Please use a PC Browser to access Register-Tadawul

Revenues Not Telling The Story For OneWater Marine Inc. (NASDAQ:ONEW) After Shares Rise 31%

OneWater Marine Inc Class A ONEW | 14.27 | -1.45% |

Those holding OneWater Marine Inc. (NASDAQ:ONEW) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

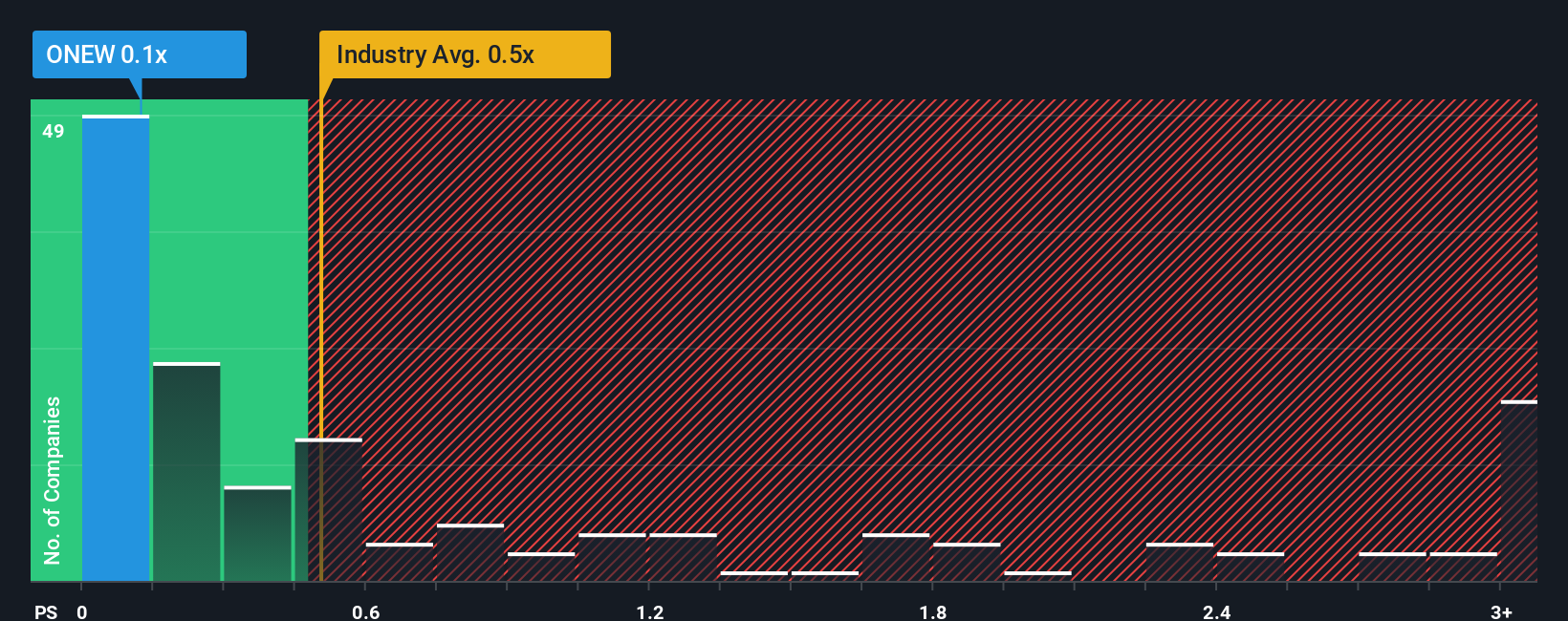

Although its price has surged higher, it's still not a stretch to say that OneWater Marine's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has OneWater Marine Performed Recently?

With revenue growth that's inferior to most other companies of late, OneWater Marine has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OneWater Marine.Is There Some Revenue Growth Forecasted For OneWater Marine?

The only time you'd be comfortable seeing a P/S like OneWater Marine's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.6% last year. Revenue has also lifted 7.3% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 1.8% per annum during the coming three years according to the six analysts following the company. With the industry predicted to deliver 7.7% growth per year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that OneWater Marine's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does OneWater Marine's P/S Mean For Investors?

Its shares have lifted substantially and now OneWater Marine's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of OneWater Marine's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

If these risks are making you reconsider your opinion on OneWater Marine, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.