Please use a PC Browser to access Register-Tadawul

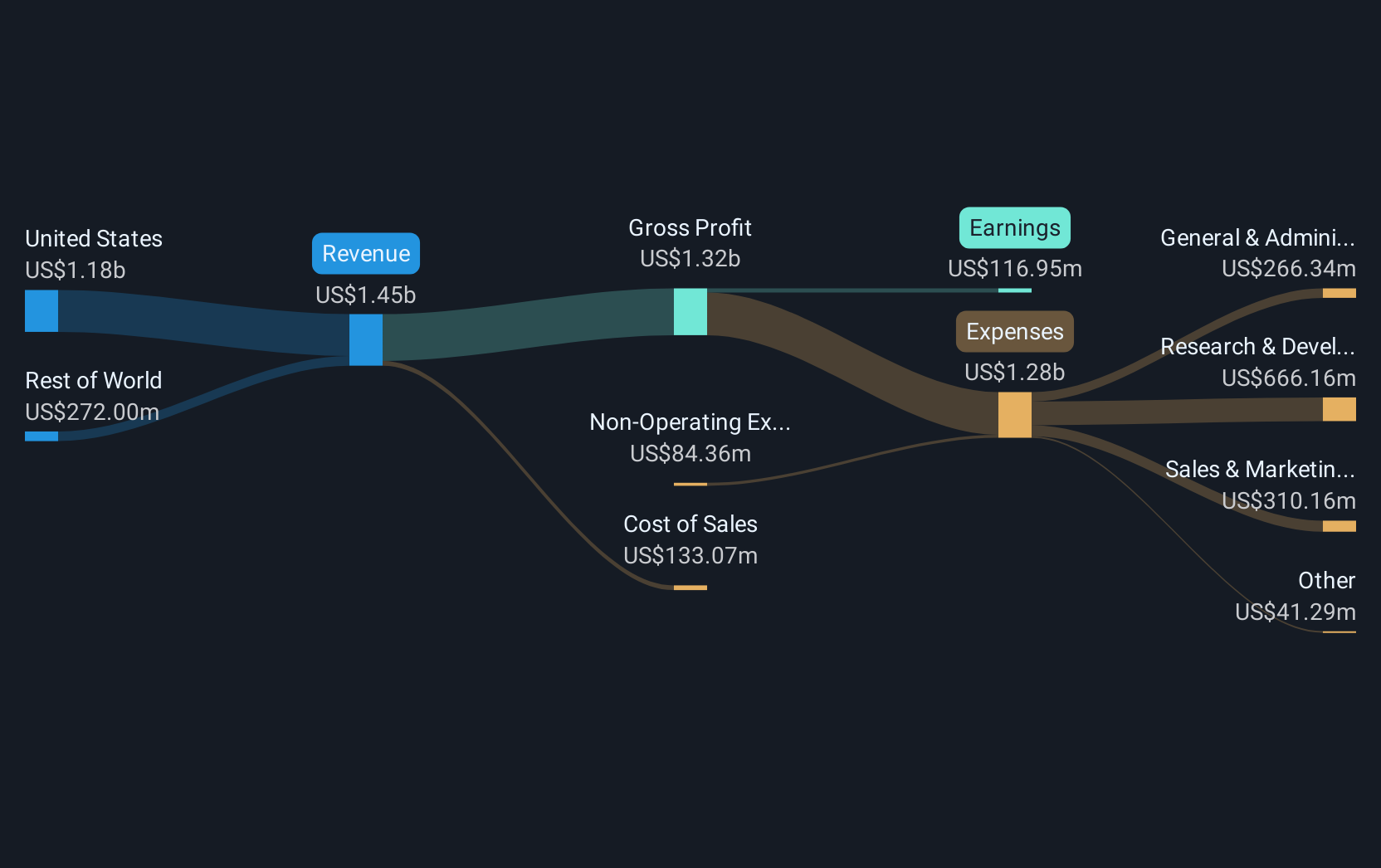

Reddit (RDDT) Sees Q2 2025 Earnings Surge With Revenue Growth

RDDT | 228.16 | +1.86% |

Reddit (RDDT) recently reported strong financial results for Q2 2025, with substantial revenue growth and profitability, showing a turnaround from last year's net loss. Despite legal challenges related to Google’s AI changes and a class action lawsuit, the stock saw a significant price increase of 99% over the last quarter. This positive movement occurred amid a broader tech rally, with indexes like Nasdaq reaching record highs, driven by gains in other major tech stocks. While specific challenges weighed on Reddit’s stock earlier, its recent earnings may have supported confidence, aligning with the overall market uptrend.

The recent positive movement in Reddit's share price, following their strong Q2 financial results, underscores investor confidence in the company's turnaround from last year's net loss. Despite the ongoing legal challenges, the substantial share price increase indicates a market reaction that aligns with broader tech industry trends as major indices reach record highs. The company's share performance over the last year is notable, with a total return exceeding 307.18%, providing a stark contrast to the recent short-term surge, and showcasing its resilience in a competitive digital landscape.

In comparison to the US Interactive Media and Services industry, Reddit's one-year return surpassed the industry average of 32.9%, highlighting its strong market position. The recent legal uncertainties may influence future revenue and earnings forecasts, primarily if these challenges impact advertiser relationships or data licensing opportunities. Despite such challenges, Reddit's revenue growth prospects remain robust, powered by its expanding international footprint and increasing user engagement.

Considering the current share price of US$215.44, it exceeds the consensus analyst price target of US$195.96, indicating a potential overvaluation in the short term. Analysts anticipate a revenue growth of 31.8% annually over the next three years, necessitating careful consideration of Reddit's capacity to sustain such growth amidst advertising reliance and international expansion dependencies. The strong long-term returns could be attributed to its strategic initiatives and successful penetration into new markets, yet these factors, along with the recent news, interlace complex implications for future projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.