Please use a PC Browser to access Register-Tadawul

ResMed (RMD): Evaluating Valuation After Global Sleep Institute Launch and VirtuOx Acquisition

ResMed Inc. RMD | 254.35 | +0.82% |

If you are watching ResMed (RMD) right now, you know there has been a flurry of activity. The company recently unveiled its Global Sleep Institute at the World Sleep Congress, a move aimed at rallying clinicians, researchers, and policymakers to tackle sleep health problems on a global scale. Pair that with the acquisition of VirtuOx, which adds at-home diagnostic muscle, and there is a clear message: ResMed is leaning into innovation and broadening its reach in digital respiratory care.

These strategic launches are happening as sentiment around ResMed shifts upward, thanks in part to solid financials and rising earnings estimates. The stock has gained 9% over the past year and 18% year-to-date, showing renewed momentum after a flat few months. Over three-year and five-year periods, returns remain strong. Combine that with this summer’s steady news flow, including presentations at high-profile healthcare conferences and a well-received quarterly report, and you have a company working hard to reinforce its growth narrative.

But given the recent rally, should investors see this as an entry point or is the market already baking in all of ResMed’s future growth?

Most Popular Narrative: 7.4% Undervalued

The leading narrative points to ResMed being undervalued by 7.4%, with its fair value estimate set higher than the current share price. This outlook reflects confidence in the company’s medium-term growth potential and operational resilience.

Strategic investments in expanding the diagnosis and treatment funnel, including acquisitions like VirtuOx, Ectosense, and Somnoware, are improving patient flow from screening to therapy. This positions ResMed to capture a larger share of the substantial underpenetrated global sleep apnea and respiratory market and supports long-term revenue growth.

This is not a run-of-the-mill valuation. Behind that fair value, analysts are betting on a shift in patient care, bold profit expansion, and a relentless focus on digital leadership. Wondering which future milestones and growth levers are driving this eye-catching price target? The story behind ResMed’s valuation is more ambitious than you might expect.

Result: Fair Value of $291.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising regulatory costs or intensifying competition from alternative therapies could pressure margins and challenge ResMed’s growth assumptions in the years ahead.

Find out about the key risks to this ResMed narrative.Another View: SWS DCF Model Perspective

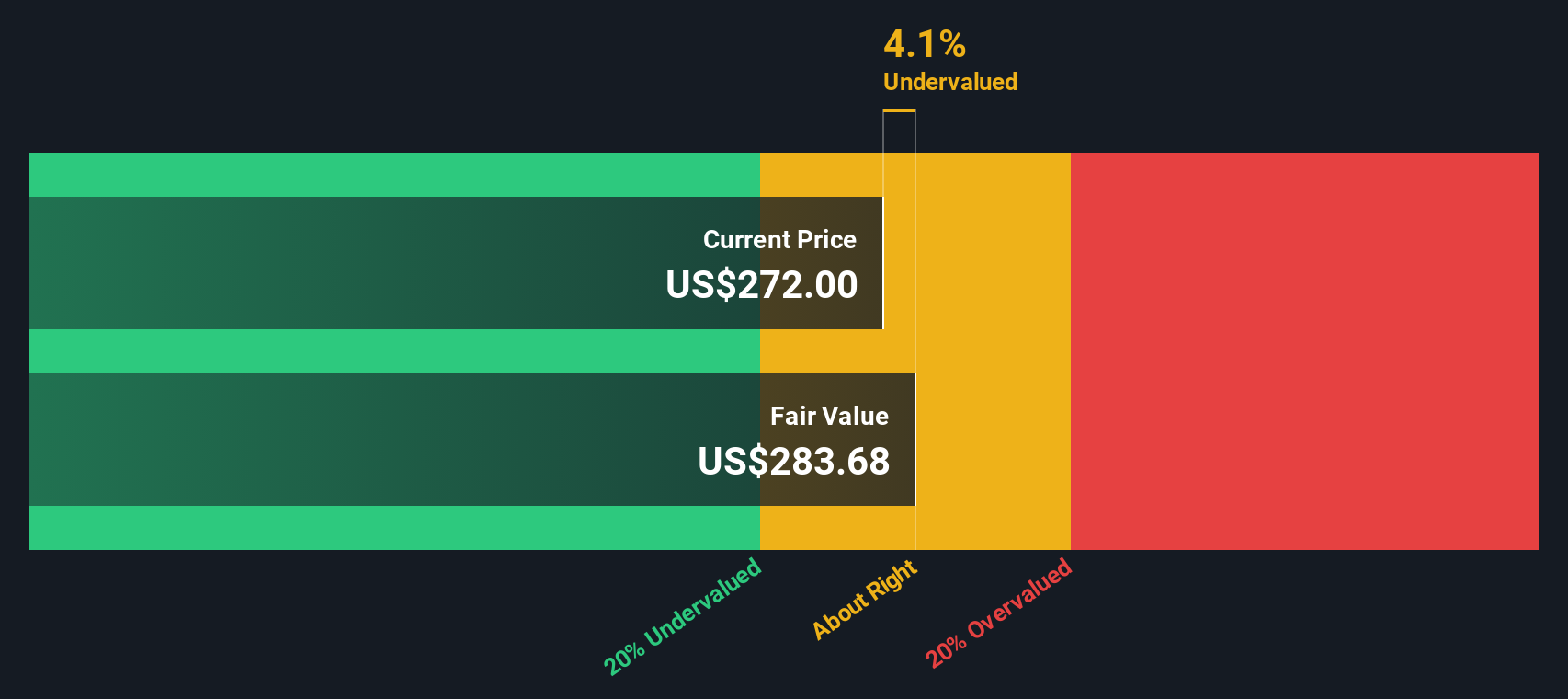

Taking a step back from analyst price targets, our DCF model also suggests ResMed is trading below its estimated fair value. This second look measures the stock through a different lens, but does it tell the whole story?

Build Your Own ResMed Narrative

If you see the story differently, or if you want to analyze the numbers firsthand, you can build a fresh ResMed narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ResMed.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Make your research matter by targeting stocks with unique advantages and untapped growth using our powerful screening tools.

- Uncover income opportunities and enhance portfolio stability as you scan for companies with attractive yields in dividend stocks with yields > 3%.

- Spot future-shaping innovators tackling tomorrow’s medical challenges by using healthcare AI stocks.

- Kickstart your search for high-potential bargains by investigating stocks that are flying under the radar within undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.