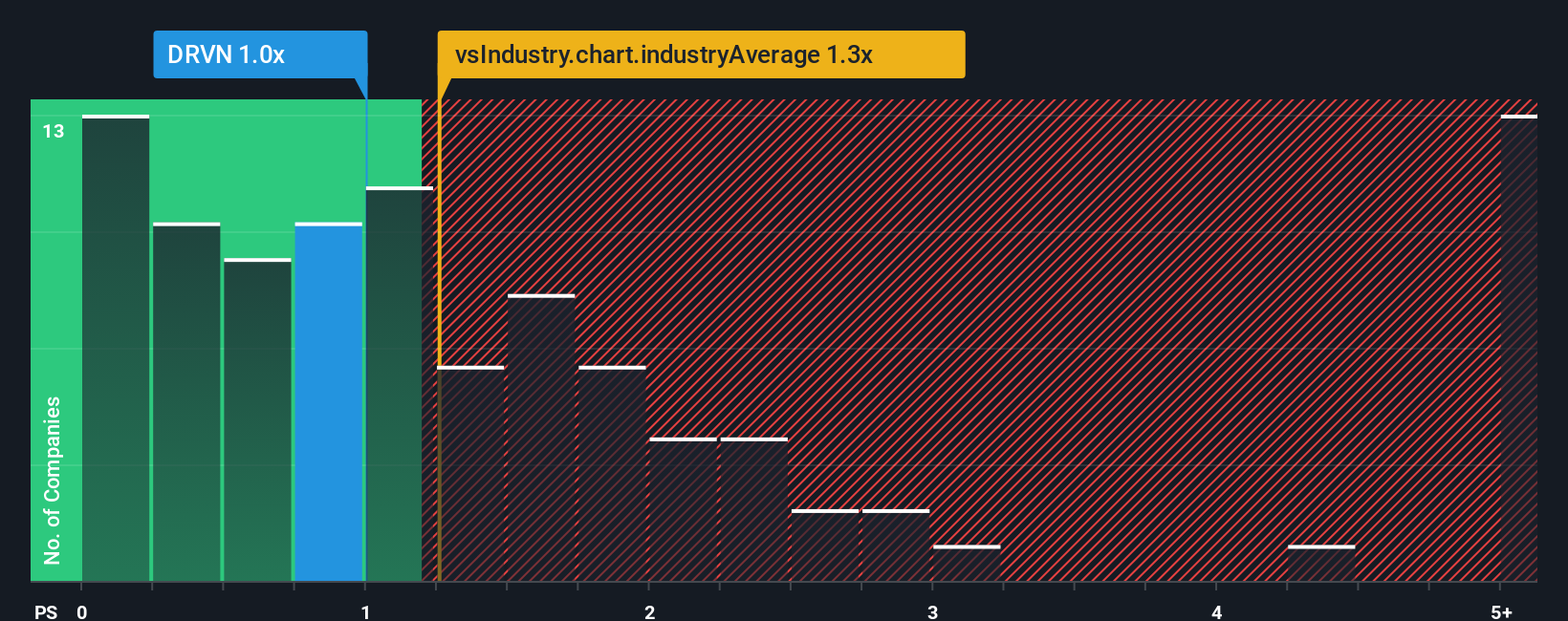

While the narratives lean on future earnings and margins to argue DRVN is undervalued, the current price to sales ratio of 1 times looks less dramatic, roughly in line with its own fair ratio of 1 times and even cheaper than peers at 1.9 times and the wider US Consumer Services sector at 1.3 times. That hints at value, but also raises a question: is the discount simply compensation for slow revenue growth and recent losses?

Build Your Own Driven Brands Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Driven Brands Holdings.

Looking for more investment ideas?

Do not stop with one potential opportunity. Expand your watchlist using focused screeners that surface high conviction ideas before the crowd catches on.

- Capture mispriced quality by scanning these 902 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned at the front line of AI enabled business models.

- Strengthen your income stream by zeroing in on these 10 dividend stocks with yields > 3% that combine reliable payouts with the potential for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.