Please use a PC Browser to access Register-Tadawul

ResMed At Wearable And AI Turning Point In Sleep Apnea Care

ResMed Inc. RMD | 259.12 | +1.10% |

- ResMed (NYSE:RMD) is at an inflection point as wearable devices move into mainstream use for sleep apnea screening.

- Recent FDA approvals support broader adoption of sleep and respiratory care technologies across the sector.

- New AI-enabled products and digital health ecosystem updates are intended to deepen patient engagement and data integration.

- Legacy competitor setbacks and ResMed's digital offerings may influence how market share develops from here.

ResMed, listed on the NYSE under ticker RMD, focuses on sleep and respiratory care solutions, including devices and software that help manage sleep apnea. The wider use of consumer wearables for screening, alongside recent FDA approvals in the space, is changing how patients are identified and monitored. For you as an investor, this points to a market where diagnosis and treatment could be more closely connected to everyday consumer technology.

The company is also leaning into AI enabled devices and a broader digital health ecosystem to support adherence and connect patients, providers, and payers through data. As screening becomes easier and more integrated into wearables, ResMed's position could affect how new patient segments are reached and retained over time. The key question for investors is how effectively the company turns these technology shifts into durable usage across its platform.

Stay updated on the most important news stories for ResMed by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on ResMed.

For ResMed, the move into AI-enabled comfort settings and tighter integration between wearables, the myAir app, and AirSense devices ties directly into how it tries to keep patients on therapy for longer and within its ecosystem. As screening for sleep apnea becomes more common through consumer devices, ResMed’s connected platform could help convert more of those screened patients into users of its masks, devices, and software, which matters in a market that also includes players like Philips and Fisher & Paykel Healthcare.

How this ties into the ResMed narrative

The current ResMed narrative already centers on therapy personalization, digital tools, and broader sleep-health awareness, and this news fits squarely into that storyline. The focus on AI-powered comfort recommendations, home-based monitoring, and software such as myAir and AirView supports the idea of deeper customer retention and recurring, software-like revenue streams alongside the traditional hardware business.

ResMed's risk and reward trade-offs

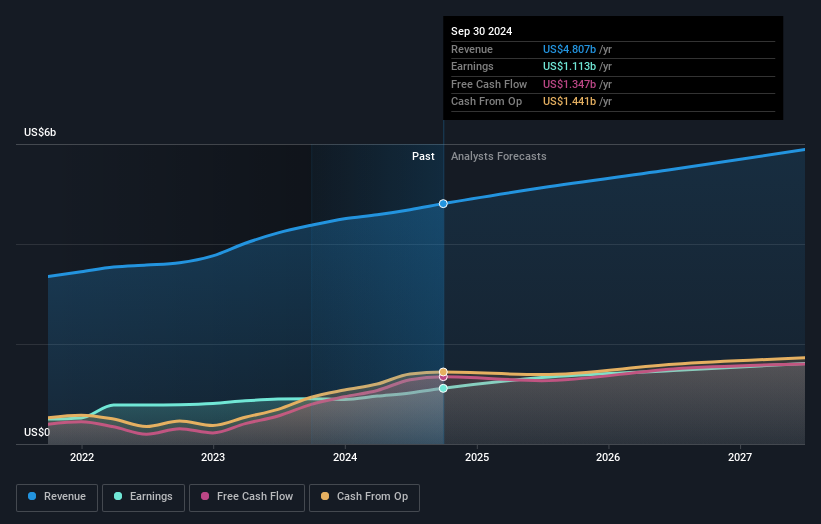

- 🎁 Strong recent Q2 numbers, including US$1,422.81m in sales and higher net income year on year, indicate that the business model can support investments in AI-powered products and software.

- 🎁 Continued dividends of US$0.60 per share and ongoing buybacks, with 7.32% of shares repurchased under the long-running program, point to cash generation that can support both growth and shareholder returns.

- ⚠️ Analysts have flagged competitive, regulatory, and pricing risks. This means AI features and a wider digital ecosystem need to maintain clear value versus alternatives from rivals like Philips and Fisher & Paykel Healthcare.

- ⚠️ A hardware-centric model still faces pressure from changing reimbursement policies and new therapies, so the success of AI tools and software platforms is important to offset any stress on device pricing.

What to watch next

Looking ahead, you may want to track how quickly AI-powered features such as personalized comfort settings roll out, how clinicians and payers respond to these tools, and whether margins stay supported as ResMed spends on digital health. If you want to see how this fits into the longer-term story, check community narratives for ResMed through the company’s page on Simply Wall St and see what other investors are focusing on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.