Please use a PC Browser to access Register-Tadawul

Robinhood’s MIAX Deal Deepens Derivatives Push And Tests Rich Valuation

Robinhood Markets, Inc. Class A HOOD | 99.48 | -1.74% |

- Robinhood Markets (NasdaqGS:HOOD) is acquiring a 90% stake in MIAX Derivatives Exchange in partnership with Susquehanna International Group.

- The deal expands Robinhood's presence in prediction markets and regulated derivatives trading.

- The move comes alongside planned acquisitions in Indonesia's brokerage and digital asset sectors.

Robinhood is moving further beyond its core app based brokerage model with this MIAXdx transaction, tying its brand more closely to derivatives and prediction products. The stock trades at $106.25, with a return of 111.0% over the past year and a very large return over the past three years. Over the past month, the share price has seen an 11.6% decline, which may shape how investors interpret this latest move.

For investors, this deal raises questions about how far Robinhood will extend into more complex, regulated products and global markets. The company is signaling interest in new revenue sources through prediction markets, futures, options, and international expansion, including Indonesia's brokerage and digital asset sectors. How it executes on integration, risk controls, and customer education around derivatives could be important areas to monitor from here.

Stay updated on the most important news stories for Robinhood Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Robinhood Markets.

Investor Checklist: Robinhood’s MIAX Derivatives Move

Quick Assessment

- ✅ Price vs Analyst Target: At US$106.25, the share price sits below the US$149.29 analyst target, implying a wide gap to consensus expectations.

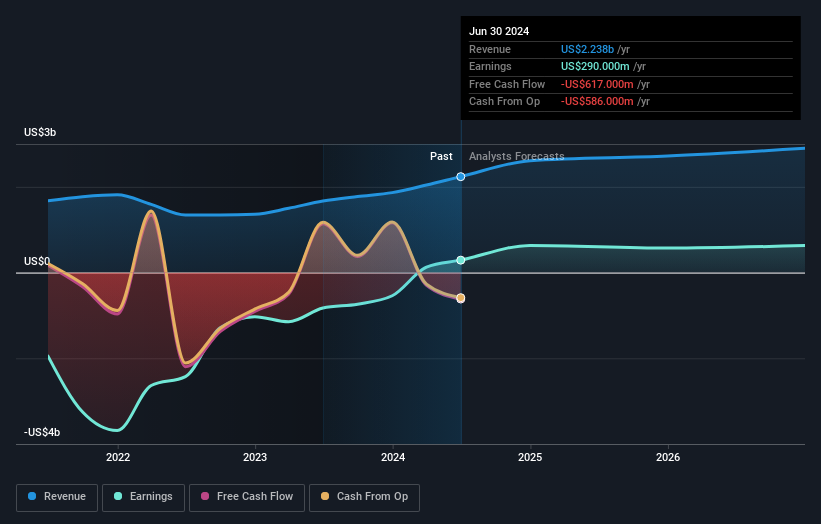

- ❌ Simply Wall St Valuation: Shares are described as trading 137.8% above estimated fair value, which flags a rich valuation.

- ❌ Recent Momentum: The 30 day return of 11.6% decline shows recent weakness despite longer term strength.

Check out Simply Wall St's in depth valuation analysis for Robinhood Markets.

Key Considerations

- 📊 The MIAX stake pushes Robinhood deeper into derivatives and prediction markets, which could change its revenue mix and risk profile.

- 📊 Watch how volumes, fees, and capital requirements evolve once MIAX is consolidated into the broader platform.

- ⚠️ With earnings quality flagged for high non cash components and recent insider selling, investors may want to be careful about relying solely on headline profit metrics.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Robinhood Markets analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.