Please use a PC Browser to access Register-Tadawul

Reddit (NYSE:RDDT) Rises 17% Over the Last Week

RDDT | 214.81 | -4.43% |

Reddit (NYSE:RDDT) experienced a price move of 17% over the last week, which aligns closely with the broader market's climb of 4%. This movement followed significant announcements, including an expanded partnership with Integral Ad Science and a new data integration with samdesk. These developments are expected to enhance Reddit's offer to advertisers and improve real-time data insights, potentially adding weight to its upward trend during a period when major indexes also reported gains. Despite uncertainties in the market, related to tariff negotiations, Reddit's advancements in advertising and data capabilities align with general positive momentum in tech stocks.

Over the last year, Reddit's total shareholder returns, including share price and dividends, reached 164.43%. This substantial growth starkly contrasts with the broader US market's one-year return of 7.9% and the US Interactive Media and Services industry’s 1.8% return, showcasing Reddit's outperformance.

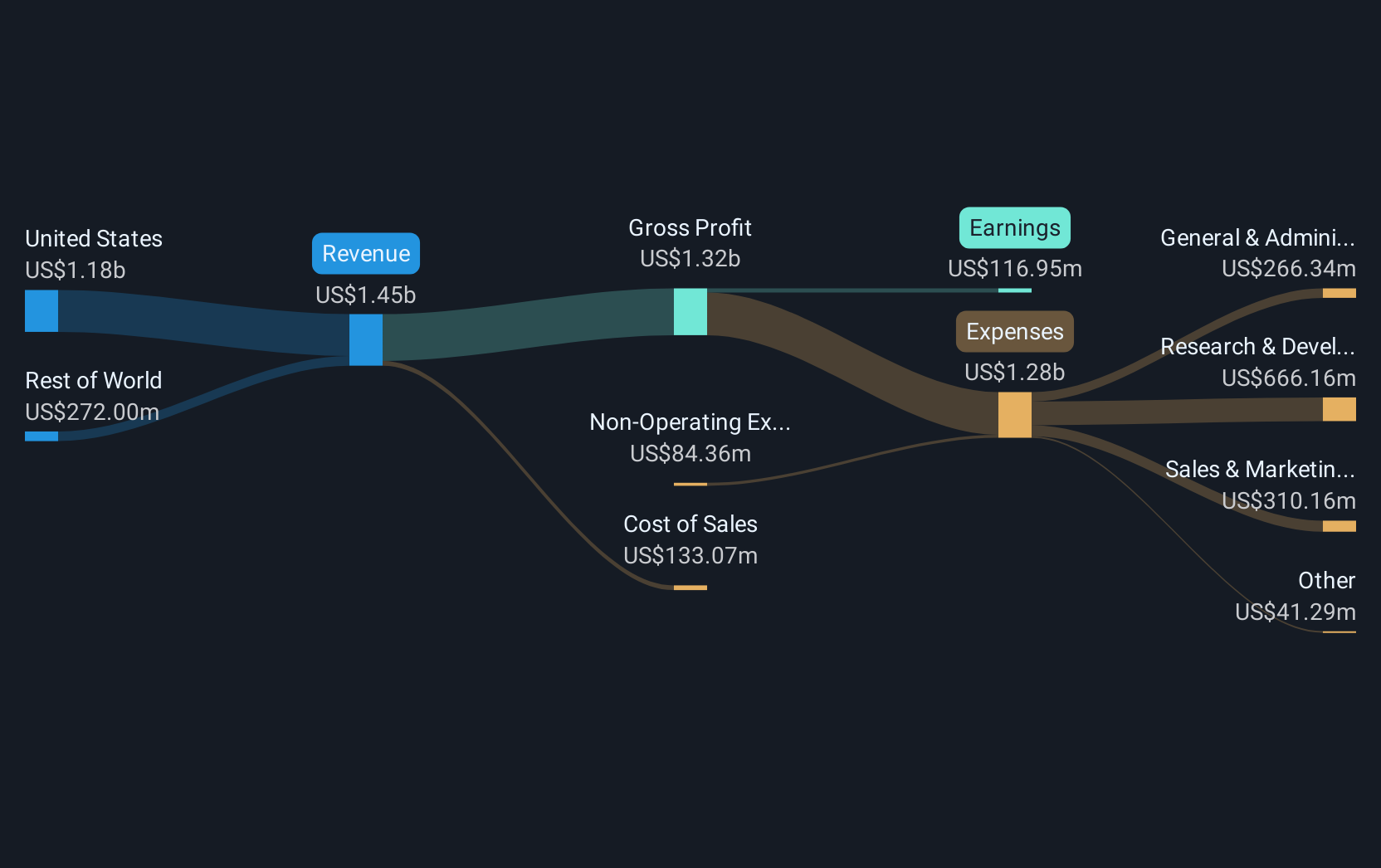

The recent partnership expansions and data integrations, outlined in the introduction, may positively influence Reddit’s revenue and earnings forecasts. The Q1 2025 revenue guidance sets expectations between US$360 million and US$370 million, signaling continued growth. However, Reddit remains unprofitable with a net loss of US$484.28 million for 2024, despite increased sales of US$1.30 billion.

Reddit's current stock price is trading below the consensus analyst price target of US$152.67, suggesting potential valuation upside. However, its high Price-To-Sales Ratio compared to industry norms indicates a cautious approach to its market position may be warranted until profitability is realized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.