Please use a PC Browser to access Register-Tadawul

Reddit Emplifi Deal Turns Conversations Into Data As Valuation Debate Grows

Reddit, Inc. Class A RDDT | 150.17 | +2.76% |

- Reddit (NYSE:RDDT) has partnered with Emplifi to integrate Reddit’s Enterprise API into Emplifi’s platform.

- The collaboration is designed to turn Reddit’s real time discussions into business intelligence for brands across sectors.

- The move reflects Reddit’s efforts to monetize data access and expand its offering beyond traditional digital advertising.

For investors watching NYSE:RDDT, this partnership indicates how Reddit is positioning itself as more than a social discussion site. By feeding its consumer conversations into Emplifi’s AI driven analytics, Reddit is connecting to a broader industry focus on first party data and social listening tools for brands.

Looking ahead, the integration may make Reddit more relevant to marketing and insights teams that want deeper, real time consumer sentiment. For shareholders, a key consideration will be how effectively Reddit can scale data licensing and enterprise use cases alongside its existing ad focused business model.

Stay updated on the most important news stories for Reddit by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Reddit.

Quick Assessment

- ❌ Price vs Analyst Target: At US$214.54, Reddit trades below the US$251.19 analyst target but still sits inside a wide target range of US$115 to US$325.

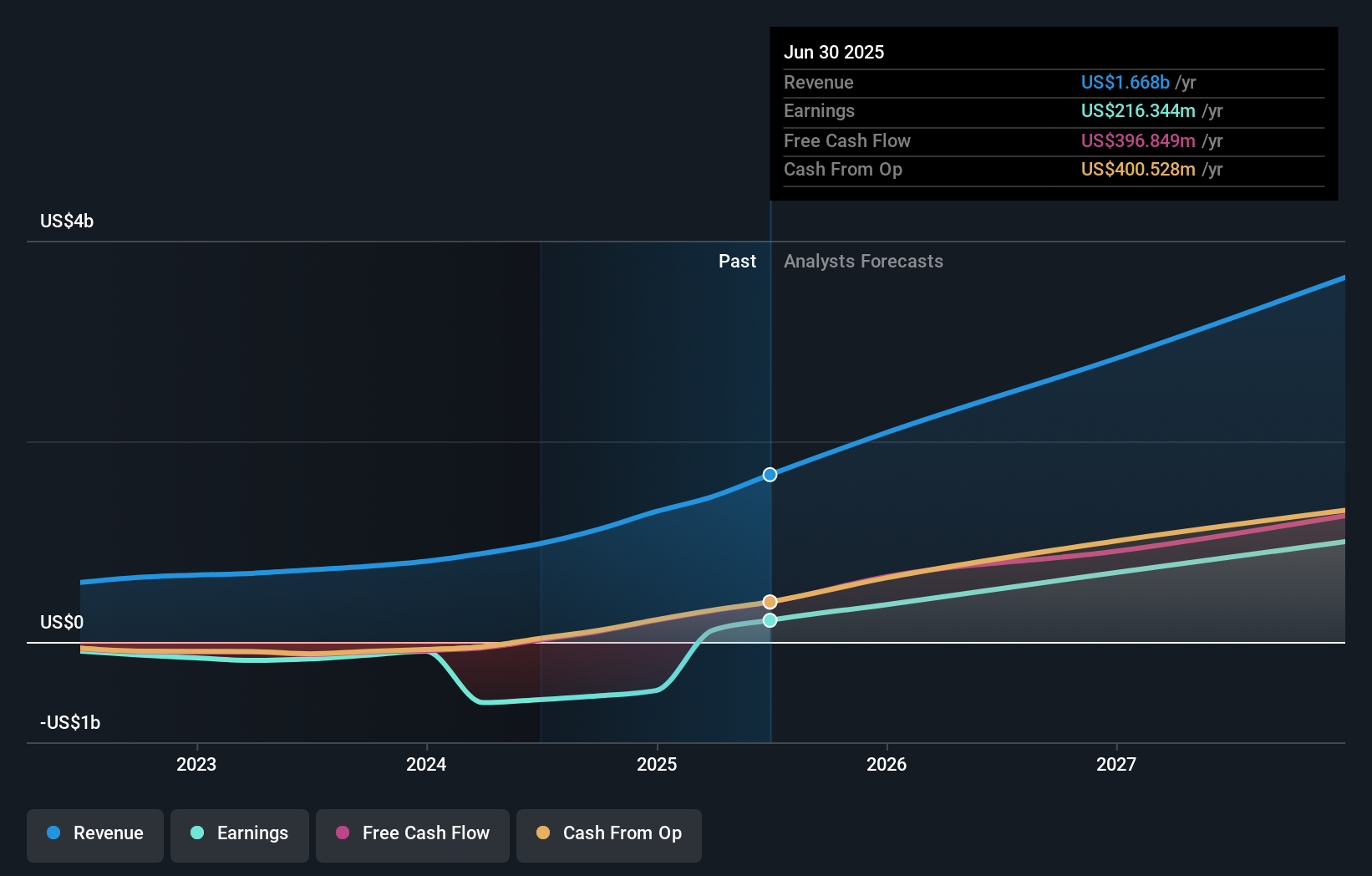

- ✅ Simply Wall St Valuation: Simply Wall St’s model flags Reddit as trading about 44.3% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return of roughly 5.0% decline shows recent negative price momentum despite the new Emplifi partnership.

Check out Simply Wall St's in depth valuation analysis for Reddit.

Key Considerations

- 📊 The Emplifi API tie up pushes Reddit further into business intelligence, which supports the idea that data licensing can sit alongside its advertising revenues.

- 📊 Watch how quickly enterprise customers adopt Reddit data, any new disclosures on data licensing revenue, and how that interacts with its high 116.4x P/E and 62.0x forward P/E.

- ⚠️ With no specific flagged risks in the dataset, a practical watchpoint is execution risk if brands are slow to embed Reddit insights into their workflows.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Reddit analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.