Please use a PC Browser to access Register-Tadawul

Rimini Street (NASDAQ:RMNI) shareholders are up 19% this past week, but still in the red over the last five years

Rimini Street Inc Class A RMNI | 4.11 | -1.44% |

It is doubtless a positive to see that the Rimini Street, Inc. (NASDAQ:RMNI) share price has gained some 77% in the last three months. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 30% in that half decade.

On a more encouraging note the company has added US$48m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Rimini Street became profitable within the last five years. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

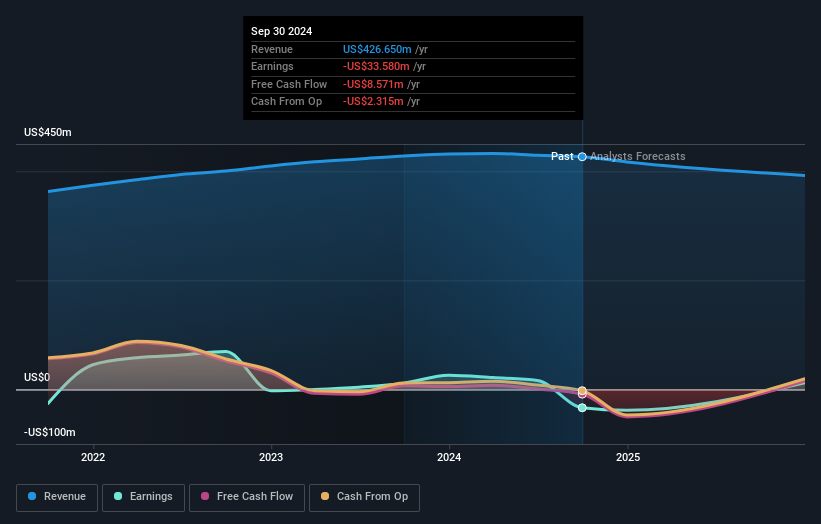

Revenue is actually up 9.3% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Rimini Street's financial health with this free report on its balance sheet.

A Different Perspective

Rimini Street shareholders are up 2.4% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.