Please use a PC Browser to access Register-Tadawul

Robinhood Chain Testnet Marks Shift Toward Broader Crypto And Global Platform

Robinhood Markets, Inc. Class A HOOD | 76.11 | +0.61% |

- Robinhood Markets (NasdaqGS:HOOD) has launched a public testnet for its Ethereum Layer 2, called Robinhood Chain.

- The company is also accelerating work on prediction markets, tokenization, and international products, including ISAs in the UK.

- These product moves aim to support 24/7 trading, self-custody, and deeper integration of tokenized assets.

Robinhood Markets, trading at $85.6, sits at the center of a fast evolving intersection between brokerage services and crypto infrastructure. The stock has seen a very large 3 year return, around 7x, and a 60.5% gain over the past year, even as the share price shows a 25.7% decline year to date and over the past month. That mix of long term gains and recent pullback frames how investors may look at the new Robinhood Chain announcement and broader product push.

For you, the key question is how these moves might reshape Robinhood’s role in your portfolio over time. The company is evolving from a trading app to a broader platform touching prediction markets, tokenization, and global accounts. As the testnet and new offerings develop, the market will get more clarity on user adoption, revenue mix, and how much crypto infrastructure really matters to NasdaqGS:HOOD beyond recent earnings headlines.

Stay updated on the most important news stories for Robinhood Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Robinhood Markets.

The Robinhood Chain testnet ties directly into Robinhood’s push to be more than a US stock and crypto broker. Management has already leaned into products like prediction markets, ISAs in the UK and tokenized equities in Europe. A dedicated Ethereum Layer 2 gives Robinhood more control over how those tokenized assets trade, settle and connect to self-custody through its wallet. That could matter for competing with Coinbase, Interactive Brokers or traditional brokers that still rely on older back-end systems. The timing is important too, as Q4 revenue of US$1.28b came in below expectations and crypto transaction revenue fell 38%, which weighed on the share price. Building Robinhood Chain, expanding prediction markets and growing international accounts are all ways for the company to rely less on short bursts of crypto trading and more on a broader mix of activity and fees.

How This Fits Into The Robinhood Markets Narrative

- The launch of Robinhood Chain and the push into tokenization supports the narrative that new products and international markets can widen Robinhood’s addressable market and deepen customer relationships.

- Heavier investment in crypto infrastructure and prediction markets could challenge the narrative if regulatory delays or higher compliance costs later compress the margins that analysts expect.

- The concrete move to operate a Layer 2 network and migrate stock tokens onto it adds a new onchain infrastructure angle that is not fully captured in the narrative’s focus on MIAXdx and prediction markets alone.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Robinhood Markets to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ A material portion of earnings quality is tied to non cash items, which analysts have flagged as a risk when assessing the durability of profits.

- ⚠️ Building and operating Robinhood Chain, plus expanding prediction markets, could expose the company to higher regulatory and compliance risk across multiple jurisdictions.

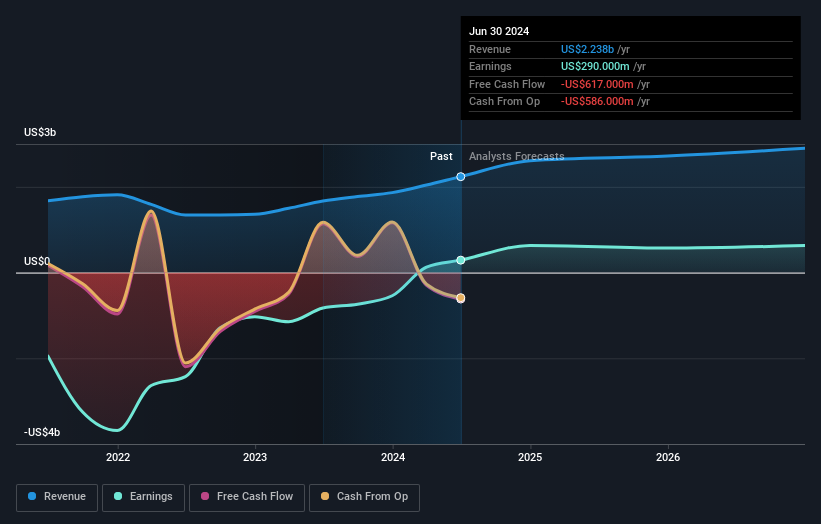

- 🎁 Revenue and profit have been growing, with 2025 revenue of US$4.47b and net income of US$1.88b compared to the prior year, which supports the case for a more diversified business.

- 🎁 Analysts highlight earnings growth potential and expect earnings to grow each year, with some seeing upside from prediction markets, tokenization and international expansion.

What To Watch Going Forward

From here, investors may want to keep an eye on three things. First, how quickly developers and users actually adopt Robinhood Chain and whether stock tokens migrate smoothly from existing setups. Second, the revenue mix between options, equities, crypto and prediction markets, given the recent 38% drop in crypto transaction revenue and the company’s intent to lean more on other products. Third, regulatory clarity around prediction markets and tokenized real world assets in the US, UK and Europe, which will shape how far Robinhood can push this model. The pace of international customer growth, including ISAs in the UK and expansion in regions such as Asia-Pacific, will also be an important signal of how global the platform can become.

To stay informed on how the latest news impacts the investment narrative for Robinhood Markets, visit the community page for Robinhood Markets to keep up with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.