Please use a PC Browser to access Register-Tadawul

Robinhood Broadens Revenue Sources With Prediction Markets And Bitstamp Deal

Robinhood Markets, Inc. Class A HOOD | 99.48 | -1.74% |

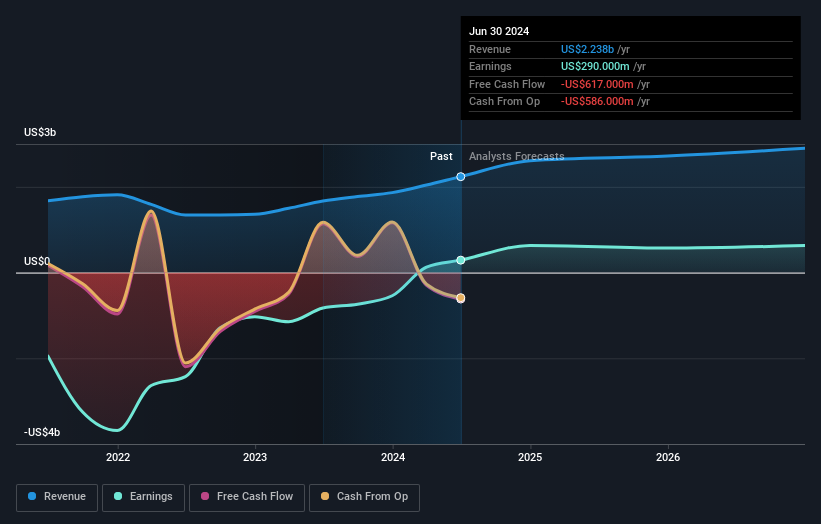

- Robinhood Markets (NasdaqGS:HOOD) has reported rapid revenue and user growth tied to expansion into banking, credit cards, and other financial services over the past three years.

- The company has moved heavily into prediction markets, which have become a major contributor to its revenue base.

- Robinhood recently agreed to acquire crypto exchange Bitstamp, aiming to build out its global cryptocurrency trading infrastructure and regulatory footprint.

For investors watching NasdaqGS:HOOD, the story is no longer just about zero commission stock trading. Robinhood now touches multiple parts of retail finance, from brokerage to banking products, credit cards, and crypto access. Its newer prediction markets and the planned Bitstamp acquisition add more moving pieces to the business model and to how the company earns its money.

As these newer lines mature, questions for you as an investor include revenue durability, regulatory risk, and how user behavior might change as products expand. The rest of this article looks at how these pieces fit together today, what they could mean for Robinhood’s risk profile, and which metrics may be useful to monitor over time.

Stay updated on the most important news stories for Robinhood Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Robinhood Markets.

Robinhood’s push into prediction markets and the pending Bitstamp acquisition tie directly into its effort to become a broader retail finance platform rather than just a stock trading app. Prediction markets are already generating over US$300 million in annualized revenue, while Bitstamp gives Robinhood more crypto infrastructure and regulatory reach, especially outside the US. Together, these could make revenue less dependent on pure equity trading volumes over time.

Robinhood Markets narrative, put into context

The existing narrative around Robinhood highlights product diversification and international expansion as key drivers of resilient growth, and this news sits squarely in that story. Expanding prediction markets, crypto, and banking style products supports the view that Robinhood is trying to build multiple recurring revenue streams. It also increases exposure to regulatory shifts in crypto and event contracts that analysts in the narrative have already flagged as a potential constraint.

Risks and rewards of the Bitstamp deal and product expansion

- Growing prediction market revenue and broader crypto access through Bitstamp could give Robinhood an additional revenue pillar that is less tied to traditional equity trading.

- Diversification into banking, credit cards, private equity, and prediction markets may deepen customer relationships and support higher average revenue per user over time.

- Greater reliance on crypto and prediction markets increases sensitivity to regulatory delays or restrictions, which the narrative already cites as a key risk for tokenized and alternative assets.

- Expanding into more products and regions can lift compliance and technology costs, and analysts have highlighted that higher expenses could pressure margins if user activity slows.

What to watch next

Looking ahead, you may want to track how quickly Bitstamp volumes are integrated into Robinhood’s platform, how prediction market revenues trend relative to trading and banking products, and whether new products actually lift engagement per user. For a broader view of how other investors are thinking about these shifts, you can read community narratives on this page and compare them with your own expectations for Robinhood.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.