Please use a PC Browser to access Register-Tadawul

Regulus Therapeutics Leads The Charge Among 3 Promising Penny Stocks

Regulus Therapeutics Inc. RGLS | 8.16 8.16 | Delist 0.00% Pre |

Amid recent market fluctuations and economic uncertainties, investors are seeking opportunities that can weather the storm. Penny stocks, a term that might seem outdated, continue to hold potential for those willing to explore beyond the mainstream. These stocks often represent smaller or newer companies and can offer growth prospects at lower price points when backed by strong financials. In this article, we explore three promising penny stocks that stand out as potential hidden gems in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.76 | $394.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.17 | $1.89B | ✅ 3 ⚠️ 3 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.08 | $9.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.94 | $61.53M | ✅ 4 ⚠️ 3 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.77 | $78.68M | ✅ 5 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.61 | $477.94M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.48 | $75.22M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.84 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $174.81M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.7902 | $71.07M | ✅ 4 ⚠️ 1 View Analysis > |

Let's explore several standout options from the results in the screener.

Regulus Therapeutics (NasdaqCM:RGLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on discovering and developing drugs targeting microRNAs to treat various diseases in the United States, with a market cap of approximately $114.60 million.

Operations: Regulus Therapeutics does not report any specific revenue segments.

Market Cap: $114.6M

Regulus Therapeutics, with a market cap of approximately US$114.60 million, is a pre-revenue biopharmaceutical company focused on microRNA-targeted therapies. Recent positive Phase 1b results for its ADPKD treatment and FDA alignment on Phase 3 trial design are promising developments. However, the company faces financial challenges, having reported a net loss of US$46.36 million in 2024 and an auditor's going concern doubt. Despite being debt-free and having sufficient cash runway for over a year, its high share price volatility and ongoing unprofitability present significant risks for investors considering penny stocks like Regulus Therapeutics.

1stdibs.Com (NasdaqGM:DIBS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 1stdibs.Com, Inc. operates a global online marketplace specializing in luxury design products and has a market cap of $110.10 million.

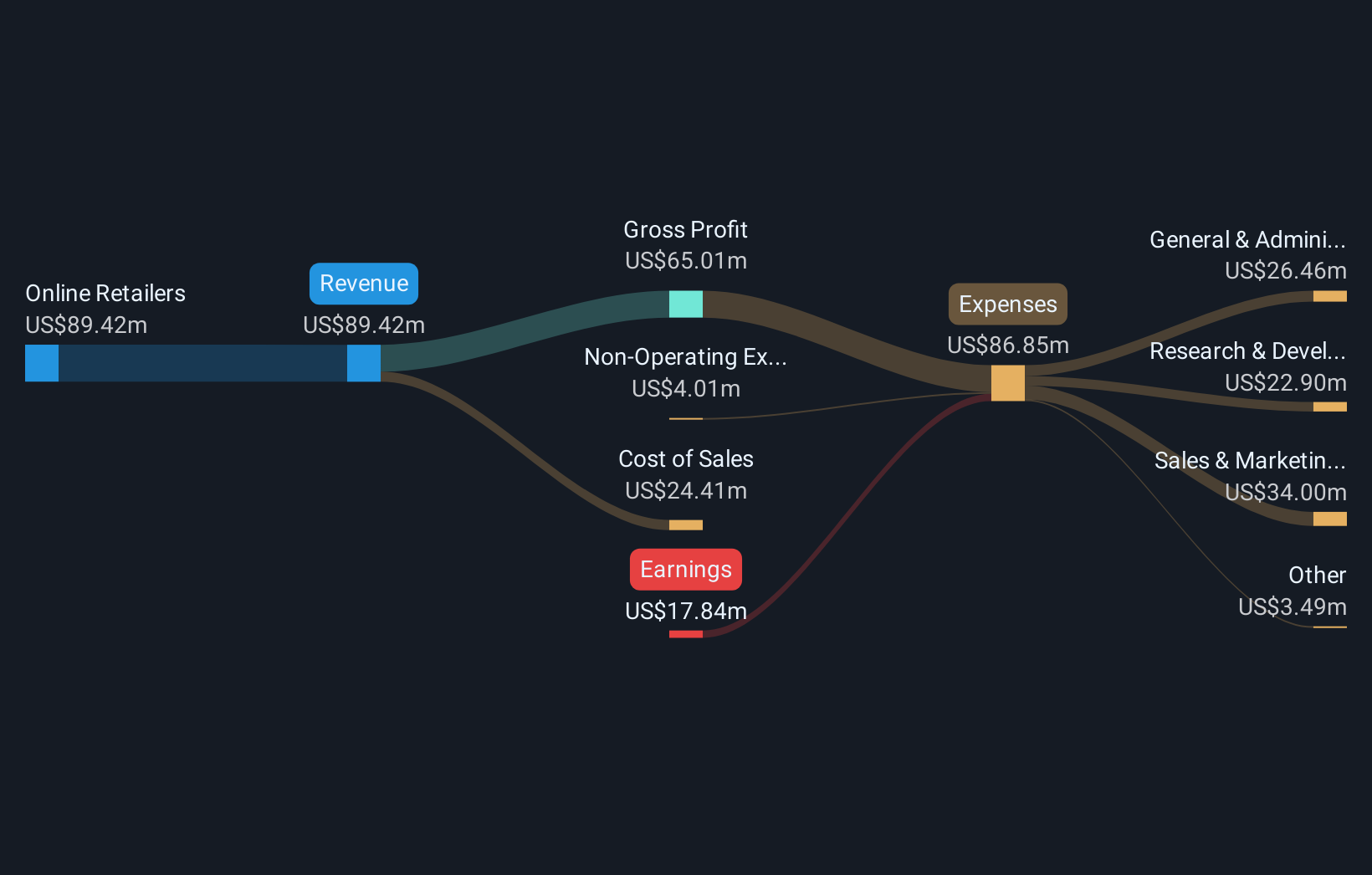

Operations: The company's revenue is primarily generated from its online retail operations, amounting to $88.26 million.

Market Cap: $110.1M

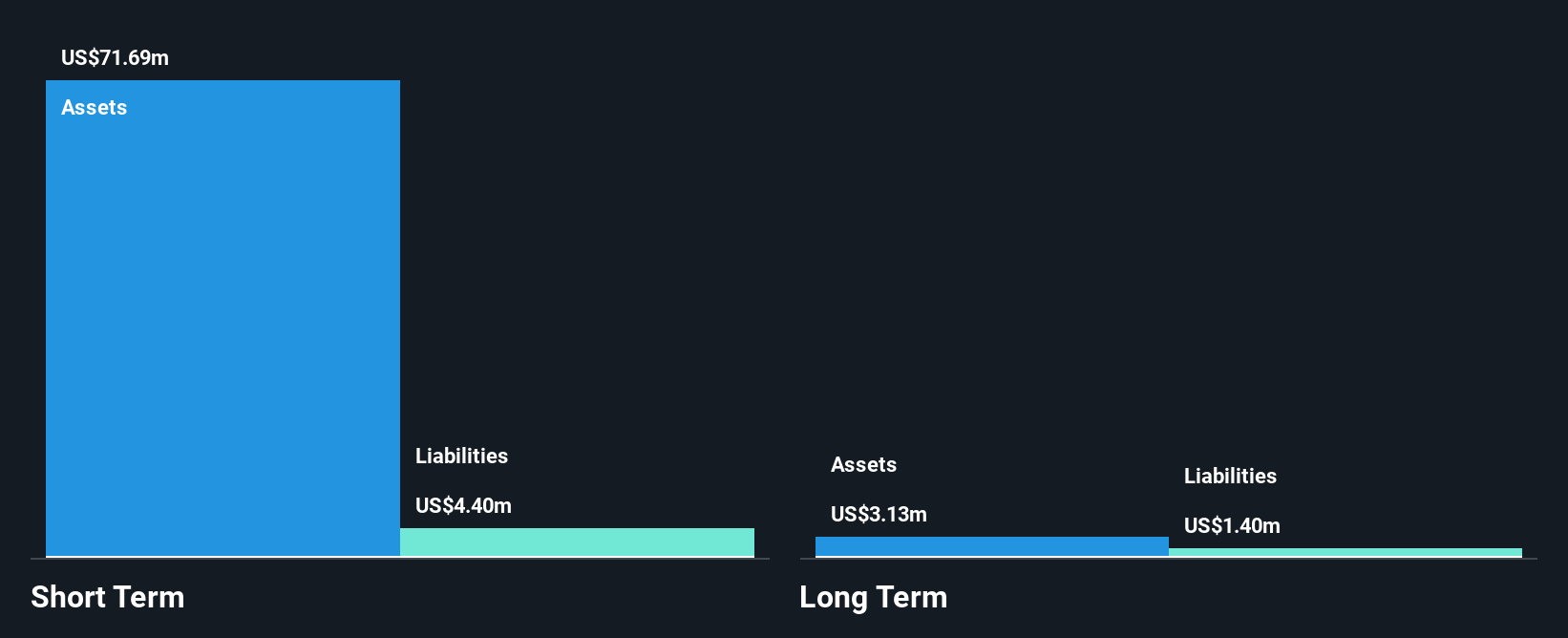

1stdibs.Com, Inc., with a market cap of US$110.10 million, operates in the luxury online retail space and reported revenues of US$88.26 million. Despite being debt-free and having a cash runway exceeding three years, the company remains unprofitable with a negative return on equity of -18.76%. Recent earnings show increased sales but also higher net losses compared to the previous year, highlighting ongoing profitability challenges. The departure of its Chief Product Officer and recent shelf registration filing for US$7.91 million may impact future operations and investor sentiment as it navigates these transitions in the penny stock landscape.

Nuo Therapeutics (OTCPK:AURX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nuo Therapeutics, Inc. is a regenerative therapies company that develops, commercializes, and markets cell-based technologies to promote natural healing in the United States, with a market cap of $63.20 million.

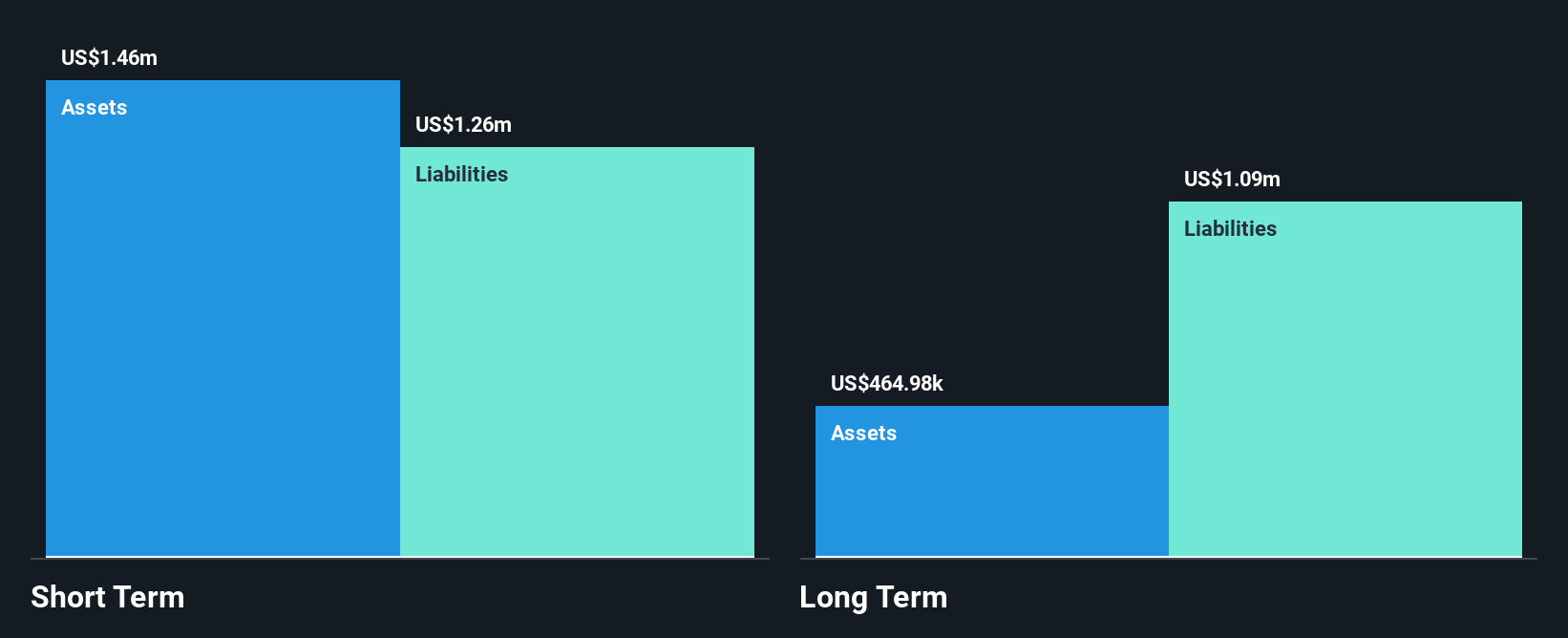

Operations: The company generates revenue through its Medical Products segment, which reported $1.17 million.

Market Cap: $63.2M

Nuo Therapeutics, Inc., with a market cap of US$63.20 million, operates in the regenerative therapies sector but remains unprofitable, with losses increasing by 39.5% annually over the past five years. The company has minimal revenue of US$1.17 million from its Medical Products segment and less than a year of cash runway if current free cash flow trends persist. Despite being debt-free and having experienced management and board members, Nuo faces challenges due to high share price volatility and negative return on equity (-278.55%), making it a risky investment in the penny stock arena.

Turning Ideas Into Actions

- Click here to access our complete index of 763 US Penny Stocks.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.