Reddit (NYSE:RDDT) Joins NASDAQ Internet Index Despite 8% Price Dip

RDDT | 0.00 |

Reddit (NYSE:RDDT) continues to capture market attention with its recent addition to the NASDAQ Internet Index, signaling its growing importance within the internet sector. Despite this milestone, the company's stock saw a 7.85% decline over the past week. The downturn in Reddit's share price is notable, especially against the backdrop of an overall market that remained flat, buoyed by reports of potential tariff reductions and tech sector rallies. While major indexes such as the S&P 500 and Nasdaq posted gains, Reddit's inclusion in the index did not translate into an immediate positive impact on its share performance.

```html

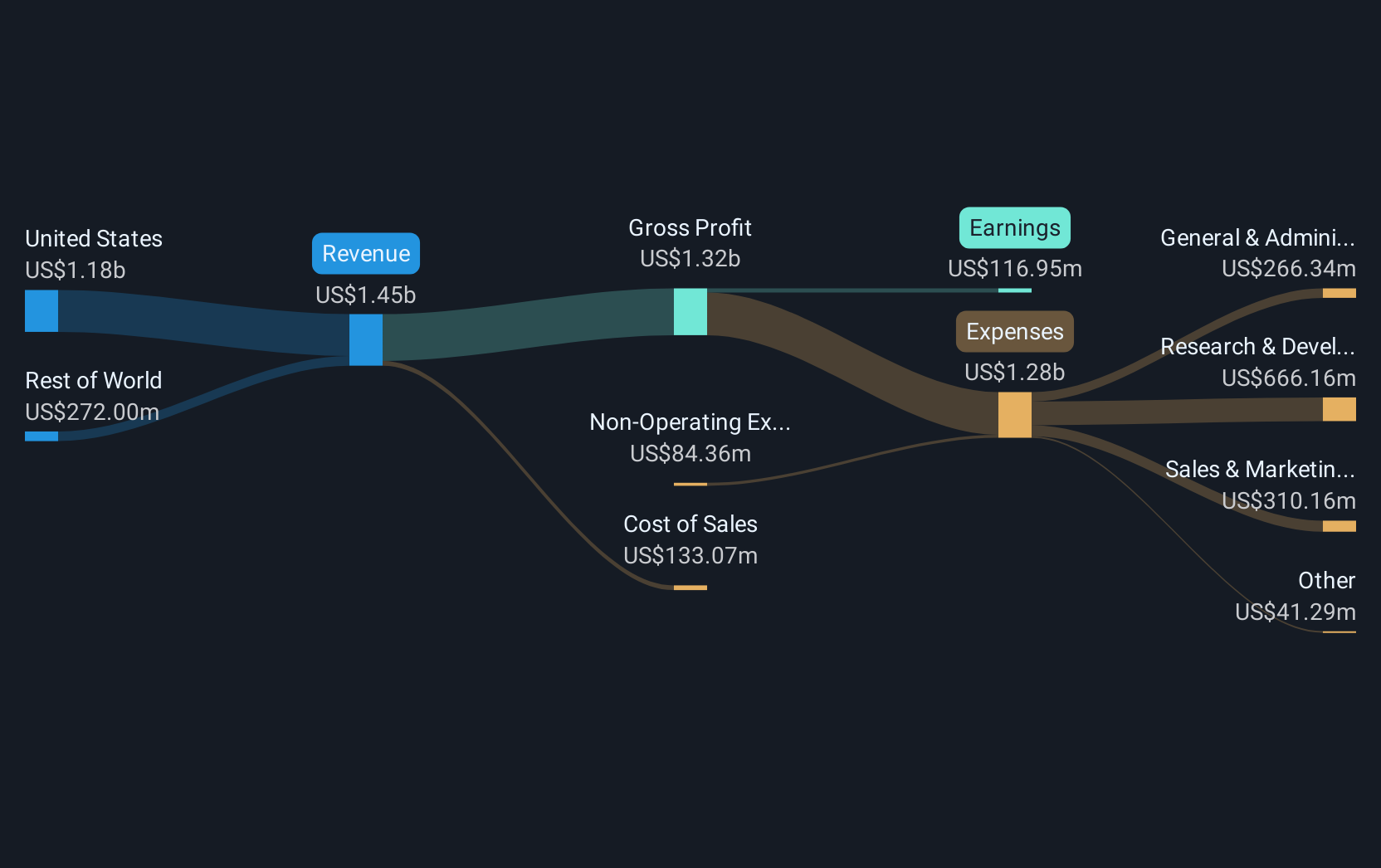

Over the past year, Reddit's total shareholder return reached 93.48%, significantly outperforming the US Market's 8.1% and the US Interactive Media and Services industry's 12%. Several factors contributed to this remarkable performance. Reddit's quarterly earnings exhibited consistent growth, with Q4 2024 sales rising to US$427.71 million from US$249.75 million year-over-year, despite an overall net loss for the full year increasing to US$484.28 million. Additionally, Reddit's focus on expanding advertiser diversity and enhancing ad relevance, as highlighted by COO Jennifer Wong, aimed to boost long-term revenue potential. Furthermore, Reddit's collaboration with Intercontinental Exchange to develop data analytics products showcased its commitment to leveraging data-driven opportunities.

The company's integration into major indexes, including its addition to the S&P Global BMI Index in 2024, helped raise its market profile. This period also saw Reddit partnering with DoubleVerify for improved media authentication, boosting advertiser confidence. These initiatives reflected the company's efforts to strengthen its market position during a year of transformation and growth.

```This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Sahm Platform 02/11 05:52

Reddit (RDDT): Profitability Achieved, Lofty Valuation Challenges Bullish Market Narratives

Simply Wall St 02/11 07:46Option Signals | Amazon Soars Nearly 10%! Multiple PUTs Plunge Over 80%; Palantir Pre-Earnings Call Option Volume Surges Nearly 70%

Sahm Platform 03/11 08:08In One Chart | AMZN Surges 9.6%, Earnings Exceed Expectations - What Happened to Top 20 US Stocks by Turnover on November 1st

Sahm Platform 03/11 08:22Stock Ratings | Cantor Fitzgerald maintains its "Overweight" rating on Cabaletta Bio (CABA) and raises its price target from $15 to $30, implying a potential upside of 731.02% from the current price.

Sahm Platform 03/11 09:04IREN Signs $9.7B AI Cloud Services Agreement With Microsoft To Deploy NVIDIA GB300 GPUs Across 750MW Texas Campus

Benzinga News 03/11 11:05Citigroup Maintains Buy on Reddit, Raises Price Target to $265

Benzinga News 03/11 20:30Reddit (RDDT): Assessing Valuation After Blowout Q3 Earnings and First-Time Profitability

Simply Wall St 03/11 23:23