Please use a PC Browser to access Register-Tadawul

Reassessing Robinhood Markets (HOOD) Valuation After Strong Three Year Return And Recent Share Price Swings

Robinhood Markets, Inc. Class A HOOD | 76.11 | +0.61% |

Event-driven snapshot of Robinhood Markets

Robinhood Markets (HOOD) has been back in focus after recent trading performance, with the stock posting a 7% move over the past week and a similar gain year to date.

That short term strength comes alongside a 7% decline over the past month and an 18% decline over the past 3 months, giving investors a mix of momentum signals to weigh against the company’s fundamental profile.

Set against a very large 3 year total shareholder return of more than 13x, Robinhood’s mix of recent share price gains and short term pullbacks suggests momentum has cooled somewhat after a strong run, as investors reassess growth prospects and risk.

If Robinhood’s swings have you thinking about where else capital might work hard, this could be a good time to broaden your search with fast growing stocks with high insider ownership.

With Robinhood posting a very large 3-year total return and trading at $123.24 against an analyst price target of $150.90, you have to ask yourself whether there is still upside here or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 18.7% Undervalued

With Robinhood’s last close at $123.24 versus a narrative fair value of $151.55, the current pricing gap is built on detailed long term assumptions.

The analysts have a consensus price target of $113.086 for Robinhood Markets based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $50.0.

Want to see what underpins that higher fair value? Revenue growth assumptions, margin shifts, and a rich future P/E all sit at the core. Curious which inputs really move the model?

Result: Fair Value of $151.55 (UNDERVALUED)

However, prediction markets face regulatory questions, and Robinhood still competes with larger, well funded brokers. This could challenge both the growth story and the current valuation.

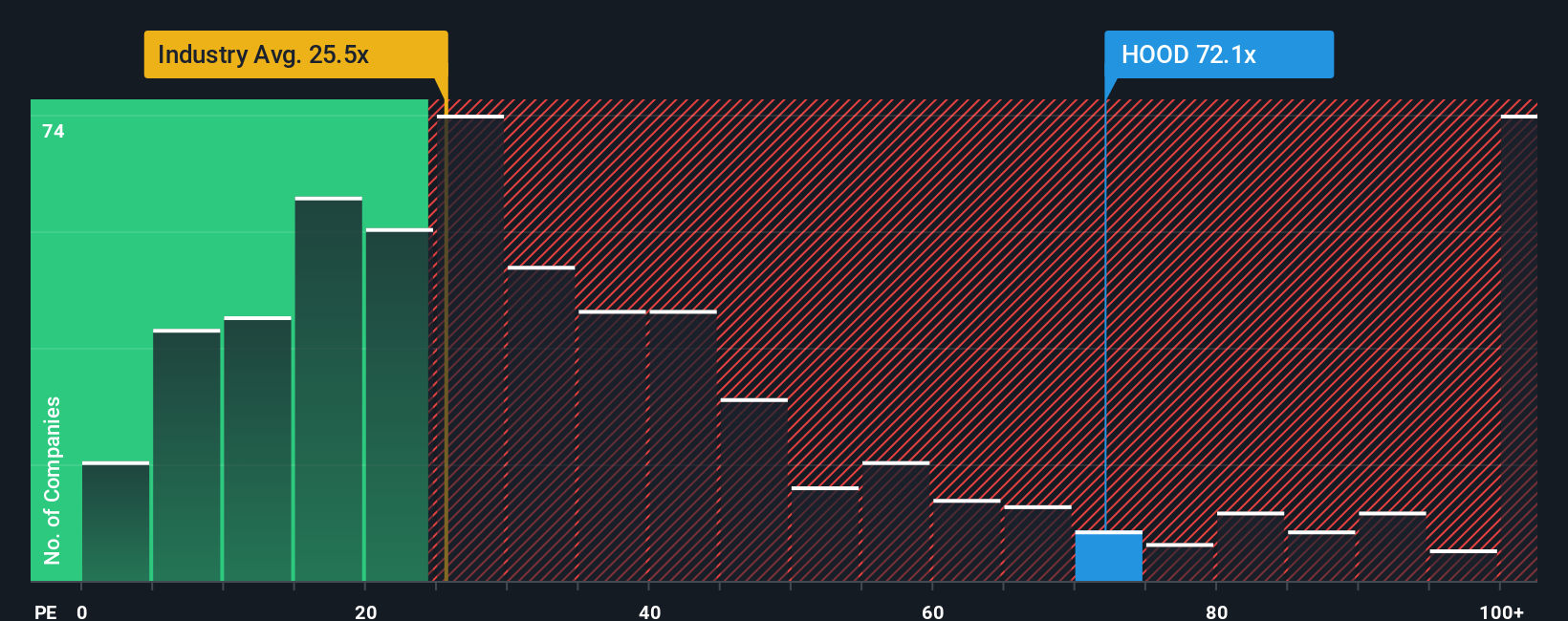

Another View: Rich Earnings Multiple Raises Questions

That 18.7% narrative discount sits awkwardly next to Robinhood’s current P/E of 50.5x, which is far higher than the US Capital Markets industry at 25.7x, the peer average at 28.5x, and a fair ratio of 26.5x. If sentiment cools, does the multiple or the fair value move first?

Build Your Own Robinhood Markets Narrative

If you look at this data and come to a different conclusion, or simply prefer your own work, you can build a complete narrative in minutes, Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Robinhood is on your radar, do not stop there. Broaden your watchlist now and give yourself more choices before the next big move passes you by.

- Spot potential mispricing by scanning these 878 undervalued stocks based on cash flows that pair solid fundamentals with prices that may not fully reflect their underlying cash flows.

- Catch emerging trends early with these 25 AI penny stocks that tie artificial intelligence themes to companies already listed and ready for closer review.

- Boost your income focus by shortlisting these 14 dividend stocks with yields > 3% that offer yields above 3% for investors who care about regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.