Please use a PC Browser to access Register-Tadawul

Redwire (RDW): Evaluating Valuation After Landmark ESA Skimsat Prime Contractor Win

Redwire Corp RDW | 10.09 10.27 | +0.50% +1.78% Pre |

Redwire (NYSE:RDW) just landed a major contract that deserves investor attention. The company announced it will serve as the prime contractor for the European Space Agency's Skimsat mission, a technology demonstration project aiming to launch a small satellite in very low Earth orbit. This agreement, reached in partnership with Thales Alenia Space, puts Redwire at the center of a program designed to advance satellite sustainability while cutting both mass and mission costs. This represents a clear vote of confidence in its platform capabilities and European partnerships.

This deal builds on a recent string of developments for Redwire, including the opening of a new rapid capabilities facility in New Mexico and a CEO presentation at a prominent investment conference. After a tough ride over the past year, which saw steep declines for much of the period, the stock has shown signs of life, climbing nearly 44% from its lows. The upward move over the past week follows months of mixed returns, hinting that market sentiment might be shifting back in Redwire’s favor as its reputation for spacecraft reliability gains greater industry attention.

With momentum stirring around this significant contract, investors are left wondering whether Redwire is currently undervalued, or if the market is already fully pricing in the company’s future growth.

Most Popular Narrative: 50% Undervalued

According to the most widely followed narrative, Redwire is considered significantly undervalued at current prices. Analysts see robust future growth prospects, with the consensus fair value set well above where the stock is currently trading.

Redwire is positioned to benefit from accelerated global investment in space exploration and defense, evidenced by new commitments from NATO allies, significant funding initiatives in the U.S., and increasing space budgets in allied countries. These trends are likely to drive robust top-line revenue growth and future contract backlogs.

Curious why so many see Redwire as a breakthrough space winner? Analysts are betting on explosive top-line growth, stronger margins, and a multiple that would surprise most skeptics. The key to this bullish view lies in a bold set of numbers: future earnings, revenue scale, and a valuation ratio that rivals industry leaders. Want to uncover exactly what drives this high-conviction target? The full narrative reveals the real story behind those headline figures.

Result: Fair Value of $18.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent volatility in government contracting, as well as technical cost overruns on complex projects, could present challenges to Redwire’s robust growth narrative.

Find out about the key risks to this Redwire narrative.Another View: Market Ratio Perspective

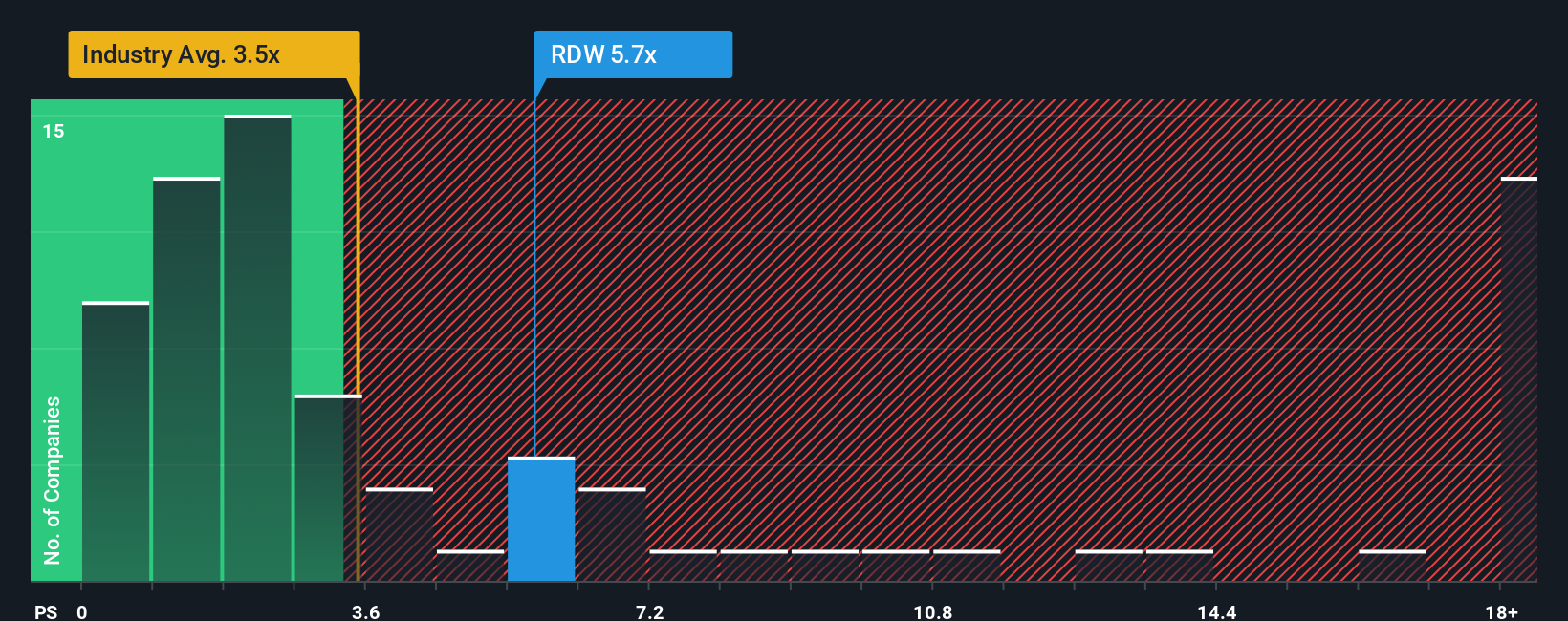

While analysts see upside based on future growth, a look at Redwire’s current share price compared to industry peers suggests it may actually be more expensive than it first appears. Could the market already be pricing in optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redwire Narrative

If you see things differently or prefer taking a hands-on approach, you can interpret the data yourself and craft your own perspective in just minutes. Do it your way

A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let great market potential slip through your fingers. With the right tools, you could spot promising moves that others miss. Give yourself an edge by checking out these hand-picked categories.

- Tap into explosive breakthroughs in machine intelligence by checking out the latest AI penny stocks shaping innovation in this fast-evolving field.

- Boost portfolio resilience with high-yield picks by reviewing dividend stocks with yields > 3% that offer strong returns and solid financial health.

- Seize long-term value opportunities by finding undervalued stocks based on cash flows trading below their calculated worth, so you’re never late to the next big mover.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.