Please use a PC Browser to access Register-Tadawul

Richardson Electronics (NASDAQ:RELL) Is Due To Pay A Dividend Of $0.06

Richardson Electronics, Ltd. RELL | 10.96 10.91 | -0.09% -0.46% Post |

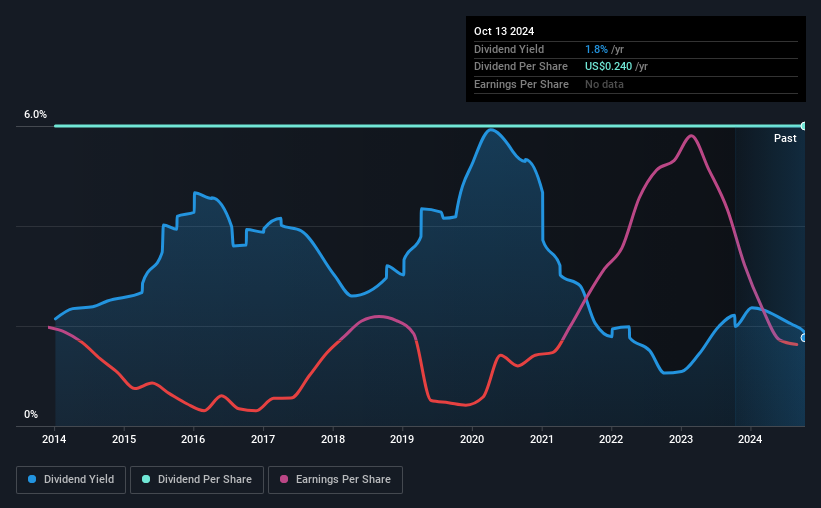

The board of Richardson Electronics, Ltd. (NASDAQ:RELL) has announced that it will pay a dividend of $0.06 per share on the 27th of November. This means the annual payment is 1.8% of the current stock price, which is above the average for the industry.

Richardson Electronics' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Richardson Electronics' Could Struggle to Maintain Dividend Payments In The Future

Richardson Electronics' Future Dividends May Potentially Be At Risk

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Richardson Electronics isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Earnings per share is forecast to rise by 125.1% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

Richardson Electronics Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The most recent annual payment of $0.24 is about the same as the annual payment 10 years ago. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see that Richardson Electronics has been growing its earnings per share at 42% a year over the past five years. Even though the company is not profitable, it is growing at a solid clip. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Richardson Electronics' payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Is Richardson Electronics not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.