Please use a PC Browser to access Register-Tadawul

Robinhood Seeks SpaceX Access As Tokenized Bets Test Valuation Jitters

Robinhood Markets, Inc. Class A HOOD | 87.07 87.01 | -3.16% -0.07% Pre |

- Robinhood Markets (NasdaqGS:HOOD) is seeking a dedicated retail investor allocation in the expected SpaceX IPO, aiming to give individual investors access to a high profile offering that is typically dominated by institutions.

- The company is also preparing product expansions into tokenized stocks and prediction markets, tying its platform more closely to blockchain based infrastructure and new forms of speculative trading.

Robinhood Markets, trading around $101.24, has seen very large gains over the past three years, with a return of about 7x in that period and a 91.0% return over the past year. At the same time, the stock has faced a 4.7% decline over the past week and a 12.3% decline over the past month, and is down 12.1% year to date, underscoring how volatile sentiment can be around NasdaqGS:HOOD as it pursues new products and partnerships.

For you as a retail investor, Robinhood's push for SpaceX IPO access and moves into tokenized stocks and prediction markets could broaden the types of assets and events you can trade in a single app. How regulators respond, and how quickly these products roll out, will shape how central Robinhood becomes to the next phase of retail trading and blockchain linked markets.

Stay updated on the most important news stories for Robinhood Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Robinhood Markets.

Quick Assessment

- ✅ Price vs Analyst Target: At US$101.24 against a consensus target of about US$148.53, the price sits roughly 32% below analyst expectations.

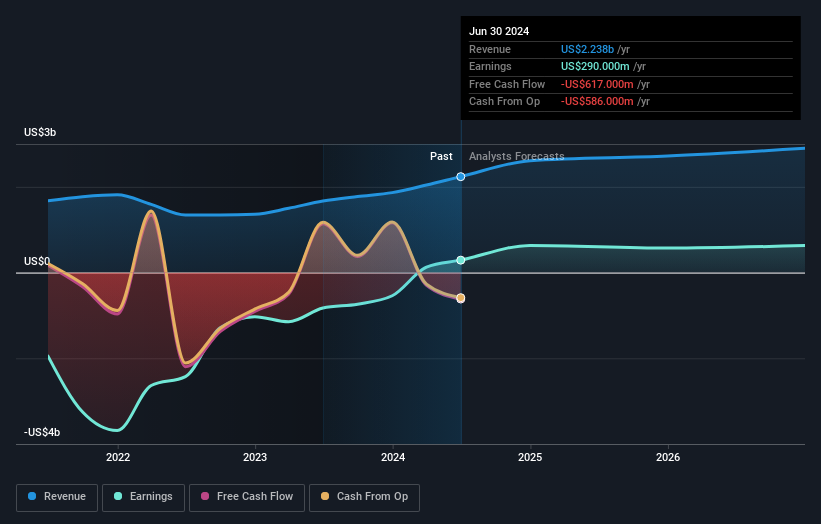

- ❌ Simply Wall St Valuation: Shares are flagged as overvalued, trading about 126% above the platform's estimated fair value.

- ❌ Recent Momentum: The stock has logged a 12.3% decline over the last 30 days.

Check out Simply Wall St's in depth valuation analysis for Robinhood Markets.

Key Considerations

- 📊 SpaceX IPO access, tokenized stocks and prediction markets could increase engagement on the platform if retail interest in these products is strong.

- 📊 Watch how trading volumes, new account growth and any revenue disclosures tied to these products evolve once they launch.

- ⚠️ The push into tokenized assets and prediction markets may attract additional regulatory scrutiny, which can affect timelines or product scope.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Robinhood Markets analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.