Please use a PC Browser to access Register-Tadawul

Revenues Tell The Story For Hyperfine, Inc. (NASDAQ:HYPR) As Its Stock Soars 34%

Hyperfine, Inc. Class A HYPR | 1.11 | +1.83% |

Hyperfine, Inc. (NASDAQ:HYPR) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

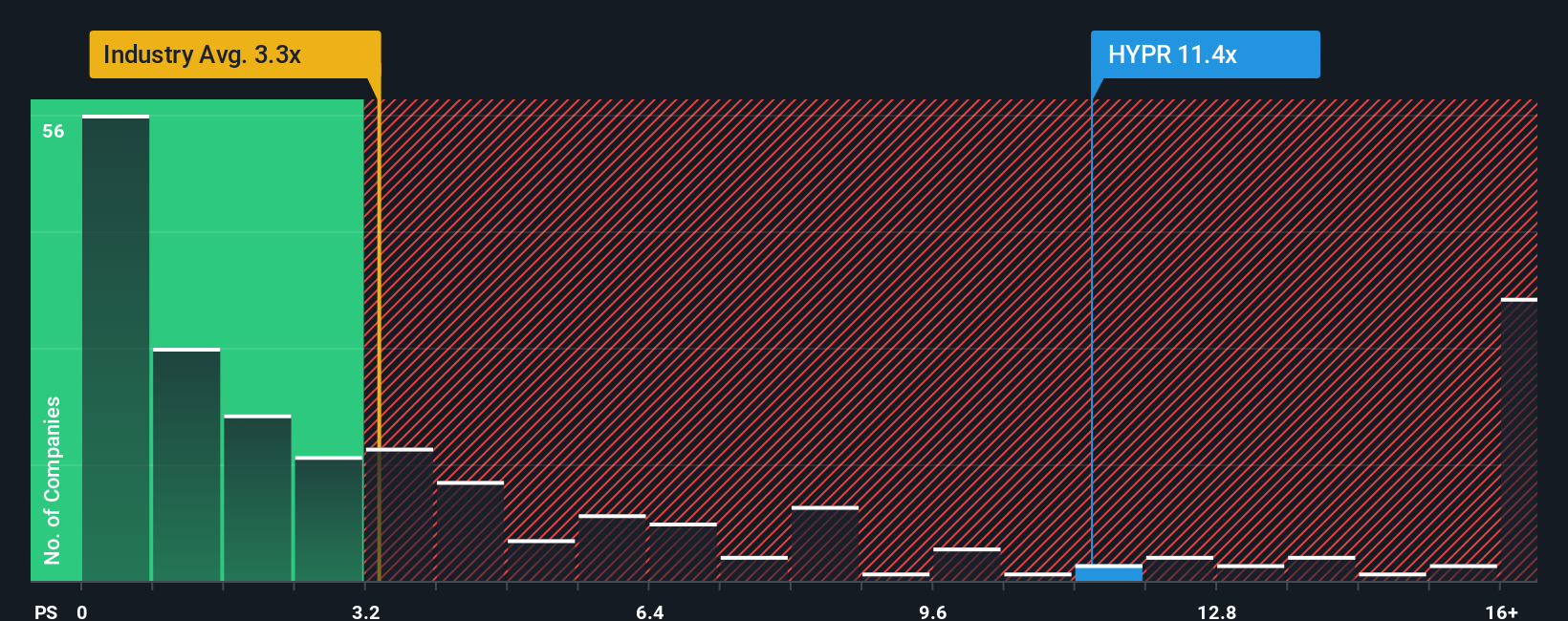

After such a large jump in price, Hyperfine may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 11.4x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios under 3.3x and even P/S lower than 1.2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Hyperfine's P/S Mean For Shareholders?

Hyperfine could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hyperfine will help you uncover what's on the horizon.How Is Hyperfine's Revenue Growth Trending?

In order to justify its P/S ratio, Hyperfine would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. Still, the latest three year period has seen an excellent 82% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 59% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 47%, which is noticeably less attractive.

With this information, we can see why Hyperfine is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Hyperfine's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hyperfine maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.