Please use a PC Browser to access Register-Tadawul

Roblox (RBLX): Examining Valuation as Regulatory Scrutiny Rises Over User Safety Practices

Roblox RBLX | 88.51 | -6.18% |

The Florida Attorney General has launched a criminal investigation into Roblox (NYSE:RBLX) following concerns about the platform’s safeguards for young users. Subpoenas focus on user safety practices, content moderation, and the handling of age verification.

The investigation lands at a time when Roblox has remained in the spotlight for its blockbuster partnerships and user events, from Mattel announcing new franchise games to Lionsgate's Halloween horror experience. Despite occasional speed bumps, momentum has been firmly on Roblox's side, with a 1-year total shareholder return of 209% and the share price more than doubling year-to-date. Investors are watching closely to see if excitement around fresh content and platform engagement can outweigh emerging risk perceptions tied to regulatory scrutiny.

If you’re on the lookout for more innovative names shaping tech and gaming, now could be the perfect moment to discover See the full list for free.

With shares up over 200% in the past year and analyst targets still sitting above the current price, the key question is whether Roblox’s rally leaves room for more upside or if future growth is already baked in.

Most Popular Narrative: 13.5% Undervalued

Roblox’s most widely followed narrative pegs fair value at $149.42, about 13.5% above the last close price of $129.24. The narrative’s detailed valuation builds on major shifts in user demographics, platform monetization, and global growth momentum to support the current upside view.

Advancements in platform infrastructure, scalability, and AI-driven content tools are reducing barriers for creators, fueling an acceleration of user-generated content and viral hits. This strengthens engagement, increases DAUs, and supports long-term growth in transaction-based revenue and average bookings per user.

Curious what blockbuster projections justify this narrative’s assertive price target? The real story behind the high valuation lies in rapid user growth and earnings improvement forecasts not yet visible in today’s numbers. Dive in to see which bold financial leaps and platform shifts underpin these surprisingly bullish assumptions.

Result: Fair Value of $149.42 (UNDERVALUED)

However, a surge in developer payouts or increased competition could put pressure on Roblox’s margins and challenge its long-term bullish outlook.

Another View: Price-to-Sales Ratio Raises Eyebrows

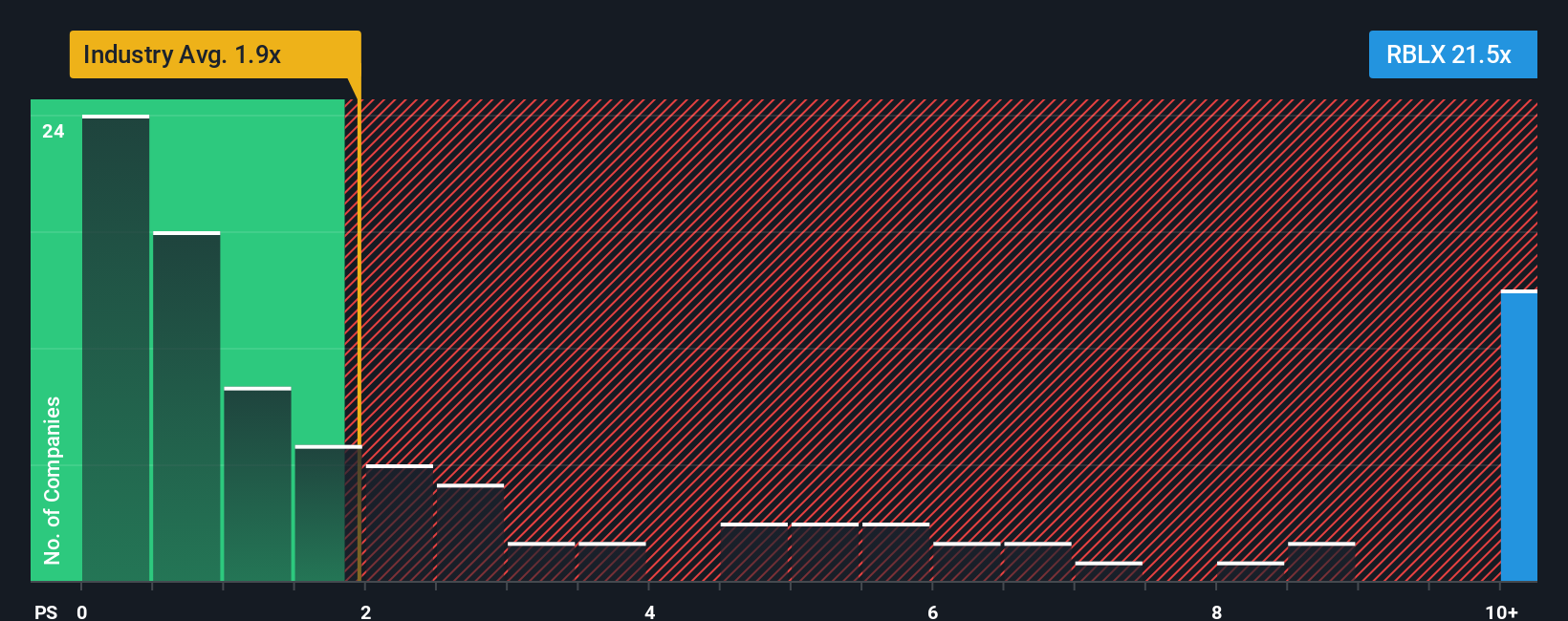

Looking at Roblox’s valuation through its price-to-sales ratio tells a different story. At 22.3x, Roblox trades at a premium compared to peer companies (5.8x), the US Entertainment industry average of 1.9x, and a fair ratio of 6.2x. This substantial gap highlights significant valuation risk if investor sentiment changes. Are the ambitions reflected in this premium fully justified?

Build Your Own Roblox Narrative

If you have your own perspective on Roblox’s future or want to dig into the numbers yourself, you can craft a custom narrative in just minutes. Do it your way

A great starting point for your Roblox research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for the obvious picks alone. Broaden your perspective and get ahead of the crowd with these unique stock opportunities curated for your next great move:

- Target fresh long-term potential by checking out these 868 undervalued stocks based on cash flows that are trading below their intrinsic value and showing solid cash flow fundamentals.

- Power up your portfolio’s future by exploring these 27 AI penny stocks that are driving transformational change in industries through artificial intelligence innovation.

- Tap into resilient income streams with these 17 dividend stocks with yields > 3%, featuring companies offering above-average yields that can help boost your returns, rain or shine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.