Please use a PC Browser to access Register-Tadawul

Richtech Robotics (RR) Is Up 14.4% After Securing Major Sales Deal and Completing Automotive Pilot Program – Has the Bull Case Changed?

Richtech Robotics RR | 4.12 | -11.97% |

- Richtech Robotics recently secured a US$4 million sales agreement with Beijing Tongchuang Technology Development Co., Ltd. and completed a successful pilot program with one of the top five U.S. automotive dealers, both announced in the past week.

- These developments point to accelerating adoption of Richtech's service robotics as major industry partners signal interest in deeper, revenue-generating collaborations.

- We’ll explore how expanded partnerships in both the automotive and technology sectors could reshape Richtech Robotics' broader investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Richtech Robotics' Investment Narrative?

For new or current shareholders in Richtech Robotics, the big picture hinges on belief in a rapidly expanding addressable market for service robotics and the company’s ability to capture meaningful contracts. The recent US$4 million sales agreement in China, alongside a pilot deal with one of the top five US auto dealers, directly addresses the need for commercial validation and recurring revenue, a major catalyst investors were watching for. Adding the company to the S&P Global BMI Index may also prompt new institutional interest. However, these wins come as Richtech contends with continued net losses, significant insider selling, and ongoing share dilution from large follow-on offerings. The short-term risk profile has arguably shifted, with revenue visibility improving, but questions remain on the company’s path to profitability and whether growth will keep pace with dilution and competition. Recent momentum may prove material, yet execution risks stay front and center.

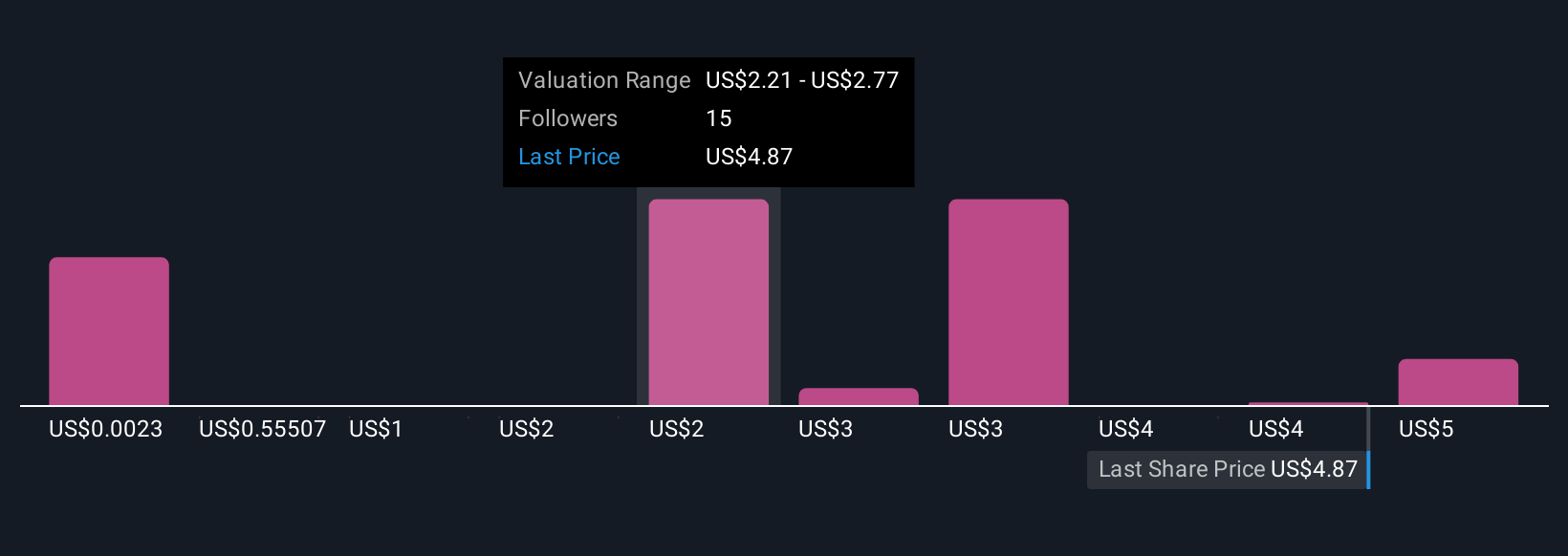

But with insider selling still in focus, investors should consider the tradeoff between momentum and risk. Richtech Robotics' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 21 other fair value estimates on Richtech Robotics - why the stock might be worth less than half the current price!

Build Your Own Richtech Robotics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Richtech Robotics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Richtech Robotics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Richtech Robotics' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.