Please use a PC Browser to access Register-Tadawul

Record Q3 Results and Raised Outlook Could Be a Game Changer for Sterling Infrastructure (STRL)

Sterling Infrastructure, Inc. STRL | 401.29 | +9.92% |

- Sterling Infrastructure recently reported record third-quarter results, with revenue rising to US$689.02 million and net income reaching US$92.09 million, both exceeding analyst expectations and leading the company to raise its full-year financial guidance.

- The company completed its previously announced share repurchase program, buying back 961,000 shares for US$119.08 million, and management cited strong performance in E-Infrastructure and Transportation Solutions as drivers of growth, despite some headwinds in Building Solutions.

- To understand how Sterling's raised full-year outlook reshapes expectations, we’ll examine the implications for its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Sterling Infrastructure Investment Narrative Recap

To believe in Sterling Infrastructure as a shareholder, you have to trust in the power of its expanding backlog and ongoing demand for E-Infrastructure and Transportation Solutions, which support multi-year revenue growth and earnings visibility. The company’s record third-quarter earnings and raised full-year guidance reinforce these strengths as the most important short-term catalyst, while also helping to buffer, but not eliminate, the risk of over-reliance on continued mega-project activity for future growth. Among recent announcements, the completion of Sterling's US$119.08 million share buyback program stands out. This action is especially relevant given it coincides with a sharp increase in both earnings and revenue, underscoring the company’s healthy liquidity position and capacity for disciplined capital allocation, a theme echoed in management’s confidence following stronger guidance. Yet, in contrast to this encouraging momentum, it’s important for investors to be aware that...

Sterling Infrastructure is expected to post $2.6 billion in revenue and $276.4 million in earnings by 2028. This outlook assumes a 6.9% annual revenue growth rate and a decrease in earnings of $8.6 million from the current $285.0 million.

Uncover how Sterling Infrastructure's forecasts yield a $390.00 fair value, in line with its current price.

Exploring Other Perspectives

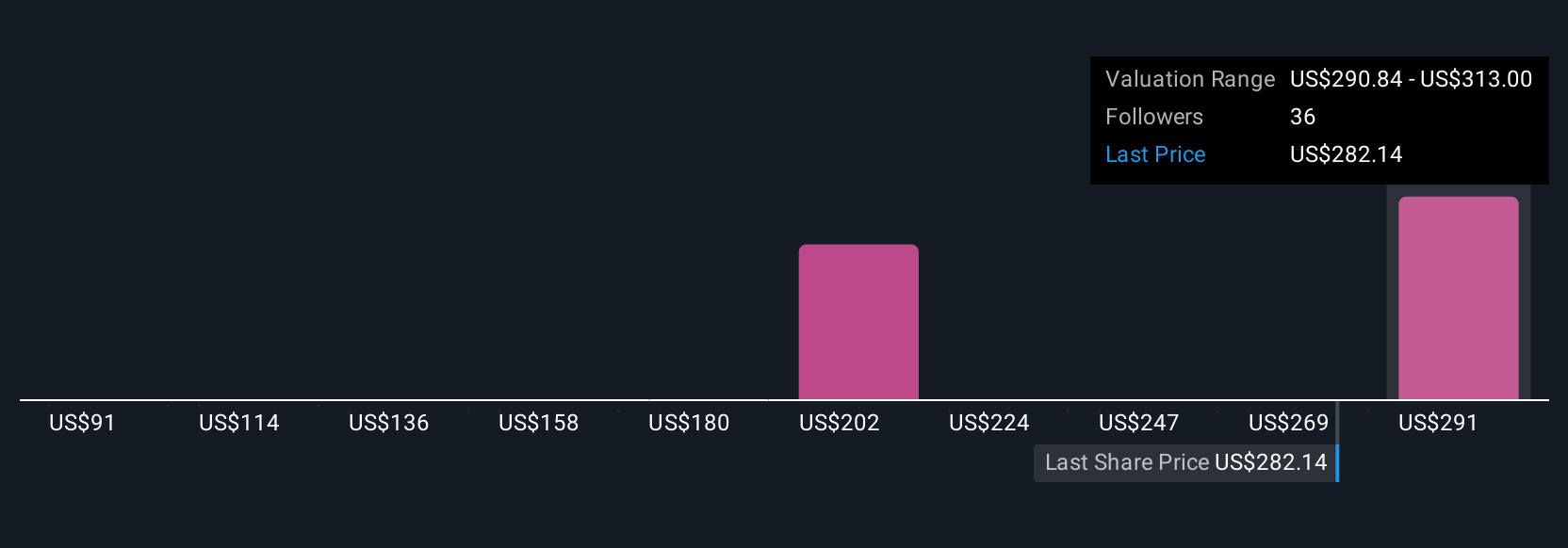

Six members of the Simply Wall St Community estimate Sterling’s fair value in a wide US$113.55 to US$390 range. While revenue and margin expansion are key drivers, contrasting outlooks emphasize why company performance expectations can shift as industry catalysts evolve.

Explore 6 other fair value estimates on Sterling Infrastructure - why the stock might be worth as much as $390.00!

Build Your Own Sterling Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sterling Infrastructure research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sterling Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sterling Infrastructure's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.