Please use a PC Browser to access Register-Tadawul

ResMed (RMD): Assessing Valuation After Citigroup’s New Buy Rating Highlights Digital Health Momentum

ResMed Inc. RMD | 256.55 | +2.00% |

ResMed (RMD) is back in the spotlight after Citigroup launched coverage on the stock with a 'Buy' rating, highlighting growing confidence in the company’s digital health strategy. This move comes as ResMed places more emphasis on using clinical data to support out-of-hospital care, which is gaining traction across the healthcare space. For investors who track market shifts and analyst sentiment, Citigroup’s bullish stance is the latest sign that ResMed’s direction is drawing attention and possibly fresh capital.

Over the past year, ResMed shares have delivered a 12% return, gaining momentum with a 7% climb in the past 3 months, though the past month saw a modest pullback. Digging deeper, institutions control about 74% of the equity, with The Vanguard Group taking the largest stake, so any rise in optimism tends to ripple quickly through the market. The company’s steady revenue and earnings growth have also helped shape a constructive narrative around its long-term opportunity in digital health.

With this mix of analyst optimism, institutional support, and shifts in price momentum, the big question now is whether ResMed’s current valuation leaves room for further upside, or if the market is already pricing in the company’s next phase of growth.

Most Popular Narrative: 6% Undervalued

The prevailing narrative sees ResMed as undervalued, with its fair value estimate sitting notably above the company’s current share price. Analysts highlight the company’s digital health momentum and operational improvements as core reasons for the upbeat outlook. This perspective is supported by both recurring revenues and margin expansion.

“Acceleration in adoption of home-based, cloud-connected therapy solutions and digital health platforms (including software like Brightree and AirView) enhances recurring high-margin revenue streams and increases both user retention and net profit margins over time.”

Curious what’s powering this bullish call? The narrative hints at ambitious growth assumptions, a future profit multiple that raises eyebrows in the sector, and expectations around margin improvement and scale. Wondering how these pieces fit together to create an estimated value higher than today’s price? Unlock the full set of projections and see the story behind ResMed’s strategic play in digital health.

Result: Fair Value of $291.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, competitive threats from new therapies and potential shifts in reimbursement policy could limit ResMed’s market share and earnings growth in the future.

Find out about the key risks to this ResMed narrative.Another View: Industry Comparison

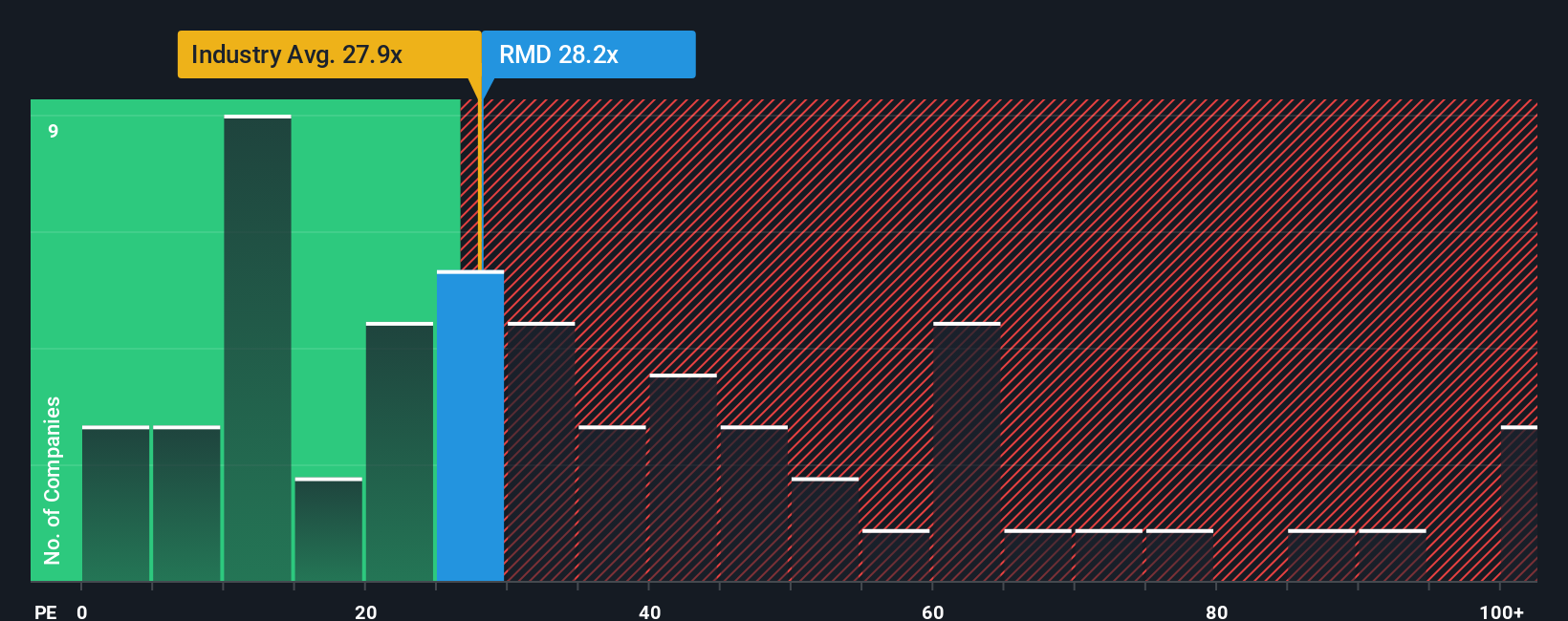

By looking at ResMed’s current share price through the industry lens, it now appears a bit expensive compared to the average for similar healthcare firms. Is the market already expecting too much, or is there still untapped upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ResMed Narrative

If you have your own perspective on ResMed’s outlook or want to dive into the numbers yourself, you can assemble your own narrative in just a few minutes, your way with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ResMed.

Looking for More Smart Investment Ideas?

Unlock your edge in today's market by tapping into unique themes shaping tomorrow's winners. Use these tailored screens and get ahead of the next big wave. Don’t let great opportunities slip by.

- Spot tomorrow’s leaders early and uncover high-upside bargains, including undervalued stocks based on cash flows, giving you the tools to target quality stocks trading below their true worth.

- Capitalize on booming sectors and put yourself at the center of medical innovation with healthcare AI stocks, connecting you to breakthrough healthcare companies fueled by artificial intelligence.

- Boost your passive income strategy by seeking out market favorites with dividend stocks with yields > 3%, revealing resilient businesses delivering consistent yields well above the average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.