Please use a PC Browser to access Register-Tadawul

Record 2025 Earnings and Share Buybacks Could Be A Game Changer For Ameris Bancorp (ABCB)

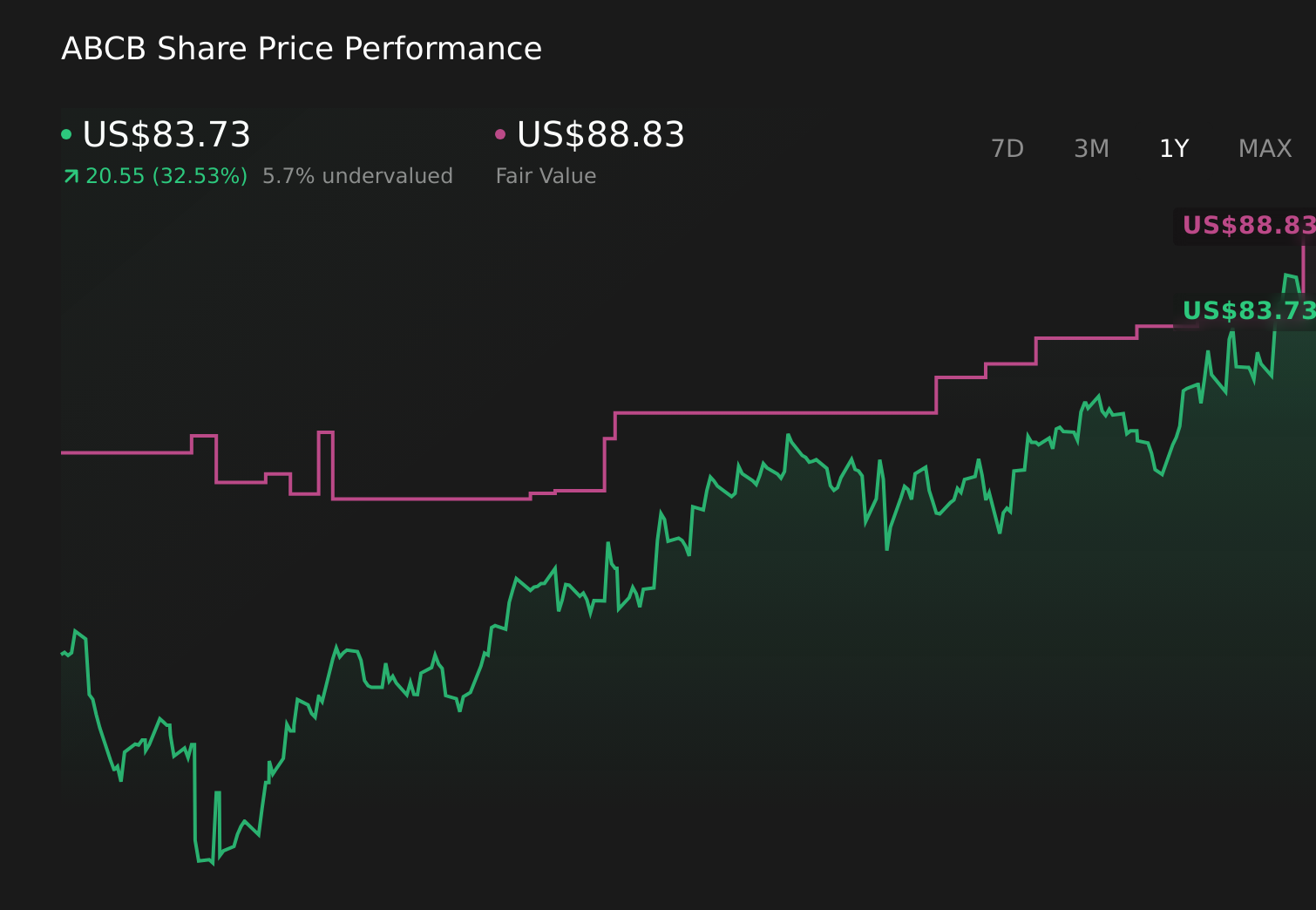

Ameris Bancorp ABCB | 83.73 | +0.96% |

- In late January 2026, Ameris Bancorp reported fourth-quarter 2025 results showing net interest income of US$245.31 million and net income of US$108.36 million, with full-year 2025 net income reaching US$412.15 million and diluted EPS of US$6 from continuing operations.

- Alongside record earnings, Ameris increased profitability while completing a multi-year buyback of 2,707,987 shares for US$140.63 million, even as quarterly net charge-offs rose to US$13.75 million.

- We’ll now examine how Ameris Bancorp’s record 2025 earnings and efficiency gains influence its investment narrative for bank-focused investors.

Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ameris Bancorp's Investment Narrative?

To own Ameris Bancorp today, you need to be comfortable with a steady, profitability-first regional bank story rather than a high-growth one. The appeal rests on consistent net interest income, record 2025 earnings and a management team that has kept expenses in check while returning capital through buybacks and dividends. The latest results largely reinforce that narrative: stronger earnings, an improved efficiency ratio and completion of a multi‑year repurchase support the case that management is focused on per‑share value, which helps explain the strong 1‑ and 3‑year total returns. At the same time, the uptick in quarterly net charge‑offs introduces a nearer‑term question mark around credit quality, which could matter more now that the share price sits closer to consensus targets and the stock screens as relatively expensive versus peers on earnings multiples.

However, rising charge‑offs could become more important for shareholders than the recent buyback progress. Ameris Bancorp's shares have been on the rise but are still potentially undervalued by 38%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Ameris Bancorp - why the stock might be worth just $83.29!

Build Your Own Ameris Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameris Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ameris Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameris Bancorp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.