Please use a PC Browser to access Register-Tadawul

Reynolds Consumer Products (REYN): Valuation Insights Following Upcoming S&P SmallCap 600 Index Inclusion

Reynolds Consumer Products REYN | 22.80 22.80 | +0.13% 0.00% Pre |

If you follow Reynolds Consumer Products (REYN), you may have noticed the stock catching a wave of interest after the company announced it is joining the S&P SmallCap 600 index. This is not just a formality, as being added to a major index means many funds and ETFs will now be required to include Reynolds in their portfolios, often resulting in a jump in buying activity. The news sent the shares up 5.3% in after-hours trading, illustrating how closely investors watch these benchmark changes for signals about a company’s perceived strength and market profile.

This index inclusion is a fresh development for Reynolds in a year where its stock performance has been anything but straightforward. Shares are down 26% over the past year and have declined around 15% since the start of the year, even as the company posted positive revenue and net income growth annually. The recent jump, however, may point to a shift in momentum or simply a recalibration in how the market values future prospects now that more institutional money will track the name.

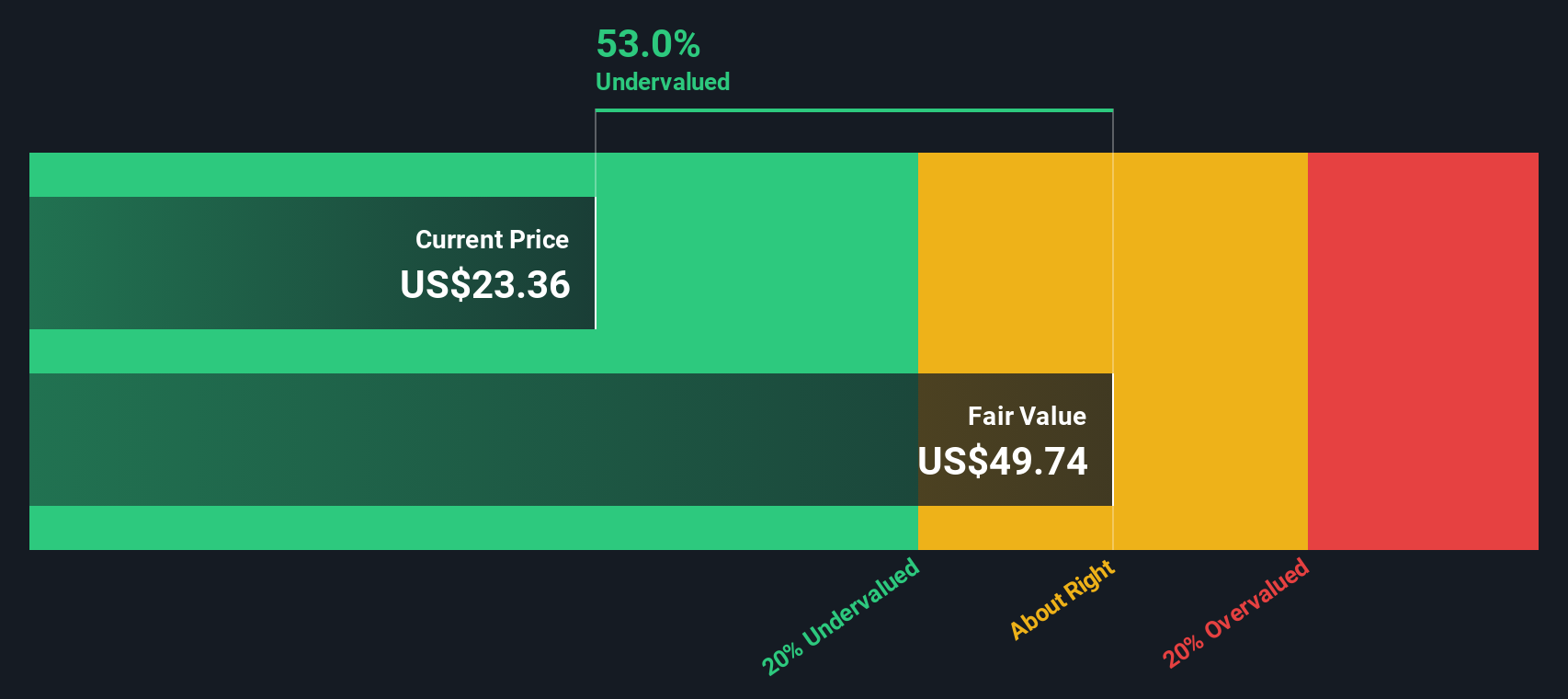

With this surge tied to index inclusion and the longer-term downtrend, some may be questioning whether the market is still underestimating Reynolds or if all the optimism is already reflected in the price.

Most Popular Narrative: 13% Undervalued

The prevailing narrative views Reynolds Consumer Products as undervalued, anticipating meaningful upside based on a blend of future growth, profitability improvements, and a modest valuation multiple compared to its peers.

Sustainable product innovation and shifting consumer demographics are expected to fuel revenue growth and strengthen market share in disposable kitchenware and food storage solutions. Operational efficiencies, enhanced retail strategies, and proprietary technology position the company for higher margins and long-term earnings growth as sustainability trends continue to rise.

Curious how this valuation is justified? The most watched narrative outlines a path to increased profitability based on a blend of impressive financial projections and renewed operational focus. Will these ambitious yet achievable targets become reality? Uncover the core assumptions and discover which factors are driving this eye-catching value estimate.

Result: Fair Value of $26.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent input cost volatility and ongoing consumer weakness remain key risks. These factors could disrupt the optimistic outlook and restrain margin improvement.

Find out about the key risks to this Reynolds Consumer Products narrative.Another View: What Does Our DCF Model Suggest?

Taking a step back from the analyst price target, our SWS DCF model offers a different perspective on Reynolds’ value. This method also suggests the shares are undervalued. Could the true opportunity be even greater than consensus believes?

Build Your Own Reynolds Consumer Products Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own perspective on Reynolds in just a few minutes. Do it your way

A great starting point for your Reynolds Consumer Products research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to one company when you could uncover tomorrow’s hottest opportunities across a range of fast-moving sectors. Let Simply Wall Street’s screeners help you find stocks that fit your goals and give you an edge before others catch on.

- Target serious value potential by uncovering stocks that may be trading well below their true worth. Check out undervalued stocks based on cash flows and spot those hidden gems.

- Get ahead of the crowd by tracking companies at the cutting edge of artificial intelligence with AI penny stocks, offering exposure to industry-shaping innovations.

- Boost your passive income strategy by identifying quality businesses offering consistent payouts. See which picks make the cut with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.