Please use a PC Browser to access Register-Tadawul

Revenues Tell The Story For Acorn Energy, Inc. (NASDAQ:ACFN) As Its Stock Soars 29%

Acorn Energy, Inc. ACFN | 14.83 14.83 | -5.12% 0.00% Pre |

Despite an already strong run, Acorn Energy, Inc. (NASDAQ:ACFN) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 151% following the latest surge, making investors sit up and take notice.

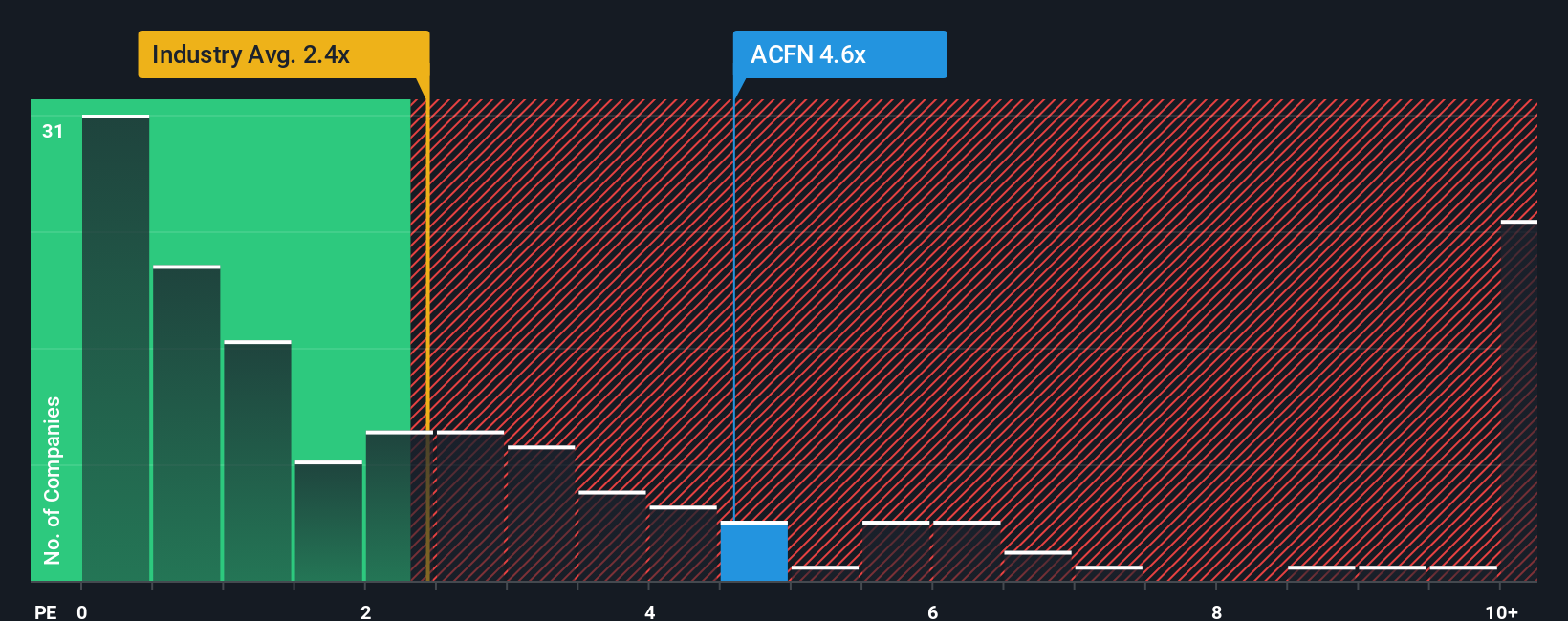

Since its price has surged higher, when almost half of the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Acorn Energy as a stock not worth researching with its 4.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Acorn Energy Has Been Performing

With revenue growth that's exceedingly strong of late, Acorn Energy has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Acorn Energy's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Acorn Energy?

Acorn Energy's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 42%. The latest three year period has also seen an excellent 75% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 18% shows it's noticeably more attractive.

In light of this, it's understandable that Acorn Energy's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Acorn Energy's P/S?

Acorn Energy's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Acorn Energy can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

If these risks are making you reconsider your opinion on Acorn Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.