Please use a PC Browser to access Register-Tadawul

Risks Still Elevated At These Prices As United Maritime Corporation (NASDAQ:USEA) Shares Dive 26%

UNITED MARITIME CORPORATION USEA | 1.88 | +0.53% |

The United Maritime Corporation (NASDAQ:USEA) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

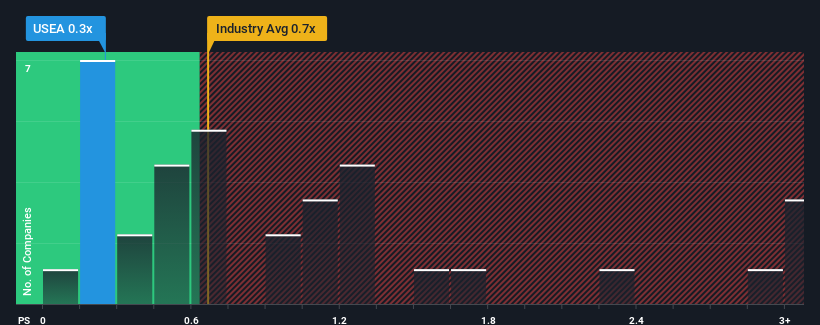

In spite of the heavy fall in price, it's still not a stretch to say that United Maritime's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Shipping industry in the United States, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has United Maritime Performed Recently?

With revenue growth that's superior to most other companies of late, United Maritime has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on United Maritime will help you uncover what's on the horizon.How Is United Maritime's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like United Maritime's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company are not good at all, suggesting revenue should decline by 18% over the next year. Meanwhile, the broader industry is forecast to moderate by 7.7%, which indicates the company should perform poorly indeed.

With this information, it's perhaps strange that United Maritime is trading at a fairly similar P/S in comparison. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

Following United Maritime's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

United Maritime's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

If you're unsure about the strength of United Maritime's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.