Please use a PC Browser to access Register-Tadawul

Record Talc Verdict Could Be a Game Changer for Johnson & Johnson (JNJ)

Johnson & Johnson JNJ | 209.21 | -2.32% |

- In late July 2025, a Boston jury awarded US$42.6 million to a plaintiff in a lawsuit against Johnson & Johnson, finding the company's talc-based baby powder caused mesothelioma and that it knowingly concealed health risks related to asbestos contamination.

- This verdict, reportedly the largest for mesothelioma in Massachusetts history, highlights significant legal and reputational challenges tied to ongoing litigation over Johnson & Johnson’s talc products.

- We'll assess how this landmark legal setback and reputational risk could influence Johnson & Johnson’s investment narrative moving forward.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Johnson & Johnson Investment Narrative Recap

Johnson & Johnson’s investment narrative rests on confidence in its global healthcare pipeline, continued innovation in MedTech and pharmaceuticals, and resilient cash flow to support dividends. The recent US$42.6 million verdict tied to talc-based baby powder puts a spotlight on ongoing legal and reputational risks, which now loom as the company’s most pressing short-term challenge; unless aggravated by further adverse rulings or escalating settlements, this event by itself does not upend immediate operational catalysts or impair financial stability.

None of J&J’s recent product launches directly relate to the talc litigation, but the launch of the VIRTUGUIDE™ AI-powered system for bunion correction reflects continued investment in MedTech innovation, a key area expected to drive growth and offset pressures in other parts of the business, supporting the long-term opportunity that underpins many optimistic projections.

Conversely, the cascade of legal judgments regarding talc liability remains an evolving risk that investors should keep ...

Johnson & Johnson's narrative projects $103.7 billion revenue and $22.8 billion earnings by 2028. This requires 4.6% yearly revenue growth and an earnings increase of $0.1 billion from current earnings of $22.7 billion.

Uncover how Johnson & Johnson's forecasts yield a $175.83 fair value, a 5% upside to its current price.

Exploring Other Perspectives

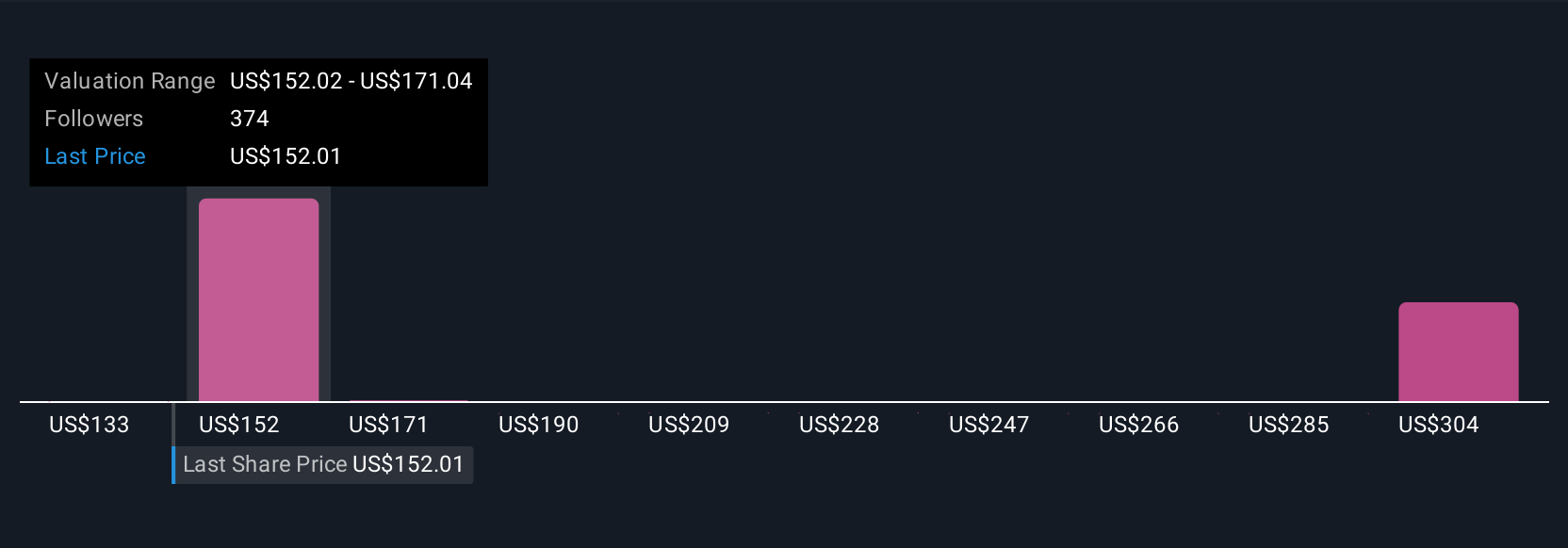

Fair value estimates from 26 Simply Wall St Community members range widely, from US$133 to US$260.66 per share. While opinions differ, the latest legal setback raises questions about how enduring litigation may affect future earnings and cash flow.

Explore 26 other fair value estimates on Johnson & Johnson - why the stock might be worth as much as 56% more than the current price!

Build Your Own Johnson & Johnson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson & Johnson research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Johnson & Johnson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson & Johnson's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.